U.S.-China Trade Agreement Provides Market Boost but Cautions Remain

In recent days, investors have expressed optimism as the U.S. and China reached an initial trade agreement, alleviating concerns about President Donald Trump’s import tariffs. This development has led to gains in major benchmarks, with the S&P 500 (SNPINDEX: ^GSPC) returning to positive territory for the year.

Jamie Dimon Urges Caution Amid Optimism

Despite the positive news, billionaire Jamie Dimon, CEO of JPMorgan Chase, remains cautious. In a Bloomberg interview, he stated that while the tariff deal is welcome, the risk of recession isn’t completely off the table. JPMorgan’s economists have lowered their U.S. recession risk forecast to below 50% from 60%. Still, Dimon cited lingering uncertainties, such as large deficits and high interest rates, that could impact the economy, suggesting that market volatility is likely to continue.

Dimon emphasized, “It’s a mistake to think we can get through all the things we’re experiencing, and that volatility will decrease.” With a tenure at JPMorgan since 2005, during which the company’s market value grew over 400% to $743 billion, his insights carry significant weight in market discussions.

Preparing for Potential Market Challenges

If Dimon’s predictions hold true, investors may still face hurdles even after the U.S.-China agreement. Therefore, adjusting your investment strategy is prudent. Here are five ways to optimize your portfolio for varying market conditions.

1. Favor Diversification

High concentration in a single company or sector can pose risks. For instance, even strong performers like Nvidia have seen declines amid broader economic concerns. Diversifying across multiple sectors and stocks can mitigate these risks. If you’re less familiar with certain industries, consider using an exchange-traded fund (ETF) to gain diversified exposure.

2. Invest in Established Companies

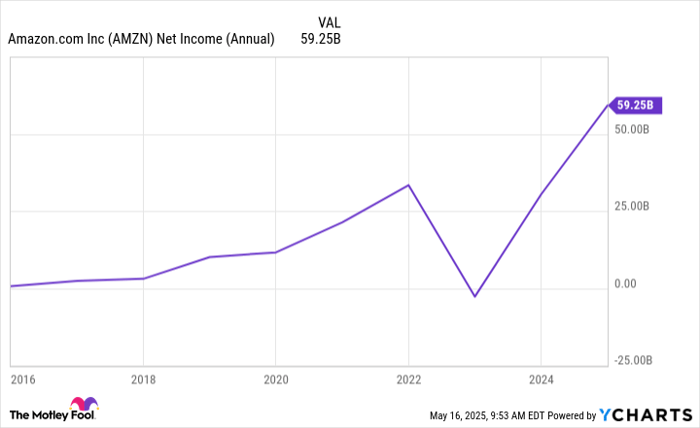

Long-established companies with consistent earnings growth are reliable options during uncertain times. For example, Amazon (NASDAQ: AMZN) faced challenges due to inflation but revamped its cost structure, returning to profitability within a year. Assessing a company’s past performance during hardships can help identify strong candidates for your portfolio.

3. Buy Dividend Stocks

Investing in dividend stocks can provide steady income regardless of market fluctuations. Companies known as Dividend Kings, such as Coca-Cola and Johnson & Johnson, have a track record of increasing their dividend payments for over 50 years, making them reliable options for sustained income.

4. Commit to Proven Assets

While the future is unpredictable, historical trends show that the stock market, represented by the S&P 500, Dow Jones Industrial Average (DJINDICES: ^DJI), and Nasdaq Composite (NASDAQINDEX: ^IXIC), has consistently rebounded after declines. Opting for assets that track these indices, like the Vanguard S&P 500 ETF (NYSEMKT: VOO), can offer diversification and long-term growth potential.

5. Focus on Long-Term Investment

Short-term trading can be tempting, but it often leads to pressure and unpredictability. Instead, consider investing in quality stocks at reasonable prices and hold them for the long term—ideally five years or more. This approach withstands market fluctuations and positions you for potential future gains.

Disclaimer: The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.