The Surge of AI Opens New Horizons for Nuclear Energy Investments

Artificial intelligence (AI) surged into the spotlight in early 2023, driving significant interest in the stock market. Investors have been eagerly purchasing shares of companies involved in AI chip production, cloud services for AI data centers, and software firms that implement AI technologies.

The growing energy demands of AI pose potential challenges for the future. Wells Fargo estimates that electricity consumption from AI could rise dramatically, hitting 652 terawatt-hours by 2030, up from just 8 terawatt-hours in 2024. Nuclear energy might offer a solution, being both efficient and environmentally friendly. While fossil fuels face emissions-related drawbacks, and renewable sources are still not entirely reliable, nuclear power could play a crucial role in meeting energy needs.

Top Nuclear Investments for Future Growth

With the rising energy requirements of AI, companies focused on nuclear energy could see significant growth. Here are three top nuclear stock picks to consider this January.

1. Cameco

As a major player in uranium production, Cameco (NYSE: CCJ) supplies roughly 18% of the world’s uranium. The Canadian firm has stakes in mines across Canada, the U.S., and Kazakhstan. As tech giants and nations evaluate nuclear options for energy independence and emissions reduction, Cameco stands to benefit. For instance, Meta Platforms recently revealed plans to utilize nuclear energy for its AI data centers starting in the early 2030s.

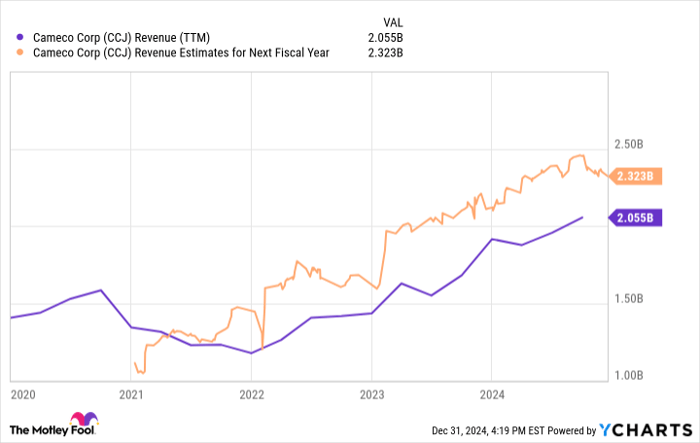

CCJ Revenue (TTM) data by YCharts

According to the International Atomic Energy Agency, there are currently 63 nuclear reactors under construction, with projections indicating nuclear capacity could increase significantly by 2050. Strained geopolitical circumstances, such as the U.S. ban on Russian uranium imports, may also benefit Western firms like Cameco.

Recent growth reflects a positive trend for Cameco. Analysts foresee revenue reaching $2.3 billion by 2025, suggesting potential for sustained expansion in the coming years.

2. Southern Company

For those seeking a balanced energy investment, Southern Company (NYSE: SO) presents a robust choice. Serving more than 9 million customers, it is one of the largest energy providers in the U.S., involved in electricity generation across various sources including natural gas, coal, nuclear, and renewables.

Southern Company has committed significant investment to nuclear energy, operating eight units across three facilities. Notably, a recent deal between Microsoft and Constellation Energy seeks to restart a nuclear unit at the Three Mile Island Nuclear Station, which could also create opportunities for Southern Company, especially given Virginia’s strong presence in the data center industry.

SO PE Ratio (Forward) data by YCharts

The stock currently offers a 3.5% dividend yield and trades at 20 times earnings, which is reasonable for long-term holders, particularly as demand for energy continues to grow alongside advancements in AI.

3. GE Vernova

After restructuring, General Electric’s energy division has become GE Vernova (NYSE: GEV). This clean energy technology company engages in clean power generation, grid electrification, and turbine production, including nuclear capabilities.

The ongoing shift from fossil fuels to cleaner energy sources provides GE Vernova with a substantial long-term growth opportunity. Management projects high single-digit revenue growth leading up to 2028 and plans to invest $5 billion in research and development during that period.

GEV PE Ratio (Forward) data by YCharts

Despite a high forward P/E ratio of 124, analysts anticipate an average earnings growth of 46% annually in the next few years. Investors may consider acquiring a small position now and increasing their stake if the stock price declines.

Seize Your Opportunity in Promising Stocks

Have you ever thought you missed your chance to invest in top-performing stocks? This might be your opportunity.

Our analysts occasionally issue a “Double Down” stock recommendation, highlighting companies poised for significant growth. Don’t hesitate to act now; the figures speak for themselves:

- Nvidia: An investment of $1,000 back in 2009 would be worth $358,640 today!*

- Apple: Investing $1,000 in 2008 would yield $46,181 now!*

- Netflix: A $1,000 investment in 2004 has grown to $478,206!*

Right now, our “Double Down” alerts focus on three remarkable companies, and another chance like this may not come for a while.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Wells Fargo is an advertising partner of Motley Fool Money. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool recommends Cameco and Constellation Energy. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.