JD.com Gears Up for Third Quarter Earnings: What to Expect

JD.com, Inc. is set to announce its third-quarter 2024 results on November 14.

Revenue and Earnings Forecasts

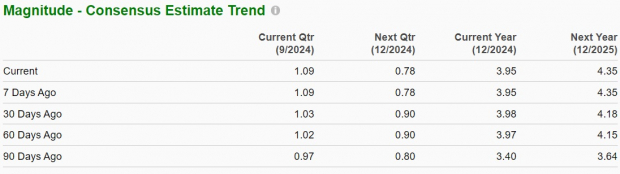

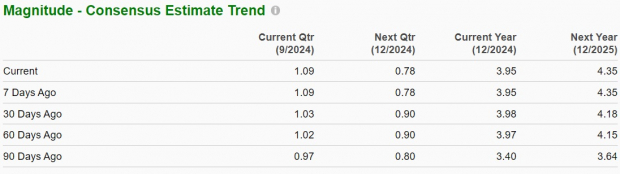

Analysts estimate that JD.com will generate revenues of $36.54 billion, which represents a 7.64% increase compared to the same quarter last year. For earnings, the consensus forecast stands at $1.09 per share, indicating growth of 18.48% from the previous year. Over the past 30 days, this earnings estimate has been adjusted upward by 5.8%.

Image Source: Zacks Investment Research

Check out current EPS estimates and surprises on Zacks Earnings Calendar.

JD.com has a strong track record when it comes to earnings surprises. In the last quarter, the company exceeded estimates by 50%. In fact, JD has outperformed the Zacks Consensus Estimate in all of its recent four quarters, with an average surprise of 24.04%.

JD.com’s Price and EPS Surprise Performance

JD.com, Inc. price-eps-surprise | JD.com, Inc. Quote

Earnings Prediction Analysis

Currently, our models do not strongly indicate a definite earnings beat for JD.com this season. A positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) can improve the likelihood of an earnings surprise. Presently, JD.com holds an Earnings ESP of 0.00% and a Zacks Rank #3.

Factors Impacting Upcoming Financial Results

The anticipated performance of JD.com in the third quarter is likely driven by its solid JD Retail segment, which boasts a wide range of products, including electronics and home goods. The company has been expanding its third-party merchant relationships, particularly featuring premium international brands. One such partnership is with French luxury group SMCP, which includes brands like SANDRO, MAJE, and CLAUDIE PIERLOT, enhancing its luxury retail segment.

JD’s omnichannel approach seems to be gaining momentum. Collaborations with Dada facilitate access to major retailers, while physical retail initiatives through 7FRESH and JD MALL are also expanding. The JD Procurement and Sales Manager Livestreaming initiative should elevate customer interaction. Moreover, JD Health’s digital services, including round-the-clock medical advice and pharmacy services, are projected to bolster the company’s third-quarter outcomes.

JD Logistics continues to be pivotal to growth, utilizing a growing network of warehouses to improve delivery efficiency, especially in lower-tier cities. This focus on fast deliveries may enhance market penetration.

Nonetheless, these positives might be somewhat tempered by obstacles in newer business areas and rising fulfillment expenses, which include procurement, warehousing, delivery, and customer service costs. Such pressures could adversely affect profit margins during the third quarter.

Stock Performance and Valuation Insights

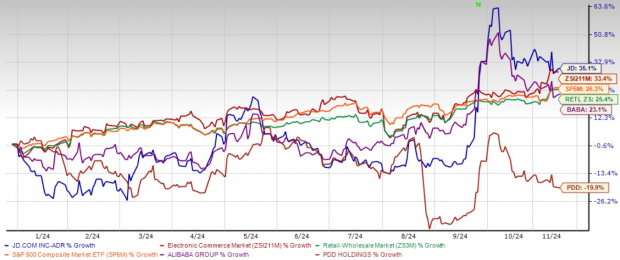

On a year-to-date basis, JD.com shares have appreciated by 35.1%. This performance slightly outpaces the Zacks Retail-Wholesale sector’s return of 35.4% and the S&P 500’s 26.3%. It has also surpassed peers such as Alibaba BABA, which is up 23.1%, and PDD Holdings PDD, which is down 19.9% year-to-date.

Year to Date Performance Chart

Image Source: Zacks Investment Research

At present, JD.com offers an attractive investment opportunity with a forward 12-month P/E ratio of 9.09X, significantly lower than the industry average of 25.36X.

Valuation Insights: JD’s Discounted P/E Ratio

Image Source: Zacks Investment Research

Investment Outlook

As JD.com approaches its upcoming earnings report, various factors present a mixed outlook. The company’s core retail segment shows strength through its diverse product lines and key partnerships, particularly with SMCP in luxury retail. Its logistics and healthcare efforts signal ongoing operational enhancement, and investments in underdeveloped city infrastructure could provide new growth avenues. However, increasing fulfillment costs and hurdles in new business areas require careful consideration. The evolving landscape of Chinese e-commerce will shape the company’s performance moving forward.

Final Recommendation

Given the balance of potential risks and benefits, current shareholders are encouraged to maintain their positions. Prospective investors should monitor key developments before making decisions about stock purchases.

Explore 5 Stocks with Potential for 100% Returns

These selections have been identified by Zacks experts as top choices with the potential to double in 2024. Although past performance varies, previous recommendations have seen remarkable gains up to +673.0%.

Many of the stocks in this report remain under the radar, presenting a unique opportunity for early investment.

Interested in learning about these potential home runs? Click to view the report.

JD.com, Inc. (JD): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

PDD Holdings Inc. Sponsored ADR (PDD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views expressed in this report are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.