Key Takeaways from Bezos’ Interview: At the New York Times DealBook Summit, Bezos discussed his strategies for building successful businesses like Amazon and Blue Origin.

Bezos, recognized as the world’s second richest individual by the Bloomberg Billionaires Index, boasts a net worth of $240 billion, having gained $63.4 billion in 2024 alone.

In his remarks, Bezos emphasized a common mindset challenge, where people often overrate risks while underestimating opportunities. He encouraged entrepreneurs to challenge this bias, suggesting that perceived risks might not be as daunting as they appear, with potential opportunities being much greater than expected.

He stated, “You say it’s confidence, but maybe I’m just accepting that human bias and trying to compensate against it.” This insight highlights the importance of a balanced perspective in navigating business landscapes.

Bezos on Thinking Big: Bezos cautioned against thinking small, claiming it leads to a self-fulfilling prophecy. He explained that if someone believes they can only achieve limited goals, their actions will align with that belief, thereby limiting their potential for success.

Stay updated on tech trends by subscribing to the Benzinga Tech Trends newsletter.

Why His Views Matter: In addition to sharing insights on business strategy, Bezos expressed optimism regarding Donald Trump’s potential second term, particularly the possibility of reducing regulations. He mentioned, “We do have too much regulation in this country,” and indicated a desire to help streamline these rules.

Bezos also touched on America’s national debt issue, advocating for a growth-focused approach to any spending cuts. His aim is for GDP growth to reach 3-5% annually, while debt growth remains restrained.

Additionally, Bezos revealed his commitment to ensuring that Amazon stays at the forefront of AI development. “My heart is in Amazon, my curiosity is in Amazon, and my fears are there and my love is there,” he remarked, adding that he is dedicating significant time to the company’s future. “I can help, and it’s super interesting, so why not?”

https://www.youtube.com/watch?v=s71nJQqzYRQ[/embed>

Market Performance: On Friday, Amazon’s stock increased by 2.94% to close at $227.03, although it slipped 0.29% in after-hours trading. Year-to-date, the company’s shares have surged 51.42%, outperforming the Nasdaq 100 index which has seen a 30.7% gain during the same period, according to Benzinga Pro’s data.

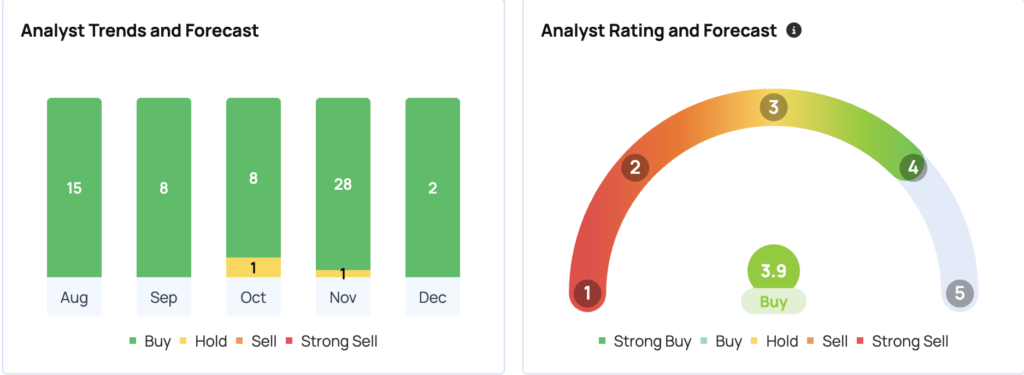

According to 38 analysts, Amazon’s consensus price target is $238.16, with JMP Securities setting the highest target at $285. Recent evaluations from Needham, BMO Capital, and MoffettNathanson suggest an average target of $244.67, indicating a potential upside of 7.8%.

Explore more on Consumer Tech by following this link.

Read Next:

Disclaimer: This content was partially produced using AI tools and reviewed by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs