The AI Investing Boom: Wall Street’s Focus on Meta Platforms

AI’s Economic Impact Projected at $15.7 Trillion

Artificial intelligence (AI) has become a popular trend for investors since ChatGPT gained attention in late 2022. PwC, a consulting firm, predicts that AI could generate an additional $15.7 trillion in global economic activity by 2030.

Major investors on Wall Street are betting that AI will spread throughout the global economy. Quarterly disclosures required by the Securities and Exchange Commission allow the public to see which AI-focused companies these billionaire fund managers are investing in.

One notable figure in the investment world is Jeff Yass, a billionaire who made his fortune as an options trader. His fund, Susquehanna International, has recently shifted its focus to buying and selling shares in AI companies.

In the third quarter, Yass and Susquehanna sold off a significant portion of their holdings in Nvidia, a leading AI technology provider. They reduced their stake by 30%, amounting to around $722 million. However, this divestment does not reveal the full picture, as the firm also engages in complex option trading strategies. It appears that Yass used the funds from selling Nvidia to invest in another key player: Meta Platforms (NASDAQ: META).

Susquehanna’s Increased Investment in Meta Platforms

Susquehanna’s investment in the parent company of Instagram and Facebook rose by 54% during the third quarter, reaching a total of $759 million. The firm’s analysts have also recently projected a price target of $675 per share for Meta Platforms, indicating a potential 22% gain based on current prices.

Meta Platforms has been improving its recommendation algorithms using machine learning for years. While some users find these constant suggestions annoying, about 3.2 billion people engage with Meta’s applications daily, which is a critical factor for the company’s success.

2023 saw ChatGPT become the fastest consumer application to achieve 100 million users. Like many Silicon Valley companies, Meta was surprised by the rapid demand for generative AI applications but quickly adapted. CEO Mark Zuckerberg announced that Meta AI now has over 500 million active monthly users. In October alone, more than a million advertisers utilized Meta’s AI tools to create over 15 million ads.

However, Meta’s ambitions go beyond just ad engagement. Zuckerberg aims to establish Meta as a significant player in the AI sector. The company is training Llama, an open-source large language model, utilizing a processing power greater than 100,000 Nvidia H100 units.

Key Considerations for Investors

Before investing in Meta Platforms stock, it’s essential to understand that the company is making substantial bets on AI, and the results are not guaranteed.

In 2024, Meta plans to allocate between $38 billion and $40 billion on capital expenditures, primarily for servers, data centers, and network infrastructure to support its AI growth. This spending marks an increase from $28.1 billion in 2023. The additional $10 billion to $12 billion planned for the year marks just the start of Meta’s major investment in AI. Management also forecasts accelerated growth in infrastructure expenses by 2025.

Currently, not all of Meta’s ventures are profitable. For example, while Realty Labs revenue increased to $270 million in the third quarter, it couldn’t cover its operational costs, leading to a $4.4 billion operational loss during that time.

Evaluating the Investment: Buy, Sell, or Hold?

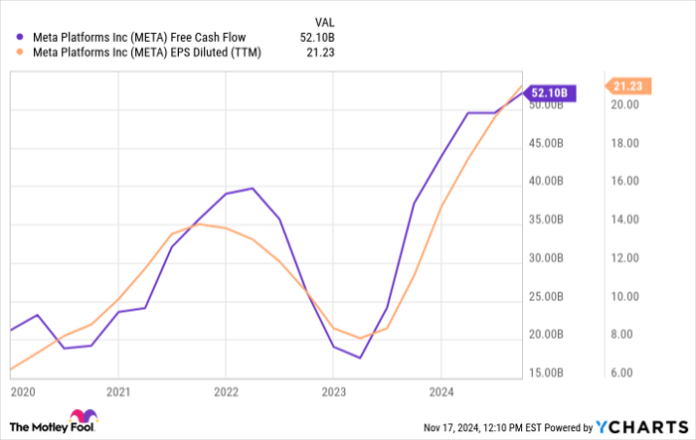

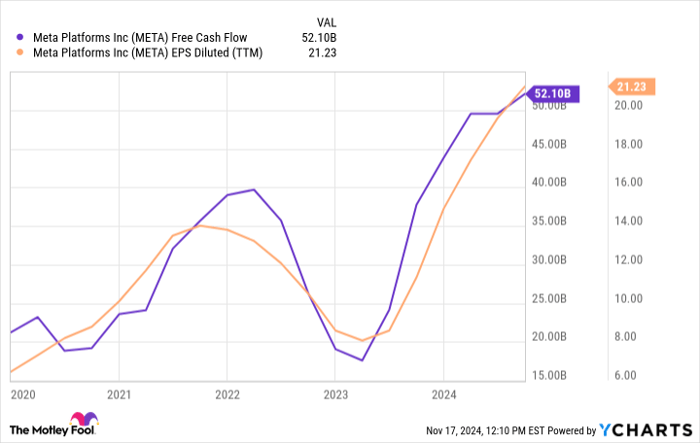

Meta’s investments are massive, yet it is also generating considerable profit—reporting $52 billion in free cash flow over the last year.

META Free Cash Flow data by YCharts

This March, Meta announced a plan to distribute $50 billion to shareholders through stock buybacks. It also initiated a dividend program to encourage management to prioritize profitability alongside new investment decisions.

Currently, Meta stock is trading at about 26 times projected earnings. Although this is a historically elevated ratio for Meta, its earnings have tripled over the past five years. While I would not rush to buy at the current price levels, there remains a solid chance for long-term outperformance in the market.

Is Now the Right Time to Invest $1,000 in Meta Platforms?

Before making an investment in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team has identified what they perceive as the 10 best stocks to buy right now—and Meta Platforms is not on that list. These recommended stocks could yield significant returns in the upcoming years.

For context, consider that when Nvidia was recommended on April 15, 2005, an investment of $1,000 would have grown to a staggering $870,068!*

Stock Advisor offers investors a roadmap for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.*

Explore the 10 recommended stocks »

*Stock Advisor returns as of November 11, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.