Jefferies Rates Edison International as a Strong Buy: What Investors Should Know

Fintel reports that on November 7, 2024, Jefferies launched coverage of Edison International (NYSE:EIX) with a Buy recommendation.

Analyst Price Forecast Indicates Significant Upside

As of October 22, 2024, analysts project an average one-year price target for Edison International at $91.14 per share. This estimation varies, with forecasts ranging from a low of $72.72 to a high of $105.00. Notably, the average price target reflects an 11.91% increase from the latest closing price of $81.44 per share.

For a comparative look, check our leaderboard of companies with the largest price target upsides.

Financial Performance Insights

Edison International is expected to generate annual revenues of $17,082 million, marking a 1.38% decline. Additionally, the projected annual non-GAAP EPS is 5.21.

Fund Sentiment Overview

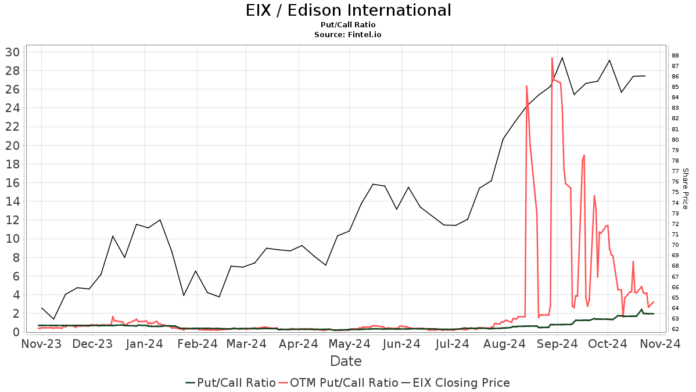

A total of 1,643 funds or institutions currently hold positions in Edison International, reflecting a quarterly increase of 51 owners, or 3.20%. Average portfolio weight dedicated to EIX stands at 0.31%, an uptick of 3.59%. However, total shares owned by institutions have slightly dipped by 0.24% to 410,008K shares.  The put/call ratio for EIX is currently at 1.72, suggesting a bearish outlook.

The put/call ratio for EIX is currently at 1.72, suggesting a bearish outlook.

Institutional Investor Actions

Capital Research Global Investors holds 19,366K shares, which amounts to 5.00% ownership of Edison International. Compared to its previous report of 20,345K shares, this represents a decrease of 5.05%. The firm reduced its allocation in EIX by 6.27% last quarter.

Pzena Investment Management owns 12,875K shares, accounting for a 3.33% stake in the company, down from 13,605K shares—a decline of 5.67%. Recently, this firm decreased its allocation in EIX by 1.59% over the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 12,092K shares, representing 3.12% ownership. This is a slight increase from its previous count of 12,061K shares, marking a 0.25% rise in its portfolio allocation, although it reduced its allocation in EIX by 1.02% last quarter.

Similarly, the Vanguard 500 Index Fund (VFINX) possesses 9,876K shares, representing 2.55% ownership, up from 9,666K shares—a rise of 2.12%. Yet, it also decreased its EIX allocation by 1.81% during the last quarter.

Geode Capital Management holds 9,410K shares, which is 2.43% of the company. This) represents an increase from the 9,169K shares it reported previously, although they have significantly cut their allocation by 48.37% over the past quarter.

About Edison International

(Provided by the company)

Edison International ranks among the largest electric utility holding companies in the United States. It offers clean and reliable energy alongside various energy services through its subsidiaries. Headquartered in Rosemead, California, it serves as the parent company for Southern California Edison, supplying electricity to approximately 15 million residents in Southern, Central, and Coastal California. Edison International also oversees Edison Energy, a global advisory firm dedicated to delivering comprehensive, data-driven energy solutions tailored for commercial and industrial clients to meet their cost, sustainability, and risk management objectives.

Fintel provides a vast range of investment research tools for individual investors, traders, financial advisors, and small hedge funds.

Our platform covers global data, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, unusual options trades, and much more. Our exclusive stock picks leverage advanced, backtested quantitative models for optimized profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.