Jefferies Upgrades Las Vegas Sands: What You Need to Know

On January 3, 2025, Jefferies raised its rating for Las Vegas Sands (WBAG:LVSC) from Hold to Buy.

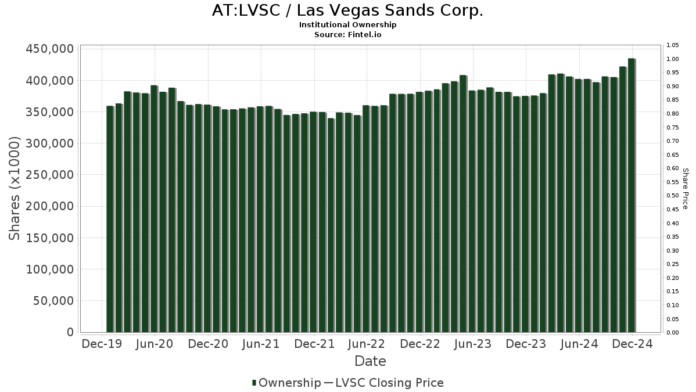

Fund Ownership Trends

Currently, 1,324 funds and institutions report having positions in Las Vegas Sands. This figure represents a decrease of 15 owners or 1.12% compared to the previous quarter. The average portfolio allocation for all funds invested in LVSC increased by 6.96% to 0.22%. Furthermore, total institutional shares have increased by 10.16% over the last three months, bringing the total to 437,275K shares.

Capital Research Global Investors now holds 46,520K shares, which is a 6.42% stake in the company. This reflects a significant increase as the firm previously reported ownership of 14,084K shares, marking a 69.73% rise. Their portfolio allocation in LVSC grew by an impressive 255.93% in the last quarter.

AGTHX – Growth Fund of America has increased its holdings to 16,429K shares, representing 2.27% ownership. In its last filing, this firm reported 2,990K shares, indicating an 81.80% increase. Their portfolio allocation in LVSC spiked by 287.49% over the previous quarter.

Investment Co of America (AIVSX) holds 15,745K shares, reflecting 2.17% ownership. This is up from 5,029K shares reported earlier, which is a jump of 68.06%. Their investment allocation has grown by 236.67% in the last quarter.

Price T Rowe Associates has 15,431K shares, or 2.13% ownership. This is a decrease from 17,280K shares, amounting to an 11.99% drop in ownership, with a corresponding 2.26% reduction in their portfolio allocation.

Fisher Asset Management reported holdings of 13,650K shares, equating to 1.88% ownership. Their previous holding was 16,339K shares, indicating a decline of 19.71% and a 10.48% decrease in portfolio allocation.

Fintel serves as a robust research platform for individual investors, traders, financial advisors, and small hedge funds, offering comprehensive data on fundamentals, analyst insights, ownership trends, and other key metrics.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.