Jefferies Boosts Alarm.com Holdings with Buy Rating

On November 5, 2024, Jefferies began covering Alarm.com Holdings (NasdaqGS:ALRM) with a Buy recommendation.

Analyst Price Forecast Signals Strong Potential for Growth

As of October 22, 2024, the average one-year price target for Alarm.com Holdings stands at $77.81 per share. This forecast varies, with estimates ranging from a low of $60.60 to a high of $89.25. The average price target reflects a potential increase of 38.82% from the latest closing price of $56.05 per share.

For more insights, see our leaderboard of companies with the largest price target upside.

Company Growth and Financial Expectations

Alarm.com Holdings is projected to generate annual revenue of $956 million, marking a 5.56% increase. The expected annual non-GAAP earnings per share (EPS) is $2.12.

Institutional Interest on the Rise

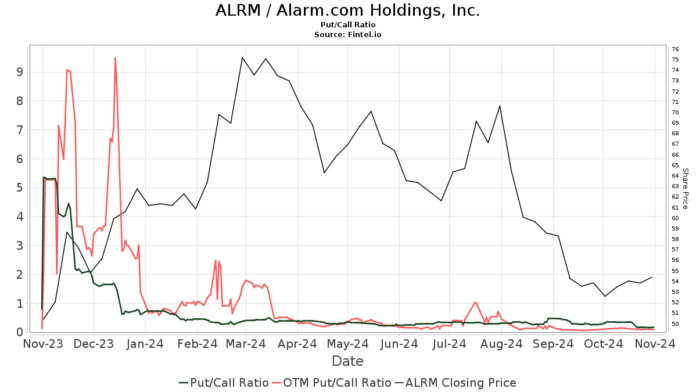

A total of 617 funds or institutions report holdings in Alarm.com Holdings, reflecting an increase of 44 owners, or 7.68%, in the last quarter. The average portfolio weight of all funds holding ALRM is 0.23%, a rise of 7.87%. In total, institutional ownership increased by 9.53% over the past three months, bringing total shares owned to 54,992,000 shares.  The put/call ratio for ALRM is currently at 0.17, suggesting a bullish market sentiment.

The put/call ratio for ALRM is currently at 0.17, suggesting a bullish market sentiment.

The iShares Core S&P Small-Cap ETF holds 3,254,000 shares, representing 6.61% ownership of the company. This is a reduction from previous holdings of 3,380,000 shares, which is a decline of 3.87%. The firm’s portfolio allocation in ALRM decreased by 12.33% in the last quarter.

Brown Capital Management holds 3,200,000 shares, equating to 6.50% ownership. In their last report, they held 3,445,000 shares, showing a 7.68% decrease in shares owned and a 7.05% drop in their portfolio allocation in ALRM.

Disciplined Growth Investors increased its shareholding to 2,711,000, representing 5.50% of the company, up from 2,553,000 shares, an increase of 5.85%, although they decreased their portfolio allocation by 3.89% in the last quarter.

William Blair Investment Management also reported a decrease, holding 1,880,000 shares (3.82% ownership) compared to previously owning 2,086,000 shares, a decline of 10.98%. Their portfolio allocation dipped by 19.82% during the same period.

Finally, the Vanguard Total Stock Market Index Fund Investor Shares holds 1,493,000 shares, or 3.03% ownership, down slightly from 1,497,000 shares, a decline of 0.26%. Their portfolio allocation in ALRM decreased by 14.96% over the last three months.

Alarm.com Holdings: A Snapshot

(This description is provided by the company.)

Alarm.com is recognized as the top platform for managing connected properties. Millions rely on Alarm.com’s technology to monitor and control their properties from virtually anywhere. The platform seamlessly integrates various Internet of Things (IoT) devices, offering solutions in security, video, access control, intelligent automation, energy management, and wellness. These solutions are delivered through a vast network of professional service providers, both in North America and globally.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data spans the globe and provides detailed insights into fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading information, unusual options trades, and more. Additionally, our curated stock picks are driven by sophisticated, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.