As the tax season comes around, a unique opportunity presents itself to those anticipating a refund – the chance to kickstart their investment journey with a monthly dividend ETF. Rather than frittering away the funds on transient pleasures swiftly forgotten, the prudent choice lies in letting that money labor for you by investing in a dividend ETF like the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI).

An investment in JEPI is akin to a perpetual gift. With an impressive 7.5% dividend yield and monthly dividend payouts, investors set themselves up for a steady stream of passive income.

My optimism for this 7.5% yielding ETF from JPMorgan (NYSE:JPM) stems from its above-average yield, monthly distribution schedule, robust selection of blue-chip assets, and a reasonable expense ratio. Let’s delve deeper into this esteemed dividend ETF below.

What Sets the JEPI ETF Apart?

JEPI made its debut in May 2020, quickly establishing itself as the largest and most sought-after actively managed ETF on the market today, thanks to its high dividend yield and monthly distribution regimen. Managed by seasoned professionals Hamilton Reiner and Raffaele Zingone, boasting 37 and 33 years of investment industry expertise, respectively, JEPI aims to provide consistent monthly income and the potential for capital appreciation by capturing a significant portion of the S&P 500’s returns with lower volatility.

It employs a combination of dividend stocks and options premiums to achieve its remarkable yield and constant monthly payments. This is accomplished by investing in S&P 500 stocks and utilizing equity-linked notes (ELNs), along with selling call options associated with the S&P 500 Index. JEPI can allocate up to 20% of its assets to ELNs, which are derivative instruments designed to blend the economic attributes of the S&P 500 Index with written call options in a singular note form, unique from exchange-traded options.

Through these ELNs, JEPI secures a consistent income stream; however, it’s essential to note that by selling these call options, the fund’s potential upside is somewhat curtailed, a tradeoff that investors must consider. As outlined in JPMorgan’s prospectus, the maximum potential gain on an underlying instrument will be the difference between the exercise price and the purchase price of the benchmark or ETF, along with the premium received.

Above-Average Monthly Dividend Offered by JEPI

JEPI’s 7.5% yield stands out significantly. Not only does it surpass the average S&P 500 yield, currently at 1.4%, but it also outshines the risk-free yield obtainable through 10-year treasuries, presently at 4.2%.

Furthermore, the allure lies in its monthly dividend distribution. While most dividend stocks and ETFs pay out quarterly, JEPI ensures a monthly dividend like clockwork.

Though the exact dividend amount may fluctuate slightly, the average yield over the past year has been a steady 7.5%. This translates to approximately $750 in dividend income for an investor who allocates $10,000 to the fund for a year, assuming the yield remains at 7.5%.

It’s a prudent move to utilize your tax return wisely, allowing your money to generate passive monthly income. Investors can even reinvest these dividends in JEPI, either manually or through their brokerage’s dividend reinvestment feature, to compound the investment over time, creating a snowball effect that amplifies returns.

JEPI’s Diversified Portfolio

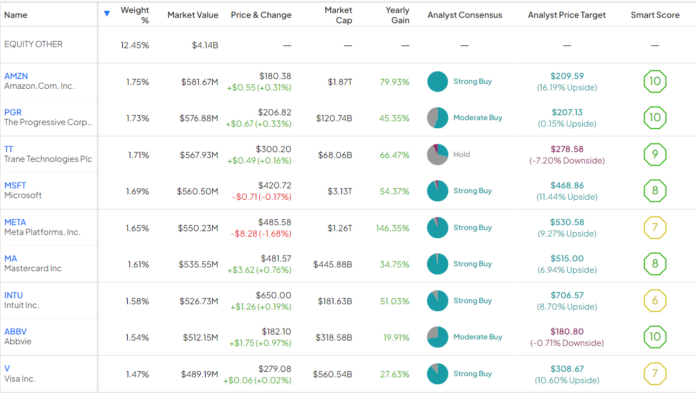

JEPI provides investors with ample diversification, encompassing 118 stocks, with the top 10 holdings constituting a mere 27.2% of the total fund allocation.

The ETF invests in a robust selection of well-known blue-chip stocks. Beyond the 12.5% invested in ELNs, the top nine holdings boast Outperform-equivalent Smart Scores of 8 or higher, as per TipRanks – an online platform that evaluates stock performance through a proprietary scoring system. Intrenched in these top holdings are industry stalwarts like Amazon (NASDAQ:AMZN), Progressive (NYSE:PGR), and AbbVie (NYSE:ABBV), all wielding a ‘Perfect 10’ Smart Score.

Breaking Down JEPI’s Expense Ratio

With an expense ratio of 0.35%, JEPI offers investors a reasonably priced option. For every $10,000 invested in the ETF, the annual fee amounts to $35. Should the fund uphold this expense ratio while delivering a 5% annual gain, a $10,000 investment over a decade would incur $443 in fees.

Analyst Insights on JEPI Stock

Looking to industry experts, JEPI garners a Moderate Buy consensus rating, backed by 104 Buy recommendations, 16 Holds, and zero Sells in the past quarter. The average price target for JEPI stands at $61.40, indicating a potential 6.1% upside.

Parting Thoughts on JEPI

Before hastily disposing of your tax refund, consider the prospect of investing it in a dividend ETF like JEPI. This move offers a monthly dividend for the foreseeable future, paving the way for a budding dividend investor journey. Reinvesting these dividends can bolster your JEPI position and fortify it over time, producing escalating returns.

While no investment is devoid of risk, establishing a diversified portfolio is typically advised. Nonetheless, JEPI presents a compelling component with its enticing 7.5% dividend yield, monthly payment structure, diverse array of US blue-chip holdings, and a modest expense ratio.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.