Uber’s Stock Faces Challenges After Significant Technical Signal

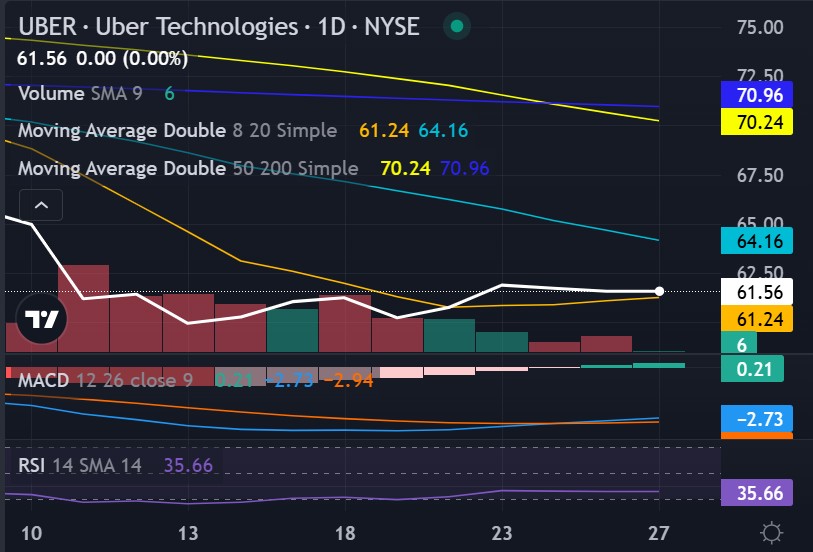

Uber Technologies Inc. UBER has encountered a technical difficulty, marked by a recent Death Cross. This bearish pattern happens when a stock’s 50-day moving average falls below its 200-day moving average.

Chart created using Benzinga Pro

The recent movement in Uber’s stock price indicates a notable change, but will this downward trend persist?

Also See: 5 Tech Stocks to Watch as AI Excitement Wanes

Currently, Uber’s stock is priced at $61.56, which is below its 20-, 50-, and 200-day simple moving averages. The moving average convergence/divergence (MACD) is at a negative 2.73, and the relative strength index (RSI) stands at 35.66, nearing oversold conditions.

These indicators confirm some selling pressure and a bearish momentum. Nevertheless, the eight-day simple moving average (SMA) at $61.24 suggests a slight glimmer of optimism, indicating a potential short-term rebound.

Jim Cramer, a well-known market commentator, has also shared his thoughts on Uber’s recent struggles. “It’s discouraging… but I think Uber is attractive. It’s come down a lot, and I like it,” he stated.

Cramer’s optimistic outlook highlights confidence in Uber’s fundamentals despite the warning signs in technical analysis.

Further complicating matters, Taiwan’s Fair Trade Commission has blocked Uber’s $950 million acquisition of Foodpanda due to antitrust concerns.

This regulatory setback hampers Uber’s efforts to strengthen its position in food delivery within the region and showcases the regulatory challenges it faces globally, impacting its growth ambitions.

Despite these hurdles, Uber continues to be a leading player in both ride-sharing and food delivery, sectors that are expected to bounce back in 2025. The company’s varied revenue sources and robust brand provide a level of resilience, yet navigating the future will require innovation and strategic adjustments.

The appearance of the Death Cross in Uber’s stock chart indicates notable near-term risks. However, it is not a signal for panic.

For investors, this bearish trend may present a chance to buy, especially if the stock begins to show stabilization. With its extensive global presence and ability to adapt, Uber has the potential to recover from these setbacks — although it appears the journey ahead could be challenging.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs