JMP Securities Begins Coverage of Instil Bio, Forecasting Major Price Upside

Positive Outlook with a Projected 287.75% Rise

Fintel reports that on November 4, 2024, JMP Securities initiated coverage of Instil Bio (NasdaqCM:TIL) with a Market Perform recommendation.

Price Target Averages Signal Significant Growth Potential

As of October 22, 2024, the average one-year price target for Instil Bio is $105.74 per share. Predictions vary widely, ranging from a low of $11.11 to a high of $189.00. This average price target suggests a remarkable increase of 287.75% from the company’s most recent closing price of $27.27 per share.

See our leaderboard of companies with the largest price target upside.

Revenue Projections Indicate Growth

The expected annual revenue for Instil Bio stands at $1 million, showcasing potential growth. The projected annual non-GAAP EPS is -1.17.

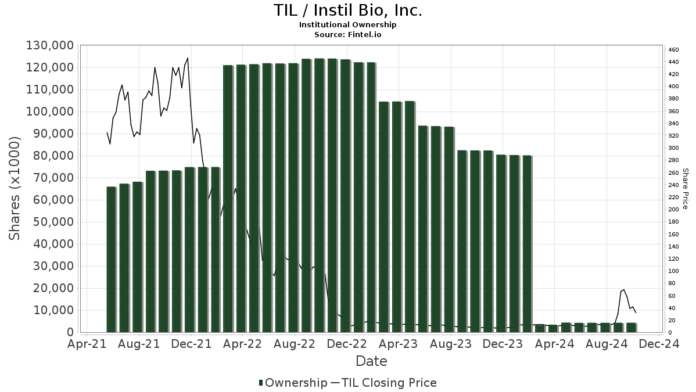

Investment Sentiment from Funds and Institutions

Currently, 48 funds or institutions hold positions in Instil Bio, reflecting a decrease of 3 owners, or 5.88%, compared to the previous quarter. The average portfolio weight of all funds dedicated to TIL is 0.29%, which is an increase of 61.45%. Total institutional shares increased by 0.53% over the last three months, reaching 4,278,000 shares.

Curative Ventures V maintains a substantial position, holding 1,899,000 shares, which is 29.20% ownership of the company, with no changes reported last quarter.

Vivo Capital remains steady with 624,000 shares, representing 9.60% ownership. Their recent filings show no changes, although the firm’s portfolio allocation in TIL increased by 12.00% over the last quarter.

CPMG holds 411,000 shares, equating to 6.32% ownership, with no changes reported for the last quarter.

BML Capital Management has increased its holdings to 391,000 shares, now at 6.01% ownership, up from 349,000 shares previously, marking a 15.64% increase in portfolio allocation.

Cable Car Capital has maintained its position with 258,000 shares, representing 3.97% ownership and reporting no change in the last quarter.

Overview of Instil Bio

Instil Bio Background Information

(This description is provided by the company.)

Instil Bio, Inc. is a clinical-stage biopharmaceutical company specializing in the development of innovative cell therapy pipelines utilizing autologous TIL therapies to target cancer treatment.

Fintel offers comprehensive investing research tools for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and much more. Our exclusive stock picks leverage advanced, backtested quantitative models to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.