Market Reacts to Strong Job Growth and Inflation Concerns

December’s robust jobs report has sent shockwaves through the stock market, raising inflation worries and indicating that the Federal Reserve may hold off on cutting interest rates for the foreseeable future.

This recent data serves as a clear warning to optimistic investors. A steady rise in stock prices in 2025 may face bumpy roads ahead.

Nonetheless, this downturn may present a valuable buying opportunity in the stock market.

To better understand its implications, let’s delve into the details of the latest jobs report.

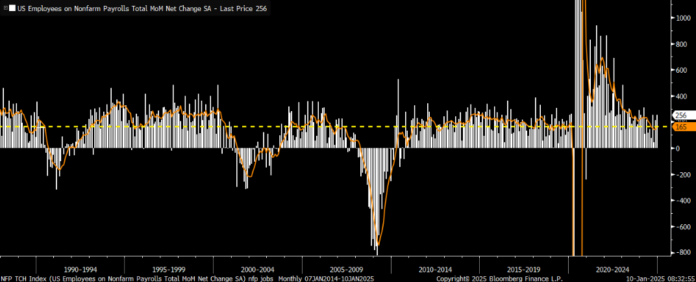

In December, the U.S. economy gained 265,000 jobs, far exceeding the forecast of 165,000. This figure also surpasses the long-term average of approximately 200,000 jobs per month. Remarkably, it marks the highest job growth since March 2024.

The unemployment rate also defied expectations, dropping from 4.2% to 4.1%. Job creation was strong across various sectors, signaling a robust increase in hiring activity.

Overall, the December jobs report was remarkably strong.

In general, increased job growth and lower unemployment can lead to inflationary pressures.

This is the main concern affecting market confidence currently.

Investors React to Inflation Fears from Job Growth

At this point, the U.S. finds itself in a challenging position regarding inflation. A rebound in the labor market could worsen inflation as wage demands rise.

This anxiety was partly supported by the University of Michigan’s January Consumer Sentiment Survey, which revealed unexpected increases in inflation expectations.

Specifically, short-term consumer inflation expectations surged from 2.8% to 3.3%, the largest increase since October 2023. Long-term expectations also rose, reaching 3.3%, the highest level since June 2008.

To put this in perspective, these long-term expectations are now higher than they were in 2022, when inflation hit nearly 10%.

Meanwhile, the overall consumer sentiment score in the survey declined, indicating rising inflationary pressures without a corresponding boost in economic growth.

Ultimately, it was a disappointing report.

This followed December’s strong jobs report, which has left investors anxious about the inflation outlook in the upcoming months.

The prevailing worry is that inflation may accelerate again without significant economic growth.

A Cautious Look at Economic Growth and Inflation Risks

As the economic landscape shifts, there are concerns that rising growth could hinder rate cuts from the Federal Reserve. In fact, some observers warn that growth might lead to rate hikes instead, pushing Treasury yields and financing rates upward, which could affect the U.S. economy negatively.

Understanding Growth and Inflation Trends

The idea that stronger economic growth correlates directly with higher inflation is common, but not always accurate. Throughout history, we have seen periods of significant growth accompanied by low inflation rates. For instance, in the 1960s, the U.S. enjoyed steady economic growth while inflation hovered between 1-2%. Similarly, during the Dot Com Boom of the 1990s, robust economic activity did not lead to runaway inflation. This suggests that a Healthy economy can flourish without exacerbating inflation, a scenario we believe is possible today.

Artificial Intelligence’s Impact

The rise of artificial intelligence (AI) offers a substantial contributing factor toward maintaining low inflation. These days, many businesses are exploring AI to enhance productivity. A survey by UBS involving 125 companies revealed that all are currently examining AI’s potential uses. AI has the capacity to significantly improve worker efficiency, potentially lowering labor costs and reducing inflationary pressures in the long run.

Moreover, as the manufacturing sector increasingly adopts robotics, we anticipate a rise in productivity and an increase in goods supply. This shift too is expected to have a lasting disinflationary effect on the economy.

Current Economic Insights

In the political arena, while the new administration hints at tariffs and deregulation that could be inflationary, there is also a clear commitment to boost domestic energy production. This increase could lead to lower oil and gas prices, thus exerting a deflationary influence on the economy.

When we examine consumer behavior today, it’s evident that past stimulus measures created an environment for higher spending and, subsequently, higher prices in 2022. Presently, however, consumers lack similar spending power. With no new stimulus checks, rising credit card debts, high mortgage rates at around 7%, and significant auto financing rates, many consumers are constrained in their spending capacity.

This lack of “easy money” means that today’s scenario is less likely to spur the sort of demand-driven inflation seen in recent years. Thus, we believe the trend for inflation is likely to remain modest for the foreseeable future.

Reflecting on December’s Job Reports

While potential inflation risks might arise in 2026 and 2027, the near-term outlook appears relatively stable. Consequently, the recent market decline may present an attractive buying opportunity for investors.

Next week will bring several key reports on inflation, including the Consumer Price Index (CPI), Producer Price Index (PPI), and Import/Export Price data. Should these reports indicate low inflation, it could alleviate recent market fears and lead to a recovery in stock prices—an outcome we foresee.

Ultimately, while market cycles will continue to evolve, we believe that stocks will trend upward through 2025. To capitalize on these trends, we are particularly interested in the developments surrounding xAI, Elon Musk’s AI project.

At the time of writing, Luke Lango held no positions in the securities mentioned in this article.

P.S. For ongoing market insights, consider following Luke’s latest analyses through his Daily Notes on the Innovation Investor and Early Stage Investor platforms.