The backbone of financial security for countless Americans, Social Security is facing a mounting financial crisis that demands urgent attention. With retired-worker beneficiaries relying heavily on their monthly benefits, the program’s fiscal health is rapidly deteriorating.

Social Security’s Ongoing Financial Challenges

Since its inception in 1940, Social Security has grappled with an enduring funding deficit. Recent projections from the 2023 Trustees Report reveal a staggering $22.4 trillion shortfall, with the Old-Age and Survivors Insurance Trust Fund projected to deplete its reserves by 2033.

Contrary to popular misconceptions, the primary drivers behind Social Security’s financial woes are rooted in sustained demographic shifts rather than mismanagement or misuse of funds. Factors like the retirement of baby boomers and increased life expectancy have placed an unprecedented strain on the program’s resources.

Janet Yellen’s Bold Approach to Social Security Reform

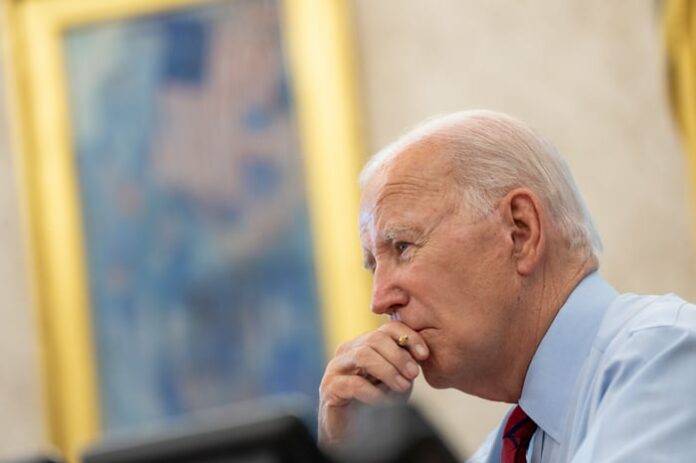

Janet Yellen, former Federal Reserve Chairperson and current economic advisor to President Biden, advocates for a comprehensive strategy to bolster Social Security’s long-term stability. Yellen’s proposal emphasizes a nuanced approach that includes both revenue enhancements and controlled spending.

In sharp contrast to President Biden’s campaign pledge of taxing the wealthy to prop up Social Security, Yellen and her co-authors highlight the necessity of modest reforms that entail adjustments in spending and revenue. Their pragmatic stance acknowledges the harsh reality that substantial changes are imperative to safeguard the program’s longevity.

Yellen’s proposal signals a departure from conventional political rhetoric, advocating for a balanced and bipartisan solution that addresses the core issues plaguing Social Security.

Pursuing a Collaborative Path Forward

In navigating the complex terrain of Social Security reform, a multifaceted and bipartisan approach emerges as the most viable path. While considerations like raising the full retirement age could help mitigate long-term expenditures, reconciling opposing views on revenue generation remains pivotal.

President Biden’s emphasis on taxing high earners could offer immediate relief but falls short of remedying the program’s deep-seated funding shortfall. Combining elements from both Republican and Democratic proposals, akin to the successful Social Security Amendments of 1983, could pave the way for enduring financial sustainability.

By harmonizing diverse perspectives and capitalizing on past bipartisan successes, policymakers can lay the groundwork for a secure and prosperous future for Social Security beneficiaries.

Unlocking Unexplored Avenues for Retirement Security

For individuals seeking to maximize their retirement income, overlooked strategies within Social Security present a wealth-building opportunity. By delving into lesser-known insights and leveraging available resources, retirees can unlock significant financial rewards that bolster their long-term economic well-being.

Discovering these hidden “Social Security secrets” could potentially transform retirement outlooks, offering newfound financial stability and peace of mind for those navigating the complexities of post-career life.

Explore the “Social Security secrets” today to secure your financial future.

Stay informed with reliable financial news and guidance from credible sources like The Motley Fool.