Analysts Predict Promising Future for Elicio Therapeutics

Jones Trading Begins Coverage with a Strong Buy Recommendation

Fintel reports that on October 31, 2024, Jones trading initiated coverage of Elicio Therapeutics (NasdaqCM:ELTX) with a Buy recommendation.

Significant Price Target Upside Expected

As of October 22, 2024, analysts have set the average one-year price target for Elicio Therapeutics at $10.20 per share. These predictions vary between a low of $10.10 and a high of $10.50. This average price target suggests a potential increase of 139.44% from its recent closing price of $4.26 per share.

Check out our leaderboard for companies with the highest price target upside.

The projected annual revenue for Elicio Therapeutics stands at $0MM, with a projected annual non-GAAP EPS of -0.54.

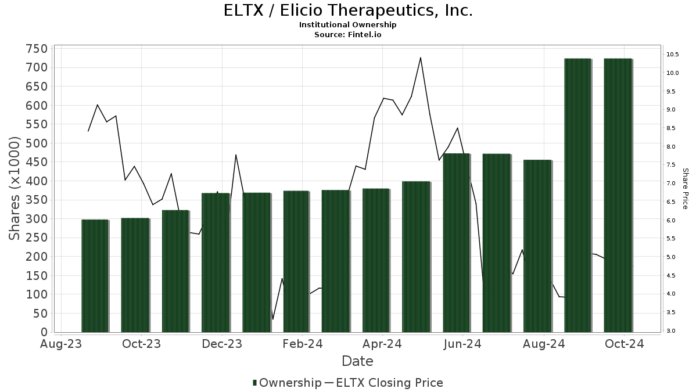

Institutional Investment Overview

Currently, 35 funds or institutions have reported their positions in Elicio Therapeutics, a number that has remained steady from the last quarter. The average portfolio allocation dedicated to ELTX is just 0.05%, although this has risen significantly by 258.76%. In the past three months, total shares owned by institutions have increased by 52.24%, now totaling 733,000 shares.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 185,000 shares, making up 1.72% of the company, with no change since last quarter.

Armistice Capital owns 100,000 shares, representing 0.93% ownership.

Geode Capital Management possesses 72,000 shares, contributing to 0.66% ownership. This marks an increase from their previous holding of 48,000 shares, reflecting a rise of 33.30%, although the firm has decreased its overall portfolio allocation to ELTX by 59.83% over the last quarter.

CM Management has adjusted its holdings down to 50,000 shares, a drop of 50.00%, reducing its portfolio allocation in ELTX by 61.54% in the same time frame.

Arena Investors maintains 50,000 shares, which also amounts to 0.46% ownership.

Fintel offers one of the most comprehensive investing research platforms available to retail investors, traders, financial advisors, and smaller hedge funds. Our extensive data covers global markets and includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and more. Furthermore, our exclusive stock picks utilize advanced, backtested quantitative models to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily represent the views of Nasdaq, Inc.