JP Morgan Upgrades Cadence Design Systems to Overweight Class

Fintel reports that on April 24, 2025, JP Morgan upgraded their outlook for Cadence Design Systems (BMV:CDNS) from Neutral to Overweight.

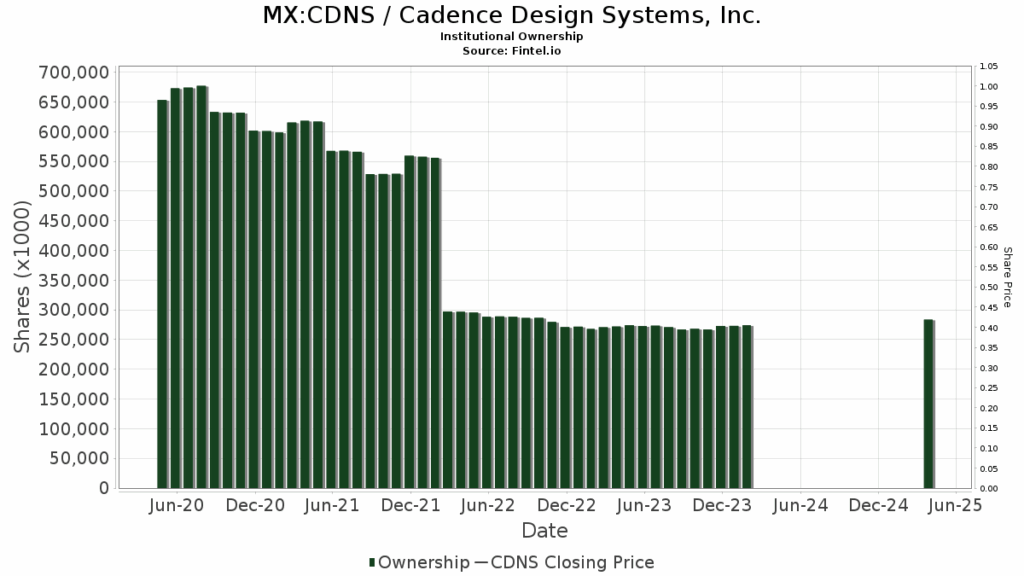

Fund Sentiment Overview

Currently, there are 1,556 funds or institutions reporting positions in Cadence Design Systems. This represents an increase of 85 owners, or 5.78%, in the last quarter. The average portfolio weight for all funds dedicated to CDNS is 0.38%, marking a rise of 1.16%. However, total shares owned by institutions remained flat over the last three months at 596,457K shares.

Insights from Other Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 8,593K shares, representing 3.13% ownership of the company. In its previous filing, it reported owning 8,678K shares, indicating a decrease of 0.99%. Nevertheless, the firm increased its portfolio allocation in CDNS by 8.18% over the last quarter.

Jennison Associates holds 8,010K shares, equating to 2.92% ownership. Their prior filing noted an ownership of 7,606K shares, representing an increase of 5.04%. The firm boosted its portfolio allocation in CDNS by 14.20% over the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) possesses 7,424K shares, representing 2.71% ownership. Compared to previous filings, where they reported 7,171K shares, this is an increase of 3.41%. The allocation in CDNS was raised by 8.58% during the last quarter.

Geode Capital Management owns 6,021K shares, or 2.20% of the company. Their prior filing showed ownership of 5,886K shares, marking a notable increase of 2.25%. However, the firm decreased its portfolio allocation in CDNS by 42.80% over the last quarter.

Alliancebernstein holds 5,676K shares, reflecting 2.07% ownership. In its prior filing, they reported 5,044K shares, representing an increase of 11.14%. Yet, they reduced their portfolio allocation in CDNS by 1.96% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.