Fintel reports that on May 15, 2024, JP Morgan upgraded their outlook for NIO Inc. – Depositary Receipt () (NYSE:NIO) from Underweight to Neutral.

Analyst Price Forecast Suggests 61.83% Upside

As of May 8, 2024, the average one-year price target for NIO Inc. – Depositary Receipt () is 9.37. The forecasts range from a low of 4.04 to a high of $22.89. The average price target represents an increase of 61.83% from its latest reported closing price of 5.79.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for NIO Inc. – Depositary Receipt () is 131,610MM, an increase of 136.63%. The projected annual non-GAAP EPS is -0.21.

What is the Fund Sentiment?

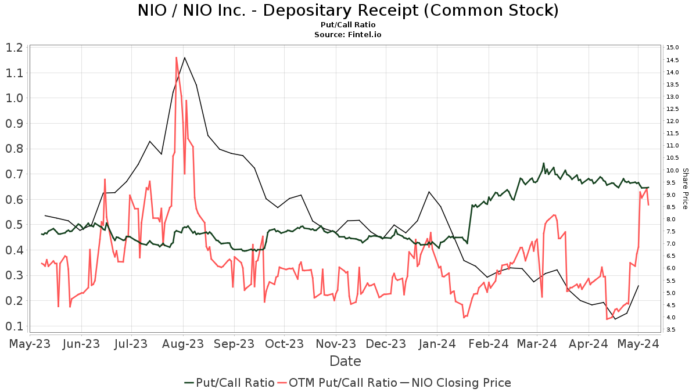

There are 638 funds or institutions reporting positions in NIO Inc. – Depositary Receipt (). This is an decrease of 8 owner(s) or 1.24% in the last quarter. Average portfolio weight of all funds dedicated to NIO is 0.14%, an increase of 20.39%. Total shares owned by institutions decreased in the last three months by 20.90% to 329,826K shares.  The put/call ratio of NIO is 0.63, indicating a bullish outlook.

The put/call ratio of NIO is 0.63, indicating a bullish outlook.

What are Other Shareholders Doing?

VWIGX – Vanguard International Growth Fund Investor Shares holds 38,610K shares representing 1.87% ownership of the company. No change in the last quarter.

Baillie Gifford holds 18,905K shares representing 0.91% ownership of the company. In its prior filing, the firm reported owning 114,636K shares , representing a decrease of 506.38%. The firm decreased its portfolio allocation in NIO by 91.97% over the last quarter.

Goldman Sachs Group holds 13,906K shares representing 0.67% ownership of the company. In its prior filing, the firm reported owning 13,007K shares , representing an increase of 6.47%. The firm decreased its portfolio allocation in NIO by 87.17% over the last quarter.

IEMG – iShares Core MSCI Emerging Markets ETF holds 12,628K shares representing 0.61% ownership of the company. In its prior filing, the firm reported owning 12,645K shares , representing a decrease of 0.14%. The firm decreased its portfolio allocation in NIO by 24.05% over the last quarter.

Ubs Asset Management Americas holds 10,552K shares representing 0.51% ownership of the company. In its prior filing, the firm reported owning 10,490K shares , representing an increase of 0.59%. The firm decreased its portfolio allocation in NIO by 93.51% over the last quarter.

NIO Background Information

(This description is provided by the company.)

NIO Inc. is a pioneer in China’s premium smart electric vehicle market. Founded in November 2014, NIO’s mission is to shape a joyful lifestyle. NIO aims to build a community starting with smart electric vehicles to share joy and grow together with users. NIO designs, jointly manufactures, and sells smart premium electric vehicles, driving innovations in next-generation technologies in connectivity, autonomous driving, and artificial intelligence. Redefining the user experience, NIO provides users with comprehensive and convenient power solutions, the Battery as a Service (BaaS), NIO Pilot and NIO Autonomous Driving (NAD), Autonomous Driving as a Service (ADaaS) and other user-centric services. NIO began deliveries of the ES8, a 7-seater flagship premium electric SUV, in China in June 2018, and its variant, the 6-seater ES8, in March 2019. NIO officially launched the ES6, a 5-seater high-performance premium electric SUV, in December 2018 and began deliveries of the ES6 in June 2019. NIO officially launched the EC6, a 5-seater premium electric coupe SUV, in December 2019 and began deliveries of the EC6 in September 2020. On January 9, 2021, NIO ET7, the smart electric flagship sedan and NIO’s first autonomous driving model, was officially launched.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.