The Russell 2000 Index is gaining momentum in 2024, breaking free from its long stagnant period and approaching targets around 2450.

As per JPMorgan analyst Jason Hunter, small-cap stocks might be on the verge of outperforming their large-cap technology counterparts. This shift could benefit investors in the iShares Core S&P Small-Cap ETF IJR, the iShares Russell 2000 ETF IWM, and the Vanguard Small Cap ETF VB.

This raises the question: Could this signal the beginning of a new trend, or is it merely a brief spike in performance?

Read Also: Russell 2000 Poised For Major Technical Breakout: Analyst Eyes ‘A Trend Reversal In Favor Of Small Caps Outperforming’ S&P 500

Positive Outlook for the Russell 2000

Hunter highlights a “bullish pattern progression” forming this year as the Russell 2000 emerges from a multi-quarter base. Having surpassed the 2282-2299 resistance band, the index is eyeing a short-term target in the range of 2432-2486. Currently, there are no signs that this rally is slowing down. If the small-cap stocks continue their ascent, we may see them nearing the cycle highs reached in 2021, potentially altering market dynamics significantly.

The index remains firmly in bullish territory. Provided it stays above 2260, linked to its post-election breakout, Hunter believes that bullish sentiment will persist, with support likely found around the 2100s, thanks to the 200-day moving average and October’s breakout zone.

Could Small Caps Outperform the NASDAQ 100?

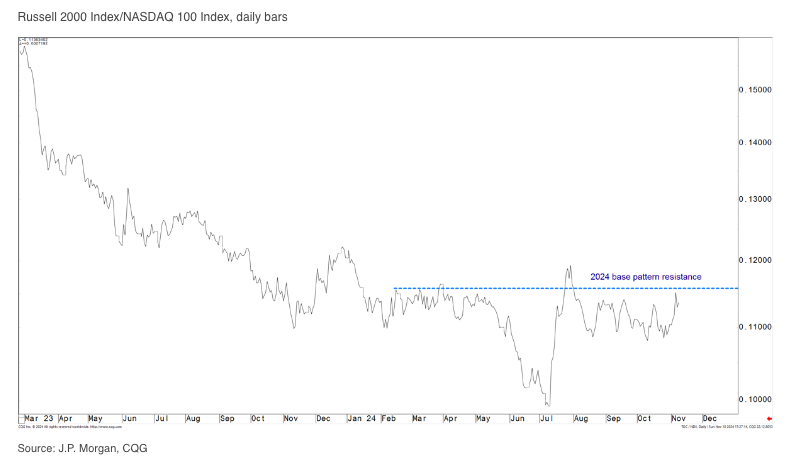

Hunter suggests that the Russell 2000’s recent activity hints at a possible shift in market leadership.

Currently, the ratio of the Russell 2000 to the NASDAQ 100 is approaching significant resistance levels. A breakout could herald a leadership transition towards small-cap stocks, which would mark a departure from the dominance of big tech observed over the past two years.

Hunter refers to this as a “tentative rotation to more cyclically sensitive groups,” and he believes that this trend could gain traction into 2025 if the Russell/NASDAQ ratio decisively breaks out this quarter.

What Fuels the Strength of Small Caps?

Even prior to the rally initiated by the election, small caps had already enjoyed a boost from the post-September FOMC price movements. Hunter notes that they have maintained critical support levels, including the October channel and moving averages, setting the stage for further advances.

The next milestones for the Russell 2000 include 2585, which arises from the recent ascending triangle pattern. Surpassing these levels could indicate a sustainable shift favoring cyclicals over mega-cap technology. Conversely, falling back below these support levels may suggest that the small-cap rally is indeed short-lived.

Cyclicals in Charge–For Now

Hunter’s perspective is one of cautious optimism. However, he cautions that the future performance of small caps compared to tech stocks relies on maintaining these breakout levels. He anticipates sustained bullish momentum into early 2025, underscoring the importance of monitoring the Russell/NASDAQ ratio to validate any potential shift in market control.

If this trend solidifies, 2024 might signify a major comeback for small caps and cyclicals. For now, it remains to be seen whether the Russell 2000 can sustain this rally and prove it is more than a temporary surge.

Read Next:

Image:

Market News and Data brought to you by Benzinga APIs