In a startling turn of events, JPMorgan Chase & Co. (JPM), the renowned Wall Street giant, finds itself at the center of a financial storm, with an eye-watering civil penalty of $350 million to resolve claims about incomplete trading data reported to surveillance platforms. The two U.S. regulators involved in this high-stakes matter are standing firm, demanding accountability from the financial behemoth.

The Unveiling of Reporting Lapses

Unraveling the layers of this labyrinthine tale, the bank disclosed that certain trading and order data across its Corporate and Investment Bank unit had not been fed into the trade surveillance platforms, shedding light on the inadvertent gaps in its reporting. JPMorgan acknowledged, “the data gap on one venue, which largely consisted of sponsored client access activity, was significant,” successfully illuminating the gravity of the situation.

Despite this stunning revelation, JPMorgan has maintained that it has not identified any employee misconduct, harm to clients, or the market. This assertion has laid the foundation for an intricate web of legal complexities that now engulfs the organization.

Divergent Fortunes and Mounting Challenges

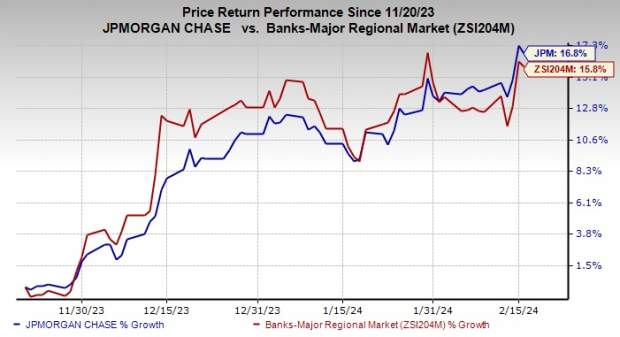

Engulfed in a twister of lawsuits and penalties, JPMorgan’s shares have followed a divergent trajectory. Over the past three months, its shares witnessed an impressive ascent of 16.8%, surpassing the industry’s 15.8% growth. This dichotomy further intensifies the already complex dynamic within the organization.

Broader Legal Woes in the Financial Landscape

As the financial world grapples with legal entanglements, JPMorgan’s travails are just one episode in a season of financial disarray. In November 2023, Morgan Stanley (MS) was embroiled in a $6.5-million settlement with six state attorneys general, while Washington Trust Bancorp, Inc. (WASH) faced its own set of challenges, culminating in a settlement with the U.S. Department of Justice.

These incidents have painted a vivid portrait of the dystopian legal landscape that some of the most prominent names in finance find themselves navigating.

Conclusion

In times of distress, the labyrinth of legal woes often distorts the market. As JPMorgan grapples with the fallout of this tumultuous chapter, the ramifications for both the bank and the broader financial sector remain as uncertain as ever.