“`html

JPMorgan Hits Record High Amid Market Strength and Economic Challenges

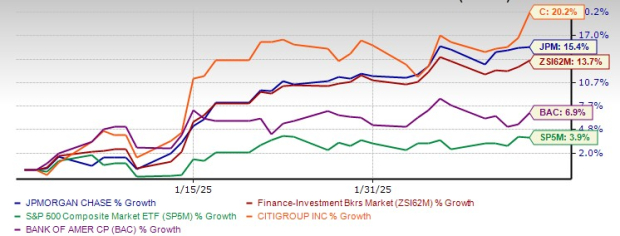

The largest American lender, JPMorgan’s JPM shares reached a record high of $279.23 on Friday. Although the stock closed just below that peak, it has seen an impressive gain of 15.4% this year. This increase outpaces the 13.4% rise of its industry peers and the 3.9% growth of the Zacks S&P 500 composite.

In comparison, JPMorgan’s competitors have also performed well; Citigroup (C) increased by 20.2%, while Bank of America (BAC) posted a gain of 6.9% to date this year.

YTD Price Performance

Image Source: Zacks Investment Research

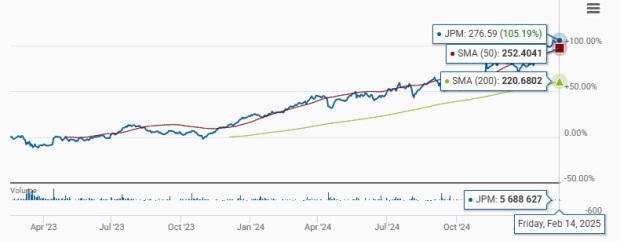

Current technical indicators suggest that JPMorgan’s stock remains strong. It is trading above both its 50-day and 200-day moving averages, signaling a bullish outlook.

50-Day & 200-Day Moving Average

Image Source: Zacks Investment Research

This points to positive market sentiment concerning the company’s financial health and future prospects.

Interest Rates Expected to Stay High

A recent inflation report revealed a 0.5% monthly rise in the consumer price index, pushing the annual inflation rate to 3%. Despite a strong job market and steady consumer spending, the likelihood of the Federal Reserve loosening its monetary policy soon is minimal.

Fed Chair Jerome Powell emphasized this during a recent House Financial Services Committee meeting, stating, “we’re not quite there yet. So we want to keep policy restrictive for now.” Additionally, ongoing tariffs announced by the previous administration may further complicate economic growth.

With these developments, it seems likely that interest rates will remain elevated for an extended period. This situation can be advantageous for JPMorgan, as the company’s net interest income (NII) has experienced a five-year compound annual growth rate (CAGR) of 10.1%, largely due to the sustained high-interest rate environment since 2022. Management anticipates that NII will peak at nearly $94 billion, compared to $93 billion recorded in 2024.

Capital Markets Show Signs of Recovery

JPMorgan’s capital markets division, which encompasses investment banking and trading, is showing signs of recovery. Last year saw a striking 37% increase in investment banking fees within the Commercial & Investment Bank segment after a significant decline of 5% in 2023 and 59% in 2022. Market revenues also rose by 7% due to increased trading volume and volatility.

The firm is optimistic about future performance in investment banking, with expectations that Markets will contribute approximately $4 billion to overall NII this year, a significant rise from the $1 billion generated in 2024.

At the Bank of America Financial Services Conference on February 11, newly appointed Chief Operating Officer Jennifer Piepszak provided insights into the capital markets’ trajectory for the first quarter of 2025, noting that revenue momentum continues and expectations are for low double-digit growth compared to the previous year.

Additionally, Piepszak projected a mid-teens growth rate for investment banking fees in the first quarter, driven by strong equity markets, rising debt issuances, and a resurgence in initial public offerings (IPOs). While mergers and acquisitions may take time to recover, there are positive expectations for the advisory business to contribute positively throughout the year.

Strategic Acquisitions Fueling Growth

JPMorgan is actively pursuing growth through strategic acquisitions in both domestic and international markets. In 2023, the firm raised its stake in Brazil’s C6 Bank from 40% to 46%. It also formed alliances with Cleareye.ai, a fintech company, and acquired Aumni. Additionally, the acquisition of the failed First Republic Bank in 2023 has significantly bolstered JPMorgan’s financial standing, contributing to record profits.

Past acquisitions, including Renovite and a 49% stake in Greece-based Viva Wallet and Global Shares, continue to aid in diversifying revenues and enhancing the bank’s digital consumer offerings. In February 2024, JPMorgan announced plans to open over 500 new branches and renovate around 1,700 locations by the end of 2027. By the end of 2024, the bank had more than 4,950 branches across 48 states in the U.S.

The company is also expanding its digital retail bank, Chase, into European Union countries after successfully launching it in the U.K. in 2021. Additionally, JPMorgan aims to strengthen its investment banking and asset management efforts within China.

Strong Financial Standing and Shareholder Returns

As of December 31, 2024, JPMorgan reported total debt of $750.1 billion, with cash and deposits reaching $469.3 billion. The company holds solid long-term ratings of A-/AA-/A1 from agencies like Standard and Poor’s, Fitch Ratings, and Moody’s Investors Service.

This solid financial footing allows JPMorgan to reward shareholders effectively. After passing the stress test in 2024, the bank raised its quarterly dividend by 8.7% to $1.25 per share in September, followed by a 9.5% increase in February 2024 and a 5% hike in 2023. Over the past five years, dividends have been raised four times, achieving an annualized growth rate of 6.03%. The current payout ratio is 27% of earnings.

Additionally, the bank authorized a new share repurchase program worth $30 billion, set to begin on July 1, 2024, with nearly $19 billion still available for repurchase as of December 31, 2024.

Mortgage Rates Challenge Home Loan Business

High mortgage rates in 2022 and 2023 negatively impacted JPMorgan’s mortgage-related income. With demand for mortgage loans and refinancing declining, this revenue stream recorded a negative CAGR of 13.6% over the last three years. Although some recovery was seen in 2024, strong improvements in origination volumes and refinancing activities are unlikely as mortgage rates are anticipated to stay elevated.

The January 2025 forecast from Fannie Mae’s Economic and Strategic Research Group suggests that mortgage rates will remain above the 6% mark, with expectations for fewer rate cuts in the near future. Consequently, higher mortgage rates will likely dampen origination and refinancing volumes, making substantial growth in mortgage fees and related income challenging for JPMorgan in the upcoming period.

Concerns Over Asset Quality

JPMorgan’s asset quality has begun to show signs of decline. The company has recorded instances of reduced asset quality, raising concerns about future performance in this area.

“`

JPMorgan’s Financial Outlook: Challenges Ahead Amidst Economic Changes

Provisions and Charge-Off Trends Signal Caution

JPMorgan has seen a significant rise in provisions since 2021, driven by a deteriorating macroeconomic environment. Provisions surged by 169% in 2022, followed by increases of 45.9% in 2023 and 14.9% in 2024. Similarly, net charge-offs grew dramatically, up 117.6% in 2023 and 39.1% in the following year.

With expectations for persistently high interest rates, weaker credit profiles among borrowers are anticipated. As a result, JPMorgan is carefully monitoring the impact of ongoing high rates and quantitative tightening on its loan portfolio. Consequently, the quality of its assets is positioned to remain under pressure.

Future Earnings Predictions for JPMorgan

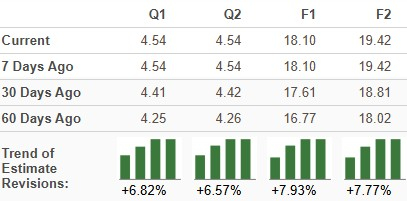

In the past month, analysts have adjusted their earnings estimates upwards for JPMorgan for 2025 and 2026, reflecting a positive outlook for the stock.

Earnings Estimates Trend

Image Source: Zacks Investment Research

The Zacks Consensus Estimate forecasts an 8.4% drop in JPMorgan’s earnings for 2025, attributed to a struggling mortgage banking sector and rising non-interest expenses. Management expects these expenses to reach nearly $95 billion this year, up from $91.1 billion in 2024, while diminishing asset quality is likely to impact overall financial performance.

Looking ahead, earnings for 2026 are projected to grow by 7.3%.

Earnings Estimates

Image Source: Zacks Investment Research

For more earnings estimates and surprises, visit Zacks’ Earnings Calendar.

Currently, shares of JPMorgan appear somewhat pricey compared to the industry average. The stock’s forward 12-month price-to-earnings (P/E) ratio is 15.14X, higher than the industry’s rate of 14.52X, indicating a potentially stretched valuation.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

Investors should remain cautious, given the pessimistic analyst views on JPMorgan this year, along with the need to monitor net interest income (NII) trends and the potential timing for interest rate reductions. However, JPMorgan’s strong market position, the leadership of CEO Jamie Dimon, and its plan to expand globally provide it with an advantage over competitors. Its strategy to strengthen its deposit base and enhance its lending activities sets the stage for future growth.

Considering these factors, investors might find value in holding JPMorgan shares at current price levels for solid long-term returns, despite the high valuation.

JPMorgan currently has a Zacks Rank #1 (Strong Buy). To explore a full list of today’s Zacks #1 Rank stocks, click here.

Don’t Miss Out: Zacks’ Top Picks for 2025

Act quickly to get in on our selection of top 10 stocks for 2025. Chosen by Zacks Director of Research Sheraz Mian, this portfolio has consistently outperformed, gaining over +2,112.6% since its inception in 2012 through November 2024, far exceeding the S&P 500’s +475.6%. Sheraz has sifted through 4,400 companies covered by the Zacks Rank to identify the 10 best options for investment in 2025. Get early access to these promising stocks.

Explore New Top 10 Stocks >>

Want more insights from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days, free of charge.

Bank of America Corporation (BAC): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.