Juniper Networks’ Third-Quarter 2024 Performance Shows Mixed Results

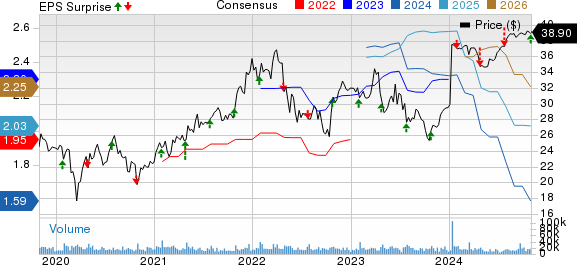

Juniper Networks, Inc. JNPR announced its third-quarter 2024 results, showcasing both revenue growth and declines across various sectors. Despite beating the Zacks Consensus Estimate for earnings, the company struggled with lower revenues compared to last year, primarily due to a drop in demand for its Wide Area Networking, Campus, and Branch solutions.

Stay informed: Explore upcoming quarterly releases on Zacks Earnings Calendar.

Encouragingly, strong growth in cloud orders, fueled by a rise in AI networking investments and increased demand for Mist systems, helped partially offset the revenue decline.

Net Income Insights

Juniper’s net income for the third quarter reached $92.6 million, translating to 28 cents per share, an increase from $76.1 million or 24 cents per share a year prior. This 22% growth was largely attributed to reduced operating costs.

The non-GAAP net income stood at $159.7 million or 48 cents per share, a decrease from last year’s $193.9 million or 60 cents per share. Nonetheless, this figure exceeded the Zacks Consensus Estimate by 4 cents.

Revenue Breakdown

Total revenues for the quarter were $1.33 billion, down from $1.39 billion in the same period last year. This decline was mainly due to weak performance in Service Provider sectors and clients adjusting to prior orders. However, annual recurring revenues from software licenses, support, and SAAS rose 26% year-over-year to $452 million, surpassing the Zacks Consensus Estimate of $1.26 billion.

Product revenues decreased by 9% to $817 million, while service revenues slightly increased by 3% to total $514 million, aided by strong sales in software support, SaaS, and hardware support contracts.

In terms of market segments, Cloud revenues surged to $349.6 million from $269.6 million a year ago, outperforming the Zacks Consensus Estimate of $265.62 million. The growth was driven by significant customer orders linked to AI investments, particularly notable in the Americas and Asia-Pacific regions.

Conversely, Service Provider revenues fell to $389 million, a 7.1% decrease from $418.8 million in the previous year, attributed to a broad slowdown across customer solutions. However, this figure did exceed the Zacks Consensus Estimate of $383.78 million.

Enterprise revenues dropped 16.5% to $592.4 million, impacted by softness in Wide Area Networking and Campus and Branch solutions, although demand remained strong in the EMEA region. Sales in this sector fell short of the Zacks Consensus Estimate of $631.19 million.

Breaking down the customer solutions, Wide Area Networking generated $363.2 million, down 16.7%, while Campus and Branch revenues totaled $319.3 million, reflecting a similar decline. Data Center revenues improved significantly by 43.9% to $244.6 million. Revenue from Hardware Maintenance and Professional Services also dipped slightly by 1.3% to $403.9 million.

Geographically, the Americas recorded revenue growth to $844.1 million from $836.5 million a year earlier. In contrast, revenues from Europe, the Middle East, and Africa decreased to $302.1 million from $345.4 million, while Asia Pacific revenues fell by 14.4% to $184.8 million.

Additional Financial Details

For the third quarter, Juniper reported a non-GAAP gross profit of $791.1 million, down from $832.3 million in the previous year. The non-GAAP gross margin slightly contracted to 59.4% from 59.5%, while non-GAAP operating margin declined to 15% from 17.5%.

Cash Flow and Financial Position

Juniper generated $192 million in cash from operations during the third quarter, down from $329.2 million the previous year.

As of September 30, 2024, Juniper had $1.06 billion in cash and cash equivalents, alongside $1.63 billion in long-term debt.

Company Ranking and Competitors

Currently, Juniper holds a Zacks Rank #3 (Hold).

Arista Networks, Inc. ANET is rated #2 (Buy) at this time, having recently announced an earnings surprise of 8.25%. The company specializes in cloud networking solutions tailored for data centers.

Ubiquiti Inc. UI is a leader with a Zacks Rank of 1, offering a broad portfolio of networking solutions and maintaining a strong global distribution network, enhancing its growth potential.

Workday Inc. WDAY also carries a Zacks Rank #2. Recently, the company reported a 7.36% earnings surprise, providing integrated finance and HR solutions in a cloud-based format.

Zacks’ Investment Insights

Our research team has identified five stocks with the potential to double in value over the upcoming months, with Director of Research Sheraz Mian highlighting one that stands out among the rest. This top pick is positioned for significant growth, supported by a rapidly expanding customer base and innovative solutions, reminiscent of past Zacks successes such as Nano-X Imaging, which saw gains of 129.6% in just over nine months.

Juniper Networks Surpasses Q3 Earnings Estimates Amid Revenue Decline

Key Earnings Highlights: Juniper Networks, Inc. (JNPR) reported strong earnings in the third quarter despite a downturn in revenue, illustrating the company’s resilience in a challenging market.

The tech company announced earnings of $0.63 per share, which comfortably exceeded analysts’ expectations of $0.53. This marks a significant performance, especially as revenue dropped to $1.35 billion, down from $1.44 billion in the same quarter last year. This decline reflects the competitive environment in the tech sector.

Comparatively, in the previous year’s Q3, Juniper had revenues of $1.5 billion. The decrease in revenue highlights the ongoing struggles faced by many companies in maintaining consistent growth during fluctuating economic conditions.

Despite a dip in revenues, Juniper Networks’ robust earnings performance is noteworthy. It serves as an example of how companies can still succeed in creating value for shareholders during difficult times.

Free: See Our Top Stock And 4 Runners Up

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.