The recent announcement from Keurig Dr Pepper Inc. KDP regarding a dividend increase to 92 cents per share showcases the company’s dedication to enhancing shareholder value. This 7% boost resonates with KDP’s commitment to enriching stakeholders through regular dividends and share buybacks, fostering a culture that attracts investors seeking reliable returns.

This move elevates Keurig Dr Pepper’s annual dividend rate to $3.68 per share, creating an appealing 10% yield for potential investors. Coupled with its $1.1 billion share repurchase in the first half of 2024, these actions not only benefit shareholders’ returns but also instill confidence in the company’s financial stability and future prospects.

With a significant increase in cash and cash equivalents, a surge in net cash from operating activities, and robust free cash flow, Keurig Dr Pepper’s strategic financial position is well-positioned for sustained growth and profitability.

Navigating KDP’s Current Performance Landscape

Keurig Dr Pepper has been leveraging its brand strength, consumer-centric innovation, and expansion into high-growth categories to drive performance. The company’s solid route-to-market capabilities have fueled market share gains, particularly in the Refreshment Beverages segment, propelling its momentum forward.

The recent strategic alliance with Kalil Bottling Company, focusing on distribution in Arizona, reflects KDP’s commitment to enhancing its market presence and solidifying its position in a rapidly evolving sector. Despite facing challenges such as cost pressures and operational headwinds, Keurig Dr Pepper has shown resilience and adaptability in navigating the competitive landscape.

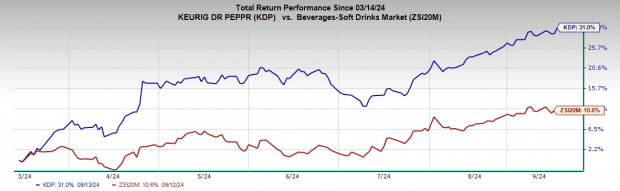

While the coffee segment has experienced some sluggishness, Keurig Dr Pepper’s shares have surged by 31% over the past six months, outperforming industry benchmarks. By addressing challenges head-on and leveraging its core strengths, KDP is poised to capitalize on growth opportunities and deliver value to shareholders.

Exploring Opportunities in the Financial Market

For investors eyeing potential opportunities, consider the following:

The Chef’s Warehouse CHEF, with a Zacks Rank #1 (Strong Buy), has demonstrated an impressive earnings surprise track record and solid growth projections.

Flowers Foods FLO, boasting a Zacks Rank #2 (Buy), offers consistent performance and growth potential in the baked goods segment.

Utz Brands Inc. UTZ, with a Zacks Rank of 2, presents a diverse portfolio in the salty snacks market, showing promise for significant growth in the current fiscal year.

By exploring these opportunities and staying informed on market trends and analysis, investors can position themselves effectively to capitalize on emerging prospects and maximize their investment portfolios.

Zacks Highlights Top Semiconductor Stock

Discover an under-the-radar semiconductor stock poised for growth in the rapidly expanding global market. With a focus on cutting-edge technology and significant market potential, this stock presents a compelling investment opportunity for savvy investors.

Explore This Stock Now for Free >>

Learn More About Investing Strategies and Opportunities with Zacks Investment Research.

Please note that the insights and opinions expressed in this article are solely those of the author and may not necessarily align with the viewpoints of Nasdaq, Inc.