“`html

Keurig Dr Pepper: Navigating Challenges with Growth Strategies

Keurig Dr Pepper Inc. (KDP) is positioning itself for future growth through solid business strategies. The company is benefiting from its brand strength and various pricing strategies. Efforts to expand and innovate its products are contributing to these positive trends.

Let’s explore further.

Positive Developments in KDP’s Strategy

Keurig Dr Pepper recently announced its plan to acquire a 60% stake in GHOST Lifestyle LLC, which is known for its popular GHOST Energy drinks. This acquisition is part of KDP’s strategy to reshape its portfolio, placing emphasis on high-growth partnerships, like those with Electrolit and La Colombe.

For some time now, the Refreshment Beverages segment has been a strong performer for KDP. Significant sales growth, alongside a beneficial product mix and the transition of Electrolit, has enhanced this segment’s performance. Maintaining this trend could positively impact KDP’s revenue in the future.

Keurig Dr Pepper’s focus on consumer-driven innovation, along with increased household penetration and loyalty, is helping boost its market share in key areas such as liquid refreshment beverages and K-Cup pods across major markets like the U.S., Mexico, and Canada.

This growth reflects a strategic blend of innovation, marketing efforts, and effective execution, supported by an ongoing commitment to cost management and productivity improvements. Strong brand performance, in-market strategies, and effective pricing have also contributed positively to KDP’s revenue streams.

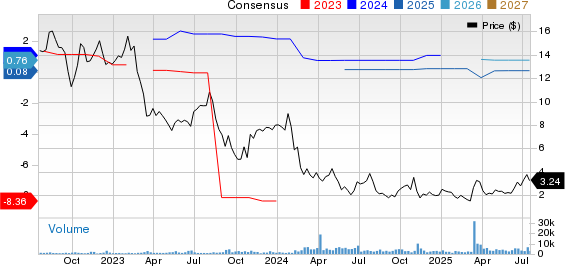

KDP’s Stock Performance Overview

Over the past month, KDP’s stock has decreased by 0.8%, which is a better outcome compared to the industry’s overall decline of 2.9%.

Image Source: Zacks Investment Research

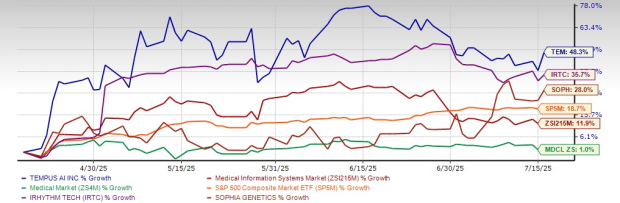

KDP’s Stock Valuation Insights

Currently, KDP’s stock is trading at an attractive valuation compared to the industry. Its price/earnings ratio is at 15.81 on a forward 12-month basis, notably less than the industry average of 19.47, and below its historical median of 16.63.

Image Source: Zacks Investment Research

Challenges Facing KDP

Despite these positives, Keurig Dr Pepper is confronting ongoing cost challenges in areas like transportation, warehousing, and labor. Increased marketing spending is also impacting its bottom line.

Moreover, the coffee segment has shown signs of weakness. In the third quarter of 2024, U.S. coffee sales fell by 3.6% compared to last year, driven by a net price decline of 6.3%. Management anticipates a continuation of sluggish trends in the at-home coffee category in 2024.

Looking Ahead

Analysts remain optimistic about KDP, particularly in the energy drinks and alternative beverages markets. The Zacks Consensus Estimate for 2025 predicts sales of $16.28 billion and earnings per share (EPS) of $2.05, representing year-over-year increases of 6.2% and 6.5%, respectively. KDP currently holds a Zacks Rank #3 (Hold).

Consumer Staples Stocks Worth Considering

Freshpet, Inc. (FRPT), a company focused on pet food, boasts a trailing four-quarter average earnings surprise of 144.5%. Currently, it has a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate shows expected growth of 27.2% for sales and 228.6% for EPS this financial year compared to the previous year.

Vital Farms (VITL), known for its pasture-raised products, holds a Zacks Rank of 2 (Buy). This company’s sales and EPS estimates reflect growth of 27.2% and 88.1%, respectively, for the current financial year compared to last year.

McCormick & Company (MKC), which specializes in spices and seasonings, also has a Zacks Rank of 2. The sales and EPS growth estimates for MKC stand at 0.5% and 8.2%, respectively, compared to year-ago figures.

Discover Top Stock Picks for 2025

Would you like to be informed early about the top 10 stock selections for 2025?

Historical performance suggests these selections could be outstanding.

Since 2012, when our Director of Research Sheraz Mian took charge of this portfolio, the Zacks Top 10 Stocks has gained +2,112.6%, outpacing the S&P 500’s +475.6%. As Sheraz reviews 4,400 companies to select the best 10 stocks for 2025, don’t miss your chance to invest when they’re announced on January 2.

Get Access to Top 10 Stocks >>

Interested in the latest Zacks recommendations? Download 5 Stocks Set to Double for free.

Freshpet, Inc. (FRPT): Stock Analysis Report

McCormick & Company, Incorporated (MKC): Stock Analysis Report

Keurig Dr Pepper, Inc (KDP): Stock Analysis Report

Vital Farms, Inc. (VITL): Stock Analysis Report

For the original article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`