Netflix’s Stock Surges: What to Expect in 2025

Netflix (NASDAQ: NFLX) stock has seen remarkable growth, tripling between 2023 and the end of 2024. As the streaming leader prepares to report its fourth-quarter earnings on January 21, investors are eager to examine the company’s year-end performance, explore 2025 content spending plans, and assess the likelihood of price hikes this year.

Here’s a closer look at why Netflix continues to thrive and considerations for potential investors.

Where to invest $1,000 right now? Our analysts have identified the 10 best stocks to buy currently. See the 10 stocks »

Image source: Getty Images.

Understanding Netflix’s Success

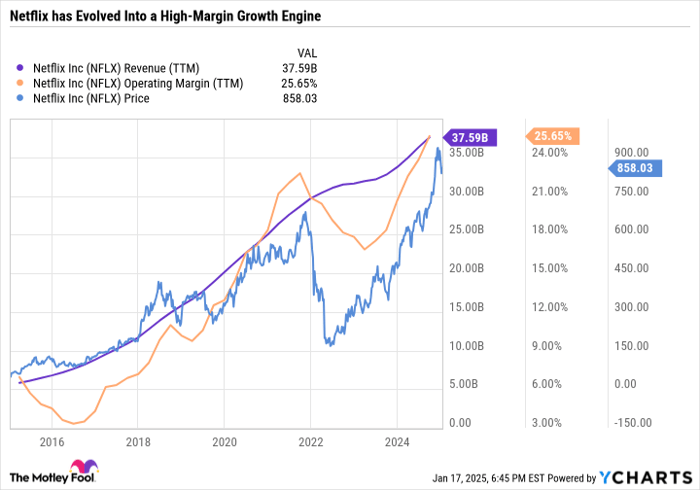

The following chart highlights the significance of Netflix’s sales and operating margin growth.

NFLX Revenue (TTM) data by YCharts.

In 2022, Netflix’s stock struggled, mirroring a broader decline in growth stocks due to falling margins and investor skepticism. However, Netflix has since bounced back, achieving strong sales growth and record operating margins.

Initially, Netflix’s business model appeared risky as the company spent billions on content, hoping to keep viewers engaged and justify future price increases. If the content does not resonate, it risks losing viewers to other streaming services.

However, Netflix is evolving. It has learned from past mistakes, balancing quantity with quality. Though some content has underperformed, many successful titles enrich its library, setting it apart from rivals.

The most relevant metric for assessing Netflix’s value is screen time. Engagement surpasses subscriber numbers as a measure of success. In its second-quarter 2024 report, Netflix cited a Nielsen study showing streaming constituted 40.3% of daily U.S. TV screen time; compared to 27.2% for cable and 20.5% for broadcast. Notably, YouTube accounts for 9.9%, and Netflix follows at 8.4%, indicating the two platforms alone make up 45% of U.S. streaming screen time.

In the third quarter of 2024, Netflix revealed that subscribers watched an average of two hours of content daily. This impressive figure illustrates the effectiveness of its mix of licensed and original content, along with the addition of games and live events as a compelling offering when compared to competitors facing pressure to bundle services.

Netflix regularly highlights its viewership for popular shows and previews upcoming releases. Major titles like Squid Game (Season 2), Outer Banks (Season 4), and Love is Blind (Season 7) launched in Q4, and how these shows performed will be critical for investors to assess the company’s future potential.

Fourth Quarter Projections

For Q4, Netflix forecasts $10.13 billion in revenue, marking its highest quarterly revenue to date, with a year-over-year growth of 14.7%. Operating margins are expected to dip to 21.6%, a typical seasonal trend for Netflix’s fourth quarter. Compared to Q4 2023, Netflix anticipates an impressive 46.4% increase in operating income.

Focus should be on how well Netflix’s holiday season content performed and expectations for 2025. Investors will be looking for continuation of mid-teens revenue growth and operating margins in the mid- to high-20% range.

Consideration of Price Increases

In 2023, Netflix discontinued its Basic Program and introduced a Standard with Ads tier at $6.99 per month, alongside Standard at $15.49 and Premium at $19.99. The Standard tier has remained at $15.49 since 2022, while the Premium tier increased to $22.99 in 2024.

Speculatively, a price increase for the Standard plan might occur in 2025, along with potential raises for the Standard with Ads plan.

Investors should pay attention to management’s comments regarding price adjustments during the earnings call. During its Q3 call, Netflix discussed long-term monetization and indicated the ability to justify future price increases, provided it continues delivering high-quality content.

Evaluating Netflix’s Valuation

Netflix has shifted its focus towards substantial earnings growth over the past five years, making the price-to-earnings (P/E) ratio a significant metric for evaluating its valuation.

Currently, Netflix has a P/E ratio of 49, with a forward P/E of 36. This suggests that based on analysts’ estimates, the stock’s valuation is higher than competitors like Meta Platforms at a forward P/E of 24, and Alphabet at 22.

While Netflix warrants a premium valuation, the extent is questionable. The company’s ability to maintain market share in streaming and capitalize on a shift from cable to streaming will play a crucial role in justifying its valuation. Presently, Netflix stock is not cheap, and investors must pay a premium for access to it.

This period might be an excellent opportunity for risk-tolerant investors to initiate a position in Netflix while others may want to keep it on their watchlist, especially if a price increase boosts earnings growth this year.

Netflix’s Challenge for Future Valuation

Netflix previously struggled with inconsistent content quality. Now, it excels by offering diverse programming, from live events to different genres and niche interests.

Although the stock is currently overpriced, it could present a good investment if you have faith in the company’s long-term prospects.

The forthcoming earnings call is crucial for Netflix, as it will highlight the effectiveness of the Q4 content slate and provide insights into plans for 2025. Investors might prefer to monitor the situation until a more attractive valuation arises.

While Netflix has proven its capabilities as a company, it must confirm its worth as a stock due to its elevated valuation.

A Chance for Lucrative Opportunities

Ever regretted missing out on investing in successful stocks? You’re not alone.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they believe are set for significant growth. If you worry about having missed your chance to invest, now might be the best time before the opportunity slips away. The potential is evident:

- Nvidia: A $1,000 investment made when we doubled down in 2009 would be worth $357,084!*

- Apple: Investing $1,000 at our 2008 recommendation would have grown to $43,554!*

- Netflix: A $1,000 investment in 2004 would have soared to $462,766!*

We are currently issuing “Double Down” alerts for three remarkable companies, and such an opportunity may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

Randi Zuckerberg, former market development director for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is part of The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also a board member. Daniel Foelber does not hold shares in the mentioned stocks. The Motley Fool recommends Alphabet, Meta Platforms, and Netflix and has positions in these companies.

The views and opinions expressed herein are solely those of the author and do not necessarily represent those of Nasdaq, Inc.