Disney’s Earnings Report: What Investors Need to Know

The Walt Disney Company (NYSE: DIS) exceeded earnings expectations in the latest quarter, with positive guidance fueling investor enthusiasm. Its shares surged on Thursday following the release of fiscal fourth-quarter results.

However, experienced investors know to scrutinize the details. Initial excitement can fade once investors delve into the fine print, revealing potential pitfalls that could dampen a stock’s rise.

With this warning in mind, let’s explore three significant insights from Disney’s fourth-quarter results that may influence your investment strategy.

Key Insights from Disney’s Q4 Performance

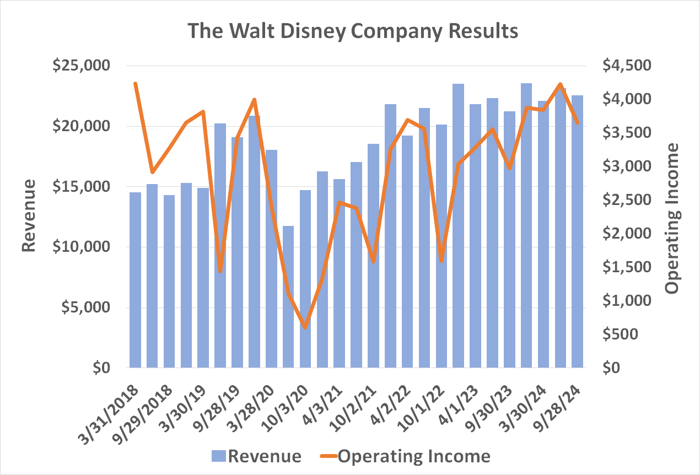

For the quarter ending in September, Disney reported $22.6 billion in revenue, translating to a per-share profit of $1.14. Both figures represent an increase from the previous year’s $21.2 billion in revenue and $0.82 profit per share. Additionally, these results surpassed estimates of just under $22.5 billion in revenue and a $1.10 profit per share.

The growth primarily came from Disney’s theatrical films and streaming services, which helped balance weaker performance in their theme parks and television sectors.

However, there are crucial nuances to consider about Disney’s overall health.

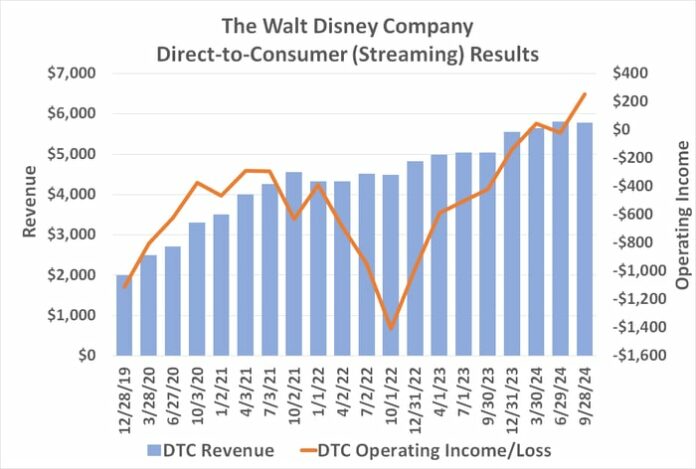

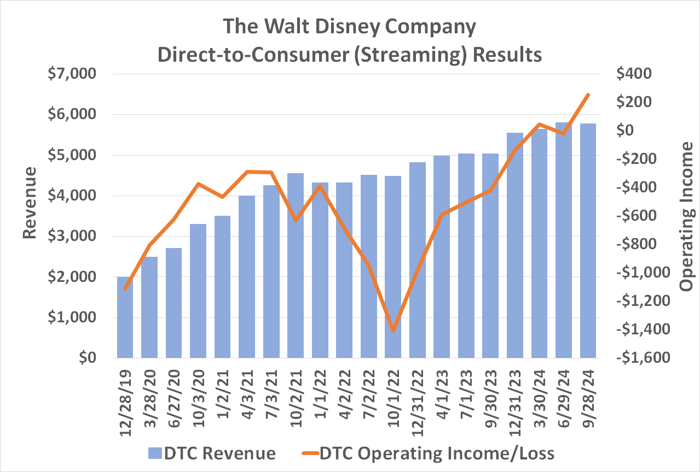

Firstly, even though Disney’s film revenue improved, the bulk of the 23% increase in operating income stemmed from its streaming platforms, Disney+ and Hulu. These services rebounded from a $420 million loss in the previous fourth quarter to generate $253 million in operating income this time. This progress reflects a longer trend, but the streaming divisions have only recently turned profitable.

Data source: The Walt Disney Company. Chart by author. Figures are in millions.

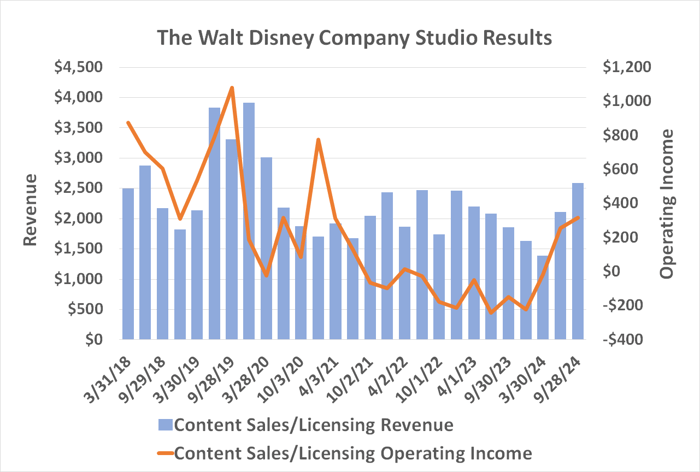

Although the studio appears to be recovering, thanks in part to recent hits like Inside Out 2 and Deadpool & Wolverine, it’s essential to note that these box office returns are only marginally better than a previous downturn in this sector. Disney’s films still contribute less to profits than they did pre-pandemic, and blockbuster releases are becoming fewer.

Data source: The Walt Disney Company. Chart by author. Figures are in millions.

This trend may suggest that the pandemic-induced acceleration of streaming has contributed to the ongoing struggles of the film industry.

Finally, while Disney forecasts double-digit growth in earnings per share for the next three years, there is concerningly no reference to revenue growth. Instead, it seems that much of the anticipated profit increase will arise from cost reductions and stock buybacks, with a notable $3 billion allocated for repurchases in the current fiscal year.

This approach may work in the short term, but cost-cutting alone cannot sustain growth indefinitely. Eventually, Disney will need to invest more to attract new customers and combat stagnation in both revenue and profits.

Data source: The Walt Disney Company. Chart by author. Figures are in millions.

Additionally, Disney’s sports sector, mainly ESPN, shows little growth. The company needs a clear strategy for this segment, as the future of a standalone ESPN streaming service could significantly impact Disney’s overall operations.

Analyzing the Benefits and Risks

This overview isn’t a complete analysis of Disney’s current state; it highlights elements often unnoticed. Notably, Disney’s parks and resorts segment, its largest revenue source, remains relatively stable and is growing with inflation. Meanwhile, its non-sports television business is experiencing some losses due to the ongoing trend of cord-cutting.

Despite the promising overall numbers for the fourth quarter, a detailed examination reveals potential challenges. Although streaming currently drives growth, warnings in the company’s guidance suggest a slowdown may be imminent. It remains uncertain whether the film business has truly rebounded to pre-pandemic levels.

The spike in shares may have been an overreaction to the quarterly results. A cautious approach might be wise, allowing time to see if Disney can rejuvenate any of its segments beyond streaming.

In essence, consider tracking Disney stock, but hesitate before adding it to your investment portfolio.

Is Now the Right Time to Invest $1,000 in Disney?

Before deciding to invest in Disney, take a moment to reflect:

The Motley Fool Stock Advisor team has recently identified what they believe are the 10 best stocks for investors to consider right now, and Walt Disney isn’t included. The selected stocks are projected to deliver substantial returns in the near future.

For instance, when Nvidia made this list on April 15, 2005, if you had invested $1,000 then, you would have $870,068.*

Stock Advisor provides valuable insights for constructing a successful investment strategy, including regular updates and new stock recommendations each month. The service has significantly outperformed the S&P 500 since 2002, returning more than quadruple its value.*

Explore the 10 recommended stocks »

*Stock Advisor returns as of November 11, 2024.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walt Disney. For further details, consult the Motley Fool’s disclosure policy.

The opinions expressed here are solely those of the author and do not necessarily represent the views of Nasdaq, Inc.