Amazon’s Financial Performance: Insights on Net Income and Stock Tracking

Amazon (NASDAQ: AMZN) has generally been a favorable stock throughout its public journey, experiencing normal market fluctuations along the way. The company consistently meets its goals and explores new ventures to create additional revenue. Presently, its emphasis is on generative artificial intelligence (AI), a promising sector that should bolster both sales and profits.

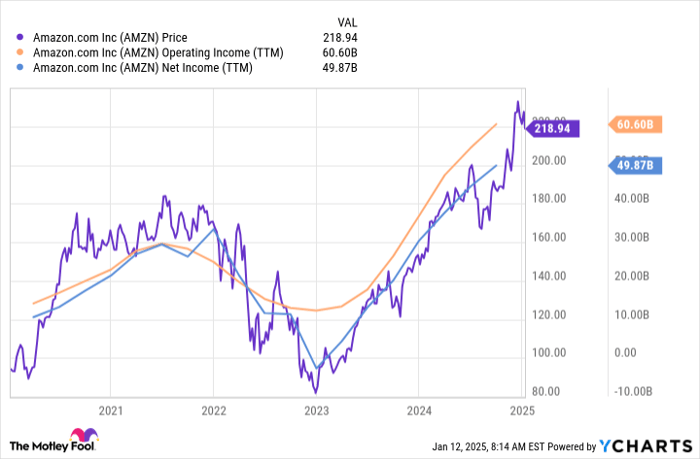

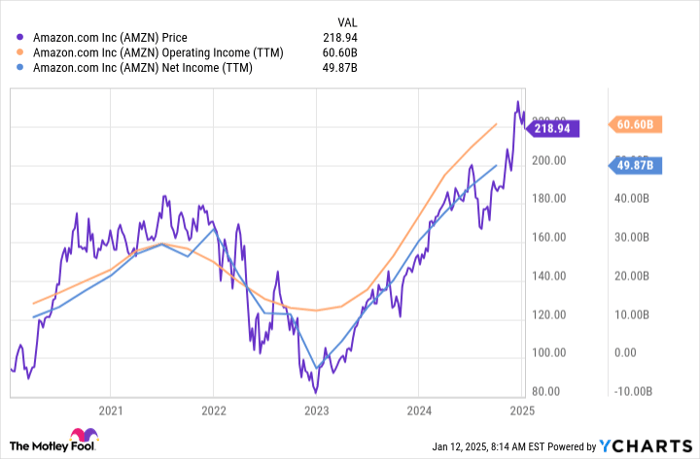

Understanding this focus is essential, as there is a clear correlation between Amazon’s stock price and its net income changes.

Comparing Operating Income and Net Income

Amazon’s leadership prioritizes operating income, highlighting this figure at the start of quarterly reports. Operating income excludes taxes and expenses that don’t significantly impact operational performance.

This approach could be seen as prudent. Notably, billionaire investor Warren Buffett, who owns a stake in Amazon, has criticized net income as “worse than useless.” Instead, he advocates for focusing on operating income, which provides a clearer understanding of a company’s financial health.

However, not all investors may hold Buffett’s perspective. The debate over the relevance of operating versus net income continues. This choice significantly affects valuation metrics such as the P/E ratio, making the distinction between net income and operating income relevant to the market. In fact, Amazon’s stock price is more closely aligned with net income than with revenues or operating income.

AMZN data by YCharts.

Net income appears later in the financial reports, but it is crucial for investors to pay attention to it. In the third quarter, Amazon’s net income rose from $9.9 billion in 2023 to $15.3 billion in 2024. This figure should be interpreted within the broader context of the company’s financial status.

A New Investment Opportunity Awaits

Do you ever feel you’ve missed out on purchasing top-performing stocks? If so, there’s exciting news you should consider.

Occasionally, our team of experts issues a “Double Down” stock recommendation for companies they anticipate will see significant growth. If you believe you’ve missed your window of opportunity, now may be the ideal time to invest before prices rise further. The performance numbers back this up:

- Nvidia: if you invested $1,000 when we took action in 2009, you’d now have $345,467!*

- Apple: if you invested $1,000 when we acted in 2008, you’d have $44,391!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $453,161!*

At this time, we are issuing “Double Down” alerts for three exceptional companies, and you might not see another opportunity like this soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.