Nvidia’s Stock Soars Amid AI Wave: What Investors Need to Know

The rise of Nvidia (NASDAQ: NVDA) in the artificial intelligence sector is undeniable, as soaring demand for its graphics processing units (GPUs) has boosted company revenue significantly.

Massive Revenue Growth in Data Centers

Nvidia’s data center segment is driving its financial success. In the second quarter of fiscal 2025, which ended on July 28, the company reported total revenue of $30 billion—more than double the amount from the same quarter last year. Notably, 88% of that revenue came from the data center group.

The question for investors now is whether Nvidia’s stock has room for further growth after a remarkable 187% increase this year. One critical metric could provide insight into the stock’s future performance.

Unfulfilled Demand and Upcoming Innovations

Nvidia is currently facing challenges meeting the demand for its H100 and H200 GPU chips. However, the company is ramping up production of its next-generation Blackwell chips, which CEO Jensen Huang describes as generating “incredible” anticipation.

According to Huang, Nvidia plans to unveil new technology every year, with an accelerator named Rubin set to launch in 2026.

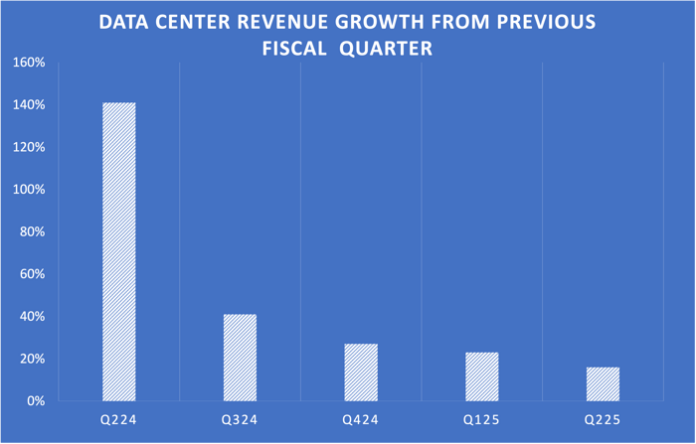

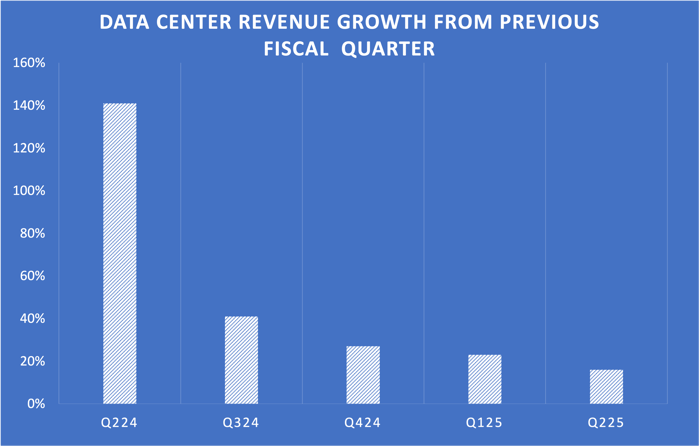

Investors will eagerly await the fiscal 2025 third-quarter report on November 20, particularly to gauge how Blackwell impacts sales. It’s important to monitor Nvidia’s quarterly sales growth in the data center segment, which has shown a decline over the last five quarters compared to previous periods.

Quarter-over-quarter sales growth has slowed from 141% to 16% in the past five periods. Data source: Nvidia. Chart by author.

For Nvidia’s stock to sustain its strong momentum, it is essential that quarterly revenue growth increases again or at least stabilizes. The introduction of Blackwell could play a significant role in achieving this turnaround, as current market trends have already driven the stock up on anticipation of continued growth.

Is Now the Right Time to Invest $1,000 in Nvidia?

Before you consider investing, keep this in mind:

The Motley Fool Stock Advisor analyst team recently identified their selection of the 10 best stocks for investors to consider now—and Nvidia was notably absent. The recommended stocks may offer significant returns in the years to come.

Reflecting on the past, Nvidia was on this list on April 15, 2005. If you had invested $1,000 back then, it would now be worth $858,854!*

Stock Advisor provides a straightforward investment roadmap, complete with guidance on portfolio building, regular analyst updates, and two new stock picks each month. The service has shown investment returns exceeding four times that of the S&P 500 since 2002.*

Explore the list of 10 stocks »

*Stock Advisor returns as of November 18, 2024

Howard Smith has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.