Nvidia’s Upcoming Earnings and Key Focus Areas

Semiconductor leader Nvidia (NASDAQ: NVDA) is gearing up to share its fiscal 2025 third-quarter earnings on November 20. Investors will have plenty to dissect, but two specific elements are particularly noteworthy.

Let’s delve into the key points to watch as Nvidia’s earnings report approaches and understand their implications for investors.

1. Progress on the $50 Billion Stock Buyback

In the first half of fiscal 2025, Nvidia bought back 162.1 million shares for $15.1 billion. Currently, the company can repurchase an additional $7.5 billion in stock.

Moreover, Nvidia’s board of directors approved a staggering $50 billion in buybacks as of August.

This uptick in share buybacks could signal that management believes the stock is undervalued. I’m particularly interested to see how much of the $50 billion has actually been spent on repurchases.

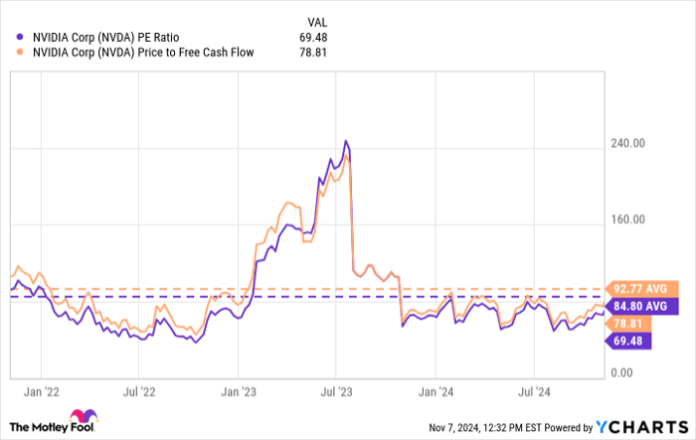

Data by YCharts.

Nvidia shares are currently trading below historical averages in both price-to-earnings (P/E) and price-to-free cash flow (P/FCF) ratios.

With the anticipated success of the new Blackwell GPU, there’s a strong possibility that Nvidia’s stock will see significant growth ahead. If shares are repurchased at competitive valuations before Blackwell’s launch, it could enhance shareholder value. Otherwise, the $50 billion buyback might come off as less than genuine, described by Motley Fool contributor Sean Williams as a “smoke-and-mirrors campaign.”

2. The Buzz Around Blackwell

The excitement surrounding Nvidia’s new Blackwell GPU cannot be understated. CEO Jensen Huang has claimed that demand is “insane,” and Morgan Stanley analysts predict the launch may generate $10 billion in revenue for fiscal 2025.

Despite this optimistic outlook, challenges could be lurking. Super Micro Computer, a close Nvidia partner specializing in chip architecture, is embroiled in accusations of accounting misconduct which could compromise its reliability as a supplier.

Nvidia has reportedly started shifting Blackwell orders away from Supermicro to other vendors amidst this turmoil.

This cautious approach by Nvidia makes sense, but it raises questions about potential short-term effects on supply and demand. Supermicro’s ongoing issues may lead to uncertainties in Nvidia’s growth trajectory in the near term.

Image source: Getty Images.

The Bottom Line

It’s worth noting that a lack of significant buyback activity or slower-than-expected growth from Blackwell won’t prompt immediate concern for investors.

Nvidia’s stock has surged in recent years, with continued growth expected due to the momentum from Blackwell. As valuations potentially climb, investors will be curious about management’s perspective on timing and pricing for future buybacks.

Is it the Right Time to Invest $1,000 in Nvidia?

Before you consider purchasing Nvidia stock, think about this:

The Motley Fool Stock Advisor analyst team recently revealed their pick for the 10 best stocks to invest in right now—and Nvidia is not on this list. The chosen stocks are believed to provide substantial returns in upcoming years.

Remember that on April 15, 2005, Nvidia was on a similar must-buy list… if you had invested $1,000 at that time, you would now have $904,692!*

Stock Advisor offers a straightforward strategy for investors, including guidance on portfolio management and fresh stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002*.

Explore the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.