KeyBanc Initiates Coverage of Acadia Healthcare with Positive Outlook

On October 11, 2024, KeyBanc initiated its coverage of Acadia Healthcare (NasdaqGS:ACHC), recommending a Sector Weight approach.

Analyst Forecast Indicates Significant Potential Growth

The average one-year price target for Acadia Healthcare stands at $89.67 per share, as of September 25, 2024. Predictions vary, with forecasts predicting a low of $75.75 and a high of $107.10. This average target suggests a potential increase of 63.57% from the closing price of $54.82 per share recently reported.

For further analysis, see our leaderboard featuring companies with the highest price target potential.

Revenue Growth and Earnings Projections

Acadia Healthcare has a projected annual revenue of $3,167 million, which translates to a 3.59% increase. Furthermore, the projected annual non-GAAP EPS is anticipated to be 3.75.

Institutional Sentiment and Activity

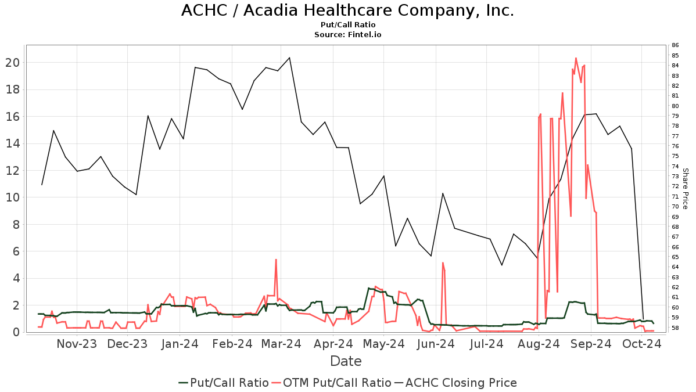

Currently, 781 funds or institutions hold positions in Acadia Healthcare, a decline of 10 owners or 1.26% since the last quarter. The average portfolio weight for all funds invested in ACHC is 0.26%, indicating an increase of 8.15%. Institutions collectively increased their holdings by 3.03% over the past three months, amassing a total of 113,789K shares. The put/call ratio is at 0.26, signaling a bullish outlook on the stock.

Institutional Investors by the Numbers

Wellington Management Group LLP currently holds 10,392K shares, representing 11.19% of the company. This reflects an increase of 23.82% from its previous holding of 7,917K shares, with the firm also increasing its portfolio allocation by 12.76% last quarter.

T. Rowe Price Investment Management possesses 7,999K shares, or 8.61% ownership. However, they have decreased their holdings from 8,524K shares—a decline of 6.57%—and lowered their allocation by 17.47% over the last quarter.

Vanguard Health Care Fund Investor Shares own 4,736K shares, equivalent to 5.10% ownership, marking an increase of 22.77% from the 3,658K shares previously reported. This also involved a 6.32% boost in their portfolio allocation for ACHC.

T. Rowe Price Mid-Cap Growth Fund holds 3,899K shares (4.20% ownership), though this number has dropped by 6.73% from their last filing of 4,161K shares, with an overall decrease in allocation by 13.94%. Meanwhile, William Blair Investment Management holds 3,515K shares (3.79% ownership), up by 17.18% from their earlier 2,911K shares, indicating a 4.48% increase in their investment last quarter.

Understanding Acadia Healthcare

(This description is provided by the company.)

Acadia is a significant player in the behavioral healthcare sector in the United States, operating 227 facilities and approximately 9,900 beds across 40 states and Puerto Rico. With more than 20,000 employees, Acadia serves about 70,000 patients daily, making it the largest stand-alone behavioral health company in the nation. Its services cover a range of settings, including inpatient psychiatric hospitals, specialty treatment facilities, residential treatment centers, and outpatient clinics.

Fintel offers comprehensive investing research for individual investors, financial advisors, and small hedge funds, covering a wide array of data, including fundamentals, analyst reports, ownership data, and fund sentiment.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.