“`html

Kinder Morgan: A Closer Look at Its Dividend Appeal

If you look at midstream giant Kinder Morgan (NYSE: KMI) in isolation today, it seems like an attractive dividend stock. The yield is roughly 4%, which surpasses the average energy company’s yield of 3.3%, as indicated by the Energy Select Sector SPDR ETF. Additionally, the midstream company’s dividend has increased each year since 2018.

However, it’s wise to dig deeper into the midstream sector before making any buying decisions regarding Kinder Morgan.

Should You Buy, Hold, or Sell Kinder Morgan?

Kinder Morgan specializes in midstream operations, owning energy infrastructure such as pipelines and storage facilities. The company primarily earns revenue through fees charged to customers for access to these essential assets. This business model often shields Kinder Morgan from the unpredictable price fluctuations of oil and natural gas.

Moreover, Kinder Morgan’s 4% yield is solidly backed by its distributable cash flow, which covered the dividend by a comfortable ratio of 1.7 in the third quarter of 2024.

Image source: Getty Images.

There is little evidence to suggest that the dividend is at risk of being cut, and it is quite likely to continue growing. Given Kinder Morgan’s status as a major player in the midstream industry, some investors may find its 4% yield attractive. Nevertheless, it’s advisable to pause before making any significant investment.

Market Performance Raises Caution

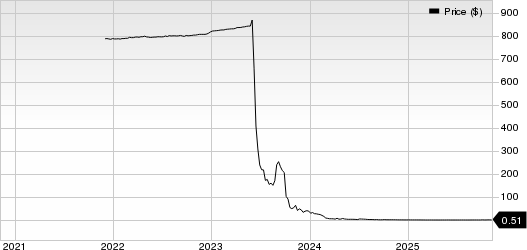

The company’s stock has surged over the past year, climbing more than 60%. This dramatic rise is notable for a typically stable niche like midstream energy. In contrast, peers such as Enbridge (NYSE: ENB) and Enterprise Products Partners (NYSE: EPD) have seen significantly smaller increases, yet their dividend yields remain more favorable. Kinder Morgan’s yield is currently about 40% lower than its peak yield from the last year, suggesting much of the positive news is already accounted for in the stock price.

KMI data by YCharts.

Interestingly, the more modest gains of peers like Enterprise and Enbridge have not led to a decline in their yield; Enterprise currently offers a yield of about 6.4%, and Enbridge’s stands at around 6%. For income-focused investors, these alternatives may present better options.

Long-Term Dividend History Matters

Another factor to consider is the long-term dividend track record of Kinder Morgan compared to its peers. Enterprise has consistently increased its distribution for 26 years, while Enbridge has maintained a 29-year streak. In contrast, Kinder Morgan’s history is less impressive, particularly following its dividend cut in 2016. This cut occurred after management reassured investors in late 2015 about a possible 10% dividend increase. Such events can raise concerns for conservative dividend investors.

Exploring Better Income Options

Kinder Morgan isn’t a poor choice by any means, but after its recent price jump, it may not be the ideal income stock compared to other large midstream companies. The company’s trailing enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) ratio stands at 14.4. This is significantly higher than Enbridge’s 12.8 and Enterprise’s 10.8, indicating that Kinder Morgan may be overvalued at this time. Overall, income-driven investors could benefit from considering alternatives like Enbridge and Enterprise.

Unlock New Investment Opportunities

Have you ever felt like you missed out on investing in promising stocks? This could be your chance.

Occasionally, our expert analysts identify a “Double Down” stock recommendation for companies poised for significant growth. If you’re concerned about missing out, now might be an excellent time to invest before the opportunity slips away. The numbers speak volumes:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,460!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,946!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,249!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and you won’t want to miss this potential opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge and Kinder Morgan. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`