The Climb Continues

Steering through the tumultuous waters of the financial world, Lasertec (TSE:6920) has set sail towards new horizons with its price target soaring by 13.19% to an impressive 37,539.40 per share. This latest surge reflects a remarkable upswing from the previous estimate of 33,164.57, dated back to January 16, 2024.

The heart-pounding journey to this new target value is not a solitary one, as it is the collective whispers of numerous analysts shaping the trajectory. These whispers have woven a tapestry with an array of targets, spreading from a low of 22,725.00 to an ambitious high of 50,400.00 per share. The average price target strides in at a promising 8.44% below the most recent closing price of 41,000.00 per share.

Strength in Stability: Lasertec’s Dividend Game

The steadfast Lasertec (TSE:6920) stands tall, offering investors a comforting 0.47% dividend yield at the current market price. Delving deeper, the company’s dividend payout ratio rests at 0.31, divulging how much of the company’s earnings are distributed among shareholders. Holding a mirror to financial well-being, a payout ratio above one signifies shaky ground as the company digs into reserves to sustain the dividend flow. Conversely, a ratio below one hints at an agile company, allowing room for growth investments.

Engraved in Lasertec’s history books is a 3-Year dividend growth rate of 2.47%, a testament to its commitment to shareholders, showcasing a steady increase in dividends over time.

Market Winds: Fund Insights

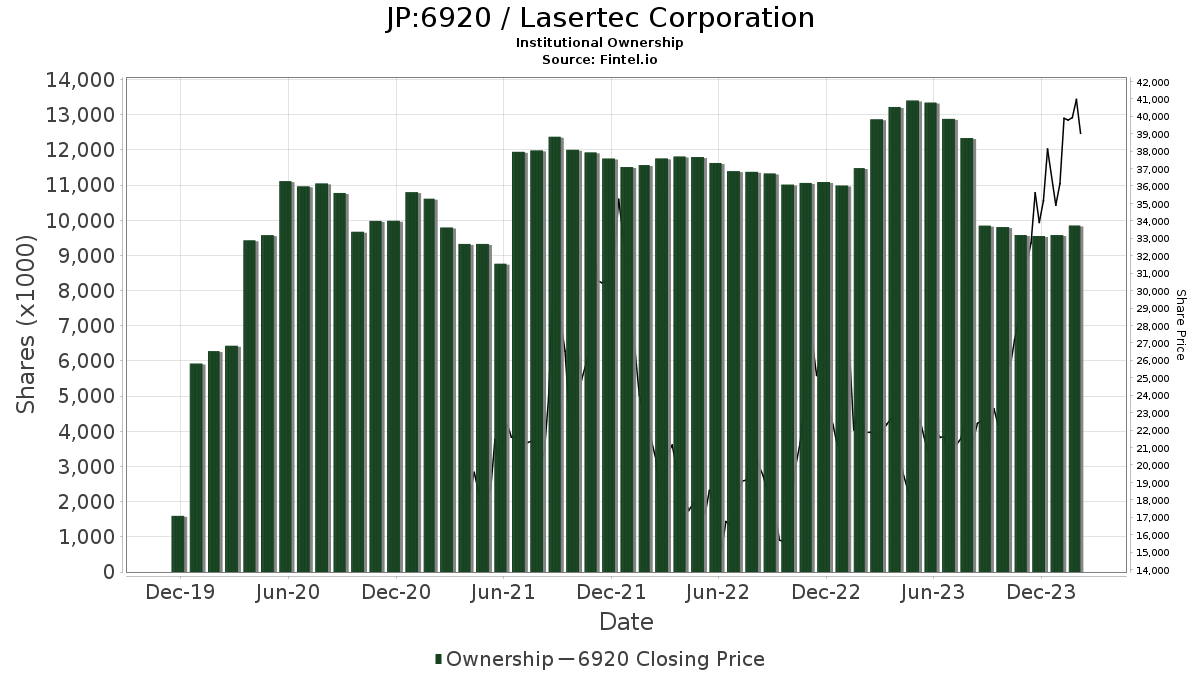

Turning our gaze to the buzzing hive of fund activity, 234 institutions are currently holding stakes in Lasertec, marking a resilient 7.34% increase in ownership from the last quarter. The average portfolio weight of these funds is pegged at 0.35%, posting a robust surge of 21.84%. In unison, these institutions have collectively amassed 9,848k shares of Lasertec, witnessing a 3.04% rise in shares held over the past three months.

The Shareholder Symphony

Among the band of shareholders, AEPGX – EUROPACIFIC GROWTH FUND leads the charge with 1,418K shares, representing a 1.57% stake in Lasertec. Their recent filing disclosed a minor 0.80% decrease in shares owned, yet an 11.71% surge in portfolio allocation towards 6920 over the last quarter.

VGTSX – Vanguard Total International Stock Index Fund Investor Shares dances closely behind, clutching 1,028K shares, a 1.14% ownership in the company. Their latest filing boasted a 1.42% growth in shares held and a substantial 22.89% hike in allocation to Lasertec during the same period.

FIGSX – Fidelity Series International Growth Fund takes its position, holding 902K shares, a 1.00% stake in Lasertec. Their most recent report unveiled a vigorous 7.81% increase in shares owned and a notable 28.32% escalation in the portion of their portfolio dedicated to 6920.

The chorus continues with LISOX – Lazard International Strategic Equity Portfolio Open Shares at 722K shares, making up 0.80% of the company. Despite a minor 4.61% reduction in shares held from the prior filing, a 9.42% uptick in portfolio allocation was witnessed in the last quarter.

VTMGX – Vanguard Developed Markets Index Fund Admiral Shares rounds out the ensemble, securing 608K shares, a 0.67% slice of Lasertec ownership. Mirroring resilience, this shareholder observed a 1.22% surge in shares possessed and an 8.84% rise in allocation towards 6920 in the last quarter.

Disclaimer: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.