Lucid Group’s Recent Surge: A Crucial Moment for Investors

After hitting a 52-week low of $2.02 per share last Wednesday, electric vehicle manufacturer Lucid Group (LCID) has bounced back by approximately 16%. The company shared its mixed third-quarter results last Thursday. Despite experiencing a greater-than-expected loss for the quarter, Lucid’s revenues exceeded forecasts. Investor sentiment appears to be bolstered by the opening of pre-orders for its new Gravity SUV model. Additionally, a recent post on X indicated that Lucid’s Air sedan participated in California Highway Patrol (CHP) tests, likely piquing investor interest.

Let’s explore the key takeaways from Lucid’s latest financial results, along with its growth opportunities and hurdles to determine if now is a strategic time to consider Lucid shares.

Important Highlights from LCID’s Q3 Results

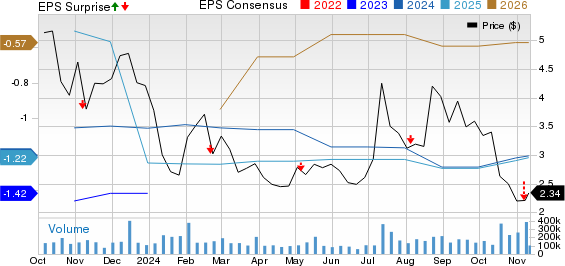

In the third quarter, Lucid reported a loss of 41 cents per share, exceeding the Zacks Consensus Estimate of a 32-cent loss and the prior year’s loss of 28 cents. Elevated research and development (R&D) and selling, general, and administrative (SG&A) expenses had a significant impact on margins, with these costs reaching around $558 million, an increase from the previous year. On a positive note, the quarter’s revenues came in at $200.4 million, marking a substantial year-over-year increase of 45.4%, and surpassed the consensus estimate of $194 million.

Stay abreast of quarterly results: Check Zacks Earnings Calendar.

The increase in revenues was driven by a surge in vehicle deliveries. Lucid reported delivering 2,781 vehicles in the September quarter, a remarkable 91% increase year-over-year and the third consecutive quarter of record deliveries. In contrast, its competitor Rivian (RIVN) saw a 36% decline in third-quarter deliveries.

Lucid has reiterated its goal for annual production, targeting 9,000 units. With only 5,642 vehicles produced from January through September, significant ramp-up in production will be essential to meet this target.

As the third quarter closed, Lucid reported approximately $5.16 billion in total liquidity, of which $1.89 billion was in cash or cash equivalents.

Lucid Group, Inc. Price, Consensus and EPS Surprise

Lucid Group, Inc. price-consensus-eps-surprise-chart | Lucid Group, Inc. Quote

Key Factors Supporting Lucid’s Future

Gravity SUV as a Future Driver: Lucid is pinning its hopes on the upcoming Gravity SUV, which could be a game-changer in the North American EV market, especially as SUVs and crossovers gain popularity. Production is expected to begin later this year, with pre-orders for the “Grand Touring” model opening last Thursday. This high-performance SUV features over 800 horsepower and a 440-mile range, starting at $94,900. A more affordable “Touring” version is slated for release in late 2025 starting at $79,900. Additionally, Gravity owners will have access to Tesla’s (TSLA) extensive NACS charging network, which could enhance its attractiveness. Lucid CEO Peter Rawlinson has emphasized that the addressable market for Gravity is six times larger than that of the Lucid Air sedan, highlighting its potential to boost the company’s growth.

Participation in Law Enforcement Fleet Programs: Notably, Lucid’s Air sedan has been undergoing tests with the California Highway Patrol, potentially opening doors for future EV deployments within law enforcement. If successful, Lucid could join the growing trend of EVs within California’s police fleet. The brand has also gained traction internationally, with the Dubai police incorporating the Air Grand Touring model into their own fleet.

Strong Backing from Saudi Arabia: Lucid’s growth prospects are bolstered by robust support from Saudi Arabia’s Public Investment Fund (PIF), its largest shareholder. PIF holds a majority stake and has provided financial stability by facilitating important funding rounds, including a commitment from the Saudi government to purchase up to 100,000 Lucid vehicles over the next ten years.

Increased Financial Stability: Following the third quarter, LCID raised $1.75 billion in capital, enhancing its cash reserves and extending its financial runway into 2026. This positions Lucid well within the competitive EV market.

A Shift in LCID Stock Valuation

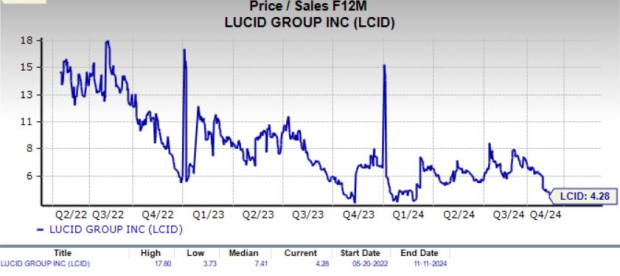

Lucid’s shares have fallen 44% year-to-date and are down 96% from their peak of $58 in early 2021. At that time, Lucid entered a market filled with excitement for EVs, drawing investor interest similar to today’s buzz around AI. As a dedicated EV brand, Lucid aimed to lead in the ultra-luxury segment with the Lucid Air, celebrated for its range, power, and innovative design.

As the electric vehicle landscape has evolved, however, Lucid now confronts a more challenging market. The anticipated surge in EV adoption has not fully materialized, and traditional automakers are increasingly influencing the market. Brands like Cadillac and Mercedes-Benz are entering the luxury EV sector, ramping up competition. These developments have cooled Lucid’s previously high stock valuation, which now reflects a market that values execution and scalability over just potential.

Image Source: Zacks Investment Research

In 2024, Lucid has set itself apart with record delivery numbers and is laying the foundation for future growth through new vehicle models. As of now, total deliveries in the first three quarters have reached 7,142 vehicles, surpassing the 6,001 deliveries from all of 2023. With the much-anticipated Gravity SUV poised for release and strong financial support, Lucid appears geared for further advancements.

Despite this positive outlook, investors must stay aware of ongoing cash burn and the risks of potential equity dilution. While challenges persist and some may see optimism as overly hopeful, recent developments indicate that Lucid could be on an upward trajectory. The Zacks Consensus Estimate for 2024 and 2025 suggests anticipated year-over-year sales growth, reinforcing confidence in Lucid’s resilience.

Image Source: Zacks Investment Research

With shares significantly down from their previous highs, the current pricing presents a potential buying opportunity for those who believe in Lucid’s strategy and direction. Investors willing to evaluate risks alongside rewards may find this an opportune moment to consider the stock.

LCID currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks That Might Double

Each stock highlighted has been selected by a Zacks expert as having the potential to gain +100% or more in 2024. Although not every selection can succeed, past recommendations have soared by +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently flying under the radar on Wall Street, providing an excellent opportunity to invest early.

Discover These 5 Potential Stock Gems >>

Want to stay updated with the latest recommendations from Zacks Investment Research? Today, you can download the report on 5 Stocks Set to Double. Click to access your free report.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.