Why Lemonade’s Innovative Approach Could Be a Smart Investment Choice

As Artificial Intelligence (AI) technology advances, investment prospects in the sector are becoming increasingly appealing. One notable company is Lemonade (LMND), an insurance provider that employs cutting-edge AI and machine learning to optimize its operations and challenge the old-fashioned insurance model. Following the release of its third-quarter financial results, which exceeded expectations, Lemonade’s shares surged by over 30% in a matter of days. Analysts are optimistic about the company’s continued profitability, making it an interesting option for investors ready to take on more risk for potentially greater rewards in the insurance field.

Lemonade’s Disruption of the Insurance Market

Lemonade, Inc. operates in the United States, Europe, and the UK, aiming to revolutionize the traditional insurance industry. By utilizing AI and machine learning, the company has streamlined processes, minimizing paperwork and accelerating service delivery. They provide various insurance products, including coverage for renters, homeowners, vehicles, pets, and personal liability. Furthermore, Lemonade acts as an agent for other insurance firms.

To manage cash flow and larger claims effectively, the company employs a unique reinsurance strategy. Additionally, its giveback model differentiates it from traditional firms by allowing customers to donate excess premiums to charities they support, thus cultivating a sense of trust and loyalty.

Lemonade’s growth strategy focuses on broadening its product offerings to adapt to customers’ needs. Recent additions, such as life, pet, and car insurance, enhance customer lifetime value and create opportunities for cross-selling. This strategy proves successful in states where all products are available, leading to a noticeable increase in multi-policy customers. Their digital-first marketing method successfully engages target audiences through various popular social media outlets, including Facebook (META), TikTok, YouTube, and Instagram.

With noteworthy efficiency and scalability, Lemonade demonstrates strong In Force Premium (IFP) per employee and per share ratios. The company operates with virtually no debt and has shown consistent growth in net cash flow, indicating healthy financial stability and potential profitability.

Lemonade’s Strong Financial Performance

In its recently released Q3 2024 earnings report, Lemonade showcased impressive growth, revealing a 24% rise in IFP and a significant improvement in loss ratios. The in-force premium surged 24% to $889 million, with customer numbers growing 17% to reach 2.3 million. The company reported revenue of $136.6 million, outperforming expectations, with a remarkable 71% year-over-year increase in gross profit to $38 million, lifting the gross profit margin to 27%. Lemonade also recorded positive net cash flow of $48 million, reflecting its operational efficiency. An adjusted EBITDA loss of $49 million resulted in an earnings per share of -$0.95, surpassing consensus estimates by $0.07.

Management is upbeat about maintaining positive net cash flow by the conclusion of 2024 and achieving adjusted EBITDA profitability by 2026. Forecasts for the fourth quarter and the 2024 fiscal year indicate ongoing growth, with the anticipated in-force premium expected to be between $940 million and $944 million. The adjusted EBITDA loss is predicted to be between $155 million and $151 million.

Is LMND Worth Buying?

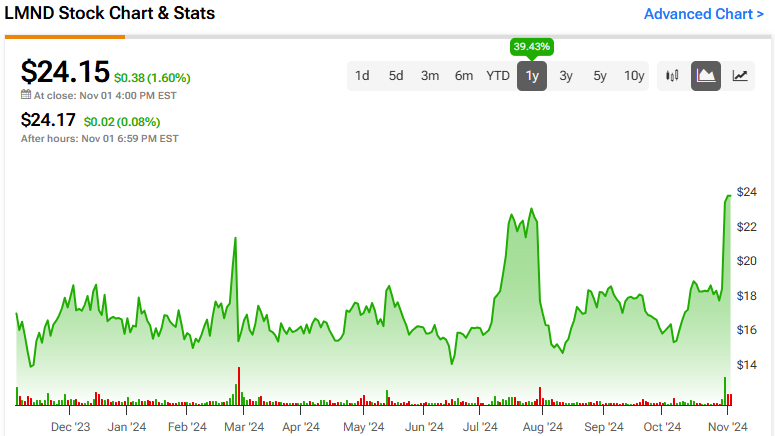

Lemonade’s stock exhibits high volatility, with a beta of 2.74. Over the past year, its price has fluctuated significantly, and recent jumps have lifted it by roughly 39%. The stock currently trades at the upper end of its 52-week price range of $13.72 – $25.98 and demonstrates positive momentum, trading above the 20-day (19.20) and 50-day (18.36) moving averages.

Analysts have taken a measured stance toward LMND stock. Following the Q3 results, Piper Sandler increased its price target from $18 to $25, while maintaining a Neutral rating. They acknowledged Lemonade’s solid quarter and expect increased profitability with EBITDA potentially turning positive by the end of 2026.

Across seven recent analyst recommendations, Lemonade receives an overall Hold rating. The average price target for LMND stands at $21.50, suggesting a potential downside of -10.97% from its current price.

Access More LMND Analyst Ratings

Conclusion on Lemonade

By effectively integrating AI technology, prioritizing socially responsible practices, and implementing a strong digital marketing strategy, Lemonade seeks to transform the insurance landscape. Its encouraging Q3 2024 results indicate strong momentum. Furthermore, the company’s consistent financial growth, strong IFP ratios, and positive cash flow present a hopeful outlook.

Even with analysts exercising caution regarding the stock, Lemonade’s innovative approach, diverse product range, and solid financial standing merit consideration for investors ready to navigate a high-risk, high-reward environment in the insurance sector.

Disclosure

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.