As the renewable energy revolution surges forward with the force of a river in flood, Liberty Energy Inc stands out as a sturdy rock among the raging currents.

Sometimes, a company’s resilience can be as surprising as Mark Twain’s famous reaction to his own obituary – laughing in the face of premature rumors of demise.

The oil & gas industry, too, has faced its fair share of premature pronouncements of an imminent end, with renewable energy sources expanding rapidly, boasting a 50% capacity growth in 2023.

Yet, amidst the tumultuous tide of change, one particular energy services company stands out: Liberty Energy Inc. (LBRT), a robust oilfield services provider that operates a fleet of cutting-edge fracking rigs for oil & gas producers.

Amidst the rising wave of renewable energy, Liberty emerges as a steadfast force, showcasing impressive growth figures that underpin the enduring strength of conventional energy sources.

Today, in a dive into the world of Smart Money, we unravel the details surrounding this leading energy entity, offering insights into the oil industry’s narrative and pondering – is it an opportune moment to add it to your investment portfolio?

Glints of Glory at Liberty

Leafing through Liberty’s latest earnings report may evoke the image of a high-flying tech startup straight out of Silicon Valley.

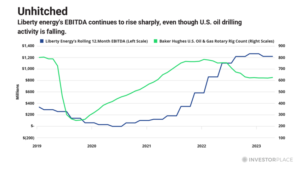

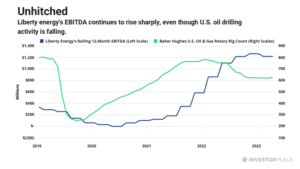

In 2023, the company notched its second consecutive year of record-breaking earnings per share. For some context, Liberty has seen a threefold surge in revenue and a quadrupling of gross earnings (EBITDA) since its public listing in 2017.

Over its initial four years post-IPO, the company averaged annual EBITDA of $40 million. Last year, that figure skyrocketed to over $1.2 billion, with earnings per share leaping by 49% year-on-year to reach $3.15.

Undoubtedly, Liberty seems to have discovered the right formula… or perhaps multiple, considering the string of successes.

In recent years, Liberty has been transitioning its predominantly diesel-run frac rigs to a blend of electric and gas-powered models. Concurrently, it is honing its in-house capacity to provide mobile natural gas supplies to its gas-powered fleets.

These innovations are sculpting a fleet that optimizes efficiency, curbs fuel expenses, and slashes emissions. Crucially, this distinctive fleet is drawing strong demand, propelling Liberty’s revenues upwards, even as the count of operational drill rigs in the U.S. sees a decline.

In essence, Liberty has attained the enviable ability to thrive even when the wider oil & gas sector might be under duress.

Foreseeing no ebb in oil sector momentum, CEO Christopher Wright, in the company’s Jan. 25 earnings call, highlighted…

“As North American oil production scales record heights, a surge in frac activity becomes imperative to counterbalance production declines… North American operators have been, and presumably shall remain, the primary contributors to the global incremental oil and gas supply. These trends bode well for a sustained, multi-year cycle ahead for energy services… We are transitioning into a less cyclical domain than before.”

Wright also articulated a compelling case for an escalating long-term thirst for oil, underpinned by recent demand trends. In essence, he challenges the popular rhetoric of an ongoing “energy transition” by posing…

“Are we truly amidst the transformative ‘energy transition’ that echoes loudly? The data presents a contrary tale. This isn’t a subjective viewpoint but a straight-off reading of the factual landscape. My background spans various energy realms, including nuclear and solar. From 2010’s consumption of just over 500 exajoules of energy, we climbed to nearly 600 exajoules in 2022… What energy sources fueled this surge beyond the 2010 threshold of 500 exajoules?”

“Oil was accountable for 24% of the global energy upswing, predominantly spearheaded by the American shale revolution. Coal, as the third fastest-growing energy source, contributed 14% to empowering our planet. Wind grasped the fourth spot at 9%, trailed by solar at 7% and hydro at 4%…”

“How do we categorize this as a ‘transition’ when the global appetites for natural gas, oil, and coal persistently swell with no visible loss of market footholds?”

While Liberty’s main focus remains on reinforcing its competitive edge in the U.S. fracking domain, it ventures into modest diversifications beyond its core operations.

An instance of this is its stake in a geothermal energy firm named Fervo.

At first glance, this move might seem distanced from the company’s core fracking sphere. Nonetheless, Liberty underscores that the same engineering prowess that fuels its fracking success could replicate in the realm of geothermal energy production. Though this venture hasn’t yet yielded revenues, Liberty persists in advancing it.

I hold such a strong affinity for this company that I offered Liberty to my Fry’s Investment Report subscribers back in August 2022. My rationale then rested on its technology leadership within the energy landscape, bolstered by exceptional earnings and revenue figures. Additionally, its trading numbers – a mere eight times 2022 EPS and under six times the 2023 figure – hinted at its affordability.

Presently, in the Fry’s Investment Report portfolio, the stock has soared by almost 50%… but I’m convinced its flight trajectory is far from concluded.

Despite Liberty’s admirable financial track record and earnings ascent, the stock trades below seven times earnings. Essentially, the market seems to view it more as the traditional cyclical energy services entity of yore rather than the rapidly ascending tech powerhouse it has morphed into.

My view remains that the current stock valuation severely underplays the company’s growth prospects, hence why I maintain it as a resolute “Buy.”

No premature obituary here for this company.

Warm Regards,

Eric Fry

P.S. An unmistakable tidal wave of AI adoption looms over us…

Millions could find themselves adrift in a sea of destruction triggered by artificial intelligence.

Hence, I’m issuing an AI Code Red.

I’ve crafted a brief presentation to prep you for the impending wave. Click here for all the critical details.