An Unwavering Bull Market

The good feelings of last year’s bull market continue to bolster investors as they witness more gains. Since the low points in October, the S&P 500 has surged by 27.5%, while the NASDAQ gained 29.5%. These numbers firmly entrench stocks in the bull market territory, marking another chapter in a decade-old bullish trend.

Raymond James Sees Bright Future Amidst Caution

Accompanying this optimism is a cautious note from Raymond James’ Chief Investment Officer Larry Adam, who believes that although the S&P 500 has started the year strongly, caution is necessary in the near term, despite resilient economic data and increased investor optimism.

Searching for Hidden Treasures

Raymond James encourages investors to seize the moment and ‘load up.’ They have pinpointed two buy-rated stocks holding significant potential for growth. Let’s delve into the specifics.

Discovering Weave Communications

Weave Communications, a tech company in the US healthcare sector, is gaining traction with its platform engineered to optimize office communications for small- and mid-sized healthcare businesses. The platform enhances efficiency and streamlines interactions with patients and customers, enabling medical and dental clinics to operate more effectively.

A Bullish Outlook for Weave

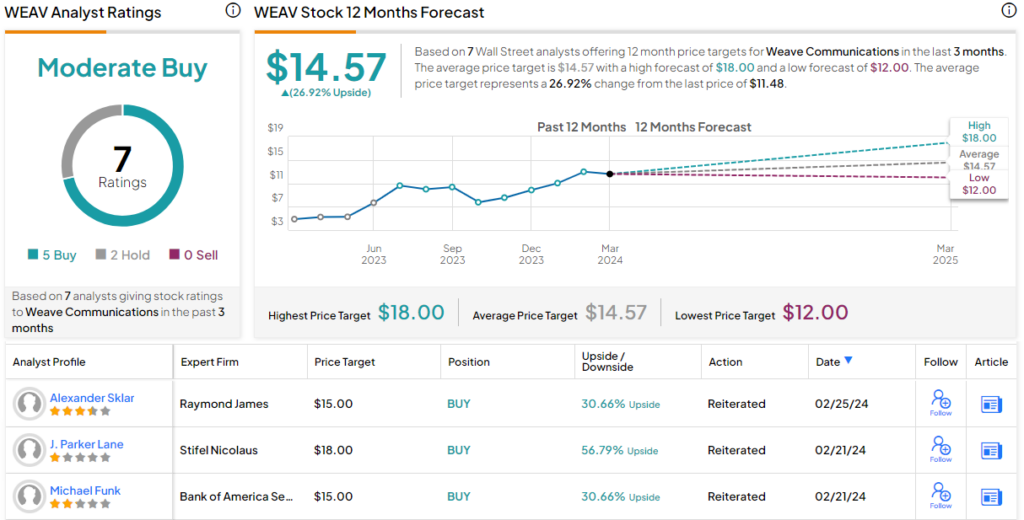

Raymond James’ analyst Alexander Sklar’s positive assessment of Weave’s recent earnings performance underscores the company’s growth potential. He believes that the stock’s pullback after the last quarterly report presents an attractive risk/reward opportunity. Sklar’s optimism is underpinned by Weave’s growth acceleration and potential for a 20% growth profile in 2024.

GoDaddy, Inc.: Navigating the Digital Landscape

Entering the realm of digital services, GoDaddy, Inc., headquartered in Arizona, offers web domain and hosting solutions to a diverse clientele of individuals and corporate entities. With a customer base exceeding 84 million domain names, GoDaddy stands out as a market leader, providing a myriad of services to streamline online presence creation.

Embracing Change with AI

Keeping pace with technological advancements, GoDaddy has rolled out GoDaddy Airo, an AI-driven suite of tools aimed at facilitating website maintenance, site construction, and email marketing. These tools harness the power of AI to enhance efficiency and streamline online operations.

Financial Stability Amidst Innovation

Examining GoDaddy’s financials, the company has maintained a robust revenue stream, hovering around the $1 billion mark per quarter consistently. In the latest quarterly report, GoDaddy reported revenue of $1.1 billion for 4Q23, up by nearly 6% year-over-year, reflecting strong operational performance.

The Rise of GoDaddy: A Financial Analysis

Stellar Financial Performance

GoDaddy, a prominent player in the domain and web hosting industry, recently announced robust financial results that have set the market abuzz. The company revealed a revenue growth of 14% year-over-year, hitting a staggering $1.4 billion. Additionally, total bookings surged to $1.1 billion, marking a 7% increase, while free cash flow soared to $305.1 million, up by a notable 51% year-over-year.

Expert Endorsement

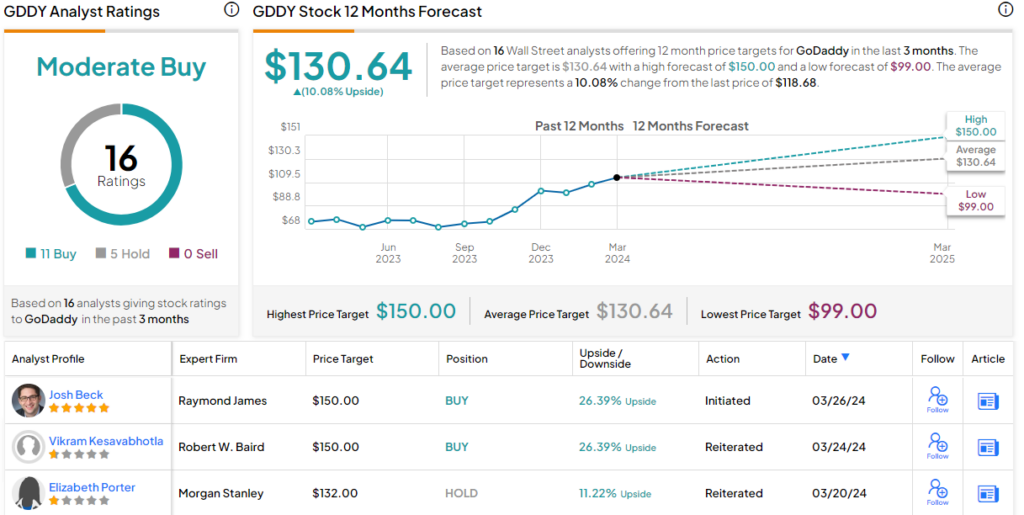

The company’s strategic maneuvers, particularly its foray into Artificial Intelligence (AI), have not gone unnoticed. Josh Beck, an esteemed analyst at Raymond James, renowned for his acumen with a five-star rating, bestowed glowing remarks upon GoDaddy. Beck’s ‘SMB GenAI Tailwind’ thesis commends GoDaddy for harnessing the pioneering Airo GenAI stack to simplify the adoption process for various products, extending beyond core domains such as logo creation, online presence, and e-commerce. He predicts a surge in customers utilizing more than two products, currently standing at over 50%. Beck envisions GoDaddy outsourcing customer care prowess and vast data (comprising 20 million customers and 14 million interactions across SMB email, messages, and social media) to cultivate a more autonomous SMB agent, capable of efficiently handling consumer inquiries and enhancing the SaaS landscape.

Market Outlook

Quantifying his optimism, Beck conferred a Strong Buy rating on GoDaddy shares, accompanied by a price target of $150 per share, indicative of a promising 26% upside potential within the next 12 months. Notably, the stock also receives a Moderate Buy rating from the Street’s consensus, derived from 16 analyst evaluations, comprising 11 Buy recommendations and 5 Holds. With the current trading price at $118.68 and an average target price of $130.64, analysts foresee a 10% increase in share value over the coming year.

Final Thoughts

With a compelling financial performance, a visionary AI strategy, and favorable ratings from industry experts, GoDaddy seems poised for a prosperous future in the digital landscape. Investors are advised to keep a close eye on this dynamic player as it navigates the ever-evolving realms of technology and innovation.

To explore more undervalued stocks and investment opportunities, consider delving into TipRanks’ Best Stocks to Buy tool. Remember, though, it is essential to conduct thorough research and analysis before making any investment decisions.

Disclaimer: Remember, the views expressed here belong to the analysts and are meant for informational purposes only. Always carry out your due diligence before committing to any investment.

Every viewpoint and statement articulated in this piece is a reflection of the author’s perspective and does not necessarily mirror those of Nasdaq, Inc.