Lucid Group Faces Bumpy Road Ahead After Significant Stock Declines

Lucid Group (NASDAQ: LCID) has garnered investor interest in the electric vehicle (EV) sector since its merger with a special purpose acquisition company (SPAC) three years ago. Known for its luxury EVs with impressive driving ranges, the company aims to compete with industry leader Tesla.

While Lucid benefits from the increasing long-term demand for electric vehicles, its path to production has not been smooth. After reaching a high of $57.75 per share in late 2021, the stock has plummeted by 95%, now trading for less than $3.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

If you’re considering buying shares in this promising EV manufacturer, keep the following details in mind.

Claiming a Competitive Edge in the EV Market

Lucid Group aims to carve out a niche in the luxury EV market by targeting a wealthier customer base. The company strives to establish itself as a premium brand, committed to delivering an exceptional driving experience.

One standout aspect of Lucid’s vehicles is their range. The flagship model, Lucid Air Pure, is priced at $69,900 and offers a remarkable 420 miles of range alongside 430 horsepower. For a more performance-driven option, the Ground Touring model, costing $110,900, features 819 horsepower and 512 miles of driving range.

Moreover, Lucid’s rapid-charging technology allows drivers to recharge 200 miles of range in just 12 minutes, making it a viable choice for long trips.

Image source: Lucid Group.

Lucid has substantial support, notably from the Public Investment Fund (PIF) of Saudi Arabia, which has invested billions in the company since 2018. As of the end of the third quarter, Lucid reported over $5 billion in liquidity, sufficient to sustain operations through 2026.

The company recently unveiled its long-awaited SUV model, the Lucid Gravity Grand Touring, which is expected to start production in December and is priced at $94,900, featuring a range of 450 miles.

With strong backing from the PIF and a gradual rollout of new vehicles, Lucid presents an intriguing investment opportunity. However, potential investors should assess the company’s financial health before taking action.

Frequent Funding Efforts Raise Concerns

Lucid Group has faced various challenges since going public. Initially, management projected that it would produce 49,000 vehicles by 2023 and 90,000 for this year. In reality, the company manufactured only 8,428 vehicles last year and delivered 6,001. This year, it managed to deliver 7,142 vehicles, with 2,781 delivered in the third quarter, marking a 91% increase from the previous year. The company aims to reach 9,000 vehicle deliveries by year-end.

Despite increasing revenues—up 31% to $573 million in the first three quarters of 2023—Lucid’s expenses have also surged, totaling about $2.9 billion this year. The company faces a hefty operating loss of $2.3 billion, similar to levels seen last year during the same timeframe.

For a company still seeking profitability, securing funding is vital for long-term growth. Without profits to reinvest in its operations, Lucid has turned to outside investors, including the PIF, to raise capital through various funding rounds.

In October, Lucid raised $719 million by selling 262.5 million shares at roughly $2.66 per share. Following this, the PIF injected another $1 billion into Lucid, raising its total investment to $8.9 billion since 2018. This funding positions Lucid for stability through 2026.

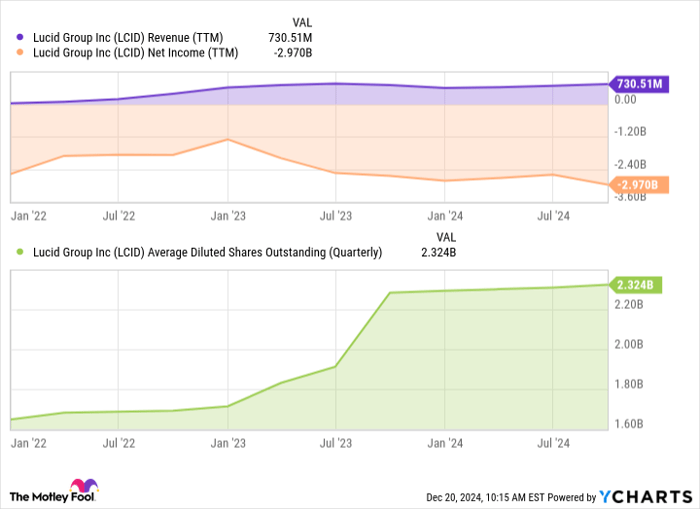

LCID Revenue (TTM) data by YCharts

Since 2022, Lucid’s total outstanding shares have risen from 1.65 billion to 2.32 billion—an increase of 40%—diluting investors’ positions as the company frequently tapped equity markets.

Is Lucid Stock a Buy, Hold, or Sell?

Lucid Group’s luxury EV models are reaching new heights, and the company could benefit from the long-term growth of the EV market. According to PwC projections, the U.S. could see 27 million EVs by 2030 and 92 million by 2040. If Lucid can stabilize and achieve positive cash flow, it could experience significant growth alongside the expanding market.

As the company takes measures to control costs, it still relies on investments from stock offerings and the PIF for cash flow. While Lucid has the necessary funding through 2026, potential investors should wait for improved financial results before initiating or holding stock.

A Second Chance at a Potentially Profitable Investment

Have you ever felt like you missed an opportunity to invest in top-performing stocks? You might want to pay attention now.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they believe are primed for significant growth. If you’re concerned you’ve missed your investment chance, now might be the perfect time to act before it’s too late. The numbers tell an impressive story:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $349,279!

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $48,196!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $490,243!

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and there may not be many opportunities like this left.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Courtney Carlsen has no investment in any stocks mentioned. The Motley Fool recommends Tesla and has positions in it. The Motley Fool has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.