“`html

Over the past few years, the housing market has been stagnant, presenting a unique opportunity for investors focused on multi-family apartment builders.

As we move into 2024, let’s take a quick look at the current housing landscape.

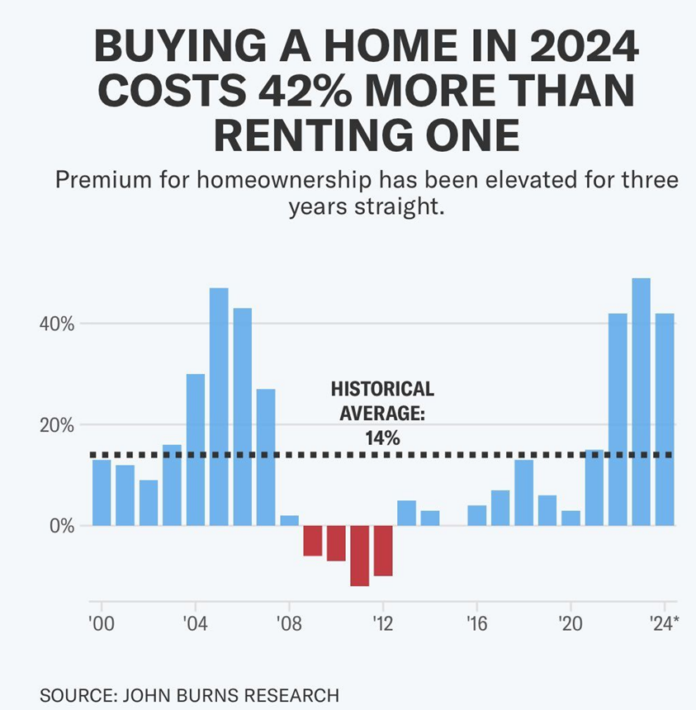

Source: John Burns Research

Analyst Charlie Bilello reports that the median household income needed to buy a home in the U.S. has reached $118,000, which is over 49% higher than the current median household income of $79,000.

Bilello observes, “The most unaffordable housing market in history continues.”

Despite the Federal Reserve reducing interest rates by 100 basis points since last fall, the 30-year fixed mortgage rates have been on the rise, further exacerbating housing affordability issues.

According to Bloomberg last week:

US mortgage rates climbed closer to 7%, putting pressure on potential buyers attempting to enter the housing market.

The average rate for a 30-year mortgage increased to 6.91% as of January 2, up from 6.85% a week earlier, as reported by Freddie Mac. A figure from the Mortgage Bankers Association rose by 8 basis points to 6.97%, marking a nearly six-month high.

High borrowing costs are impacting affordability and have led to a nearly 7% decline in the MBA’s index of home-purchase applications, reaching the lowest level since mid-November.

Nevertheless, this challenging environment can foster a bull market for keen investors.

Shifting to Rentals: A Response to Unreachable Homeownership

In recent years, the apartment construction sector experienced its most significant boom in four decades. Consequently, a surplus of empty units caused rental prices to drop.

Amid the ongoing housing affordability crisis, many aspirational homeowners are opting for apartments, shifting the balance of supply and demand.

In a statement from The Wall Street Journal in November:

The vacancy rate for apartments, which denotes the proportion of available units, halted its rise for the first time in three years last quarter, as demand reached its peak since 2021, according to CoStar.

Over 1.2 million new apartment units built in the last two years are now being filled.

Assuming demand remains steady, the economy remains robust, and housing prices stay high, landlords could regain pricing power starting in 2025.

This shift may enable property owners to increase rents more significantly than they have recently.

This has noteworthy implications for inflation, as housing represents a crucial component of Consumer Price Index and Personal Consumption Expenditures metrics. However, we will explore that in a different discussion. For now, let’s consider the investment prospects, highlighting the strongest multi-family landlords.

Top Multi-Family Enterprises to Watch as Rental Conditions Improve

Your research should include Equity Residential (EQR), the fifth-largest apartment owner and the fourteenth-largest apartment property manager in the United States, with a current dividend yield of 3.82%.

AvalonBay Communities (AVB) is another noteworthy mention. It manages around 80,000 apartment units and ranks as the third-largest REIT in the U.S., boasting a dividend yield of 3.10%.

Lastly, consider Camden Property Trust (CPT), which has interests in nearly 60,000 apartments across 171 communities in the U.S., delivering a yield of 3.45%.

In summary, the single-family housing market remains troubled with no immediate solutions, while the surplus of apartment inventory is close to being absorbed.

This trend suggests potential for rising rents, increased net operating incomes for landlords, and subsequently, heightened stock prices.

As WSJ concludes:

Apartment firms continue to benefit from renters unable to move into homeownership.

Major property owners have noted that very few of their renters are choosing to buy homes in this challenging environment. This trend is expected to persist into 2025.

For Higher Growth, Explore Emerging Tech Opportunities

If you are seeking more explosive growth than what apartment REITs can offer, tech expert Luke Lango has insights to share.

Last week, Luke released his “Top 10 Stock Market Predictions for 2025,” and we pay close attention to his insights due to his proven track record. For context, in 2024, he accurately predicted:

- The S&P 500 would rise over 15% in 2024 (it increased by 23%).

- Growth stocks would significantly outperform value stocks (they did by roughly 3-to-1).

- AI and tech stocks would lead the market (this was reflected in the 29% rise of the Nasdaq and the 24% increase of the Global X Artificial Intelligence ETF, AIQ).

- Bitcoin would hit $100,000 (it peaked at around $108,000).

Looking towards 2025, Luke points to strong growth opportunities in autonomous vehicles, electric vertical takeoff and landing (eVTOL) stocks, and Quantum AI stocks.

On the topic of autonomous vehicles, Luke states:

Given the promising developments we’ve witnessed this year, we anticipate that 2025 will mark the start of the Age of AVs. Thus, we are optimistic about investing in Autonomous Vehicle stocks in 2025.

Luke also discusses eVTOL stocks, or “flying car” stocks:

We have a positive outlook on these stocks for 2025, as several companies are expected to launch commercial operations next year.

As the industry progresses, we anticipate significant advancements in this sector.

“`

Investing Insights: eVTOL and Quantum AI Stocks Poised for Growth

Exploring the Potential of eVTOL Stocks

As eVTOL technology expands through widespread rollouts, investors are optimistic about the future of eVTOL stocks. Analysts predict significant gains for these stocks by 2025.

Consider looking into top eVTOL stocks such as Surf Air Mobility (SRFM), Archer Aviation (ACHR), and Blade Air Mobility (BLDE).

Quantum AI Stocks in Demand

According to industry analysts, Quantum AI stocks have experienced a remarkable surge recently, with some appreciating over 1,000% since early September.

While there may be a short-term correction ahead, the outlook for these stocks remains positive as the quantum computing sector is expected to focus more on practical applications in 2025. This shift could lead to further increases in stock value.

Key players in the Quantum AI arena include IonQ (IONQ), Rigetti (RGTI), and Quantum Computing (QUBT).

To learn more about specific investment strategies from Luke in his service Innovation Investor, click here.

Complementing Aggressive Investing with Caution

As we embrace the excitement of potential gains, it is also crucial to recognize the importance of caution in investing, as highlighted by macro expert Eric Fry.

He emphasizes the need to avoid what he terms “bad risks.” These are situations where the potential for loss outweighs the chance for profit.

Eric advises investors to start by asking, “What can go wrong?” instead of “What can go right?” Practicing this discipline helps investors make informed choices.

To illustrate a more balanced approach, Eric shares insights from his service Leverage. By utilizing call options, he provides his investors with opportunities for greater returns while controlling risk. For instance, his subscribers have reported impressive gains: 103% in PayPal, 148% in Block, and 310% in Corning.

As Eric notes, it’s essential to resist the temptation to invest in overvalued stocks simply because others are doing the same. Staying disciplined and saying “no” to bad risks is the first step towards beating the market.

The advice is timely as we approach 2025.

Stay tuned for updates on housing and apartment investment opportunities, along with the latest insights from Luke and Eric in the Digest.

Best wishes for your investments,

Jeff Remsburg