LiveOne Reaches 500,000 Tesla Users, Plans Sustained Growth

LiveOne, Inc. (LVO) has achieved a significant milestone, surpassing 500,000 users from Tesla, Inc. (TSLA). Initially available to Tesla subscribers, this partnership will expand its user base further starting this week. In December 2024, the company reported over 450,000 Tesla users, with more than 100,000 using the free ad-supported version, which sees an average of over 50 minutes of listening time in vehicles each day.

Looking ahead, LiveOne projects that its user numbers will exceed 550,000 by February 1, 2025, bolstered by the addition of over 150,000 new ad-supported subscribers. This expansion follows a limited initial rollout intended for Tesla drivers.

In October 2024, LiveOne announced an updated partnership with Tesla that involved permanently replacing the streaming button in Tesla vehicles with LiveOne’s service, indicating a substantial change in the user experience for TSLA owners.

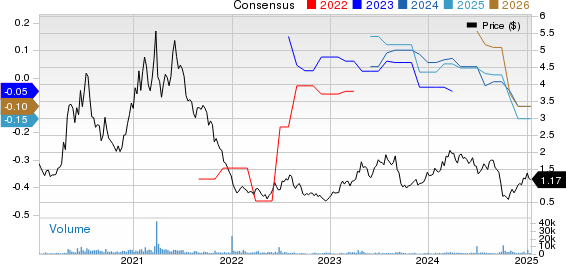

LiveOne Financial Outlook and Price Consensus

LiveOne, Inc. price-consensus-chart | LiveOne, Inc. Quote

Management at LVO emphasized that reaching this milestone enhances their confidence in securing additional B2B partnerships, similar to collaborations with Spotify, Apple, Samsung, iHeart, Facebook, and TikTok. Moreover, the company’s new alliances with Fortune 500 media firms are expected to drive more than $25 million in revenue.

LiveOne Reports $10M Cash Savings, Focuses on Growth

The company announced a pivotal financial update, revealing over $10 million in cash savings alongside plans for strategic reinvestment. To solidify its financial footing, LiveOne has extended $5 million in payables, including obligations to Sound Exchange, into long-term agreements and settled a $2.75 million credit line with East West Bank. The savings are earmarked for converting even more Tesla users, broadening B2B partnerships like the recent $25 million deal with a Fortune 500 company, enhancing original content, and leveraging AI and data mining technologies.

As part of its strategy, LVO aims to broaden its B2B agreements, having already established significant new partnerships while scouting for future collaborations. In the first quarter of fiscal 2025, LVO secured a notable $24 million contract with a prominent streaming network, anticipated to yield about $2 million in monthly revenue. This contract is expected to not only bolster LVO’s immediate financials but also enhance its standing within the industry, attracting further opportunities.

In August 2024, the company celebrated the milestone of surpassing 250 million users with TextNow. Additionally, LiveOne forged partnerships with eBay, Facebook, and TikTok, reinforcing its commitment to expanding B2B initiatives and strengthening market presence. The second-quarter revenues for fiscal 2025 reached $32.6 million, reflecting a 14% increase year-over-year, primarily driven by the Audio Division’s performance and solid partnerships.

LiveOne’s Stock Performance and Zacks Rank

Currently, LVO holds a Zacks Rank #4 (Sell). Over the past six months, the company’s shares have declined by 24%, compared to the industry’s average growth of 8.2%.

Image Source: Zacks Investment Research

Other Stocks to Watch

In the broader technology sector, Dolby Laboratories, Inc. (DLB) and Intrusion Inc. (INTZ) are better-ranked stocks. DLB currently has a Zacks Rank #1 (Strong Buy), while INTZ holds a Zacks Rank #2 (Buy). To view the complete list of today’s top-ranked stocks, click here.

The Zacks Consensus Estimate for Dolby’s fiscal 2025 earnings per share stands at $4.05, which has remained steady over the past 30 days. DLB has consistently outperformed the Zacks Consensus Estimate in each of its last four quarters, averaging a surprise of 15.37%. In the most recent quarter, DLB reported a surprising increase of 19.12%, with shares rising by 8.3% in the last three months.

Likewise, INTZ has surpassed the Zacks Consensus Estimate in each of the last four quarters, achieving an average surprise of 43.06%. In its last quarter, the company reported a 16.67% earnings surprise, resulting in a remarkable share increase of 91.7% within six months.

Explore Zacks’ Top Picks for 2025

Time is running out to be among the first to discover our 10 top stock recommendations for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has demonstrated remarkable success since its inception in 2012, returning +2,112.6%, significantly outperforming the S&P 500’s +475.6%. After reviewing 4,400 companies within the Zacks Rank, Sheraz has identified the top 10 stocks to buy and hold for 2025.

Want to stay updated with Zacks Investment Research? Today, you can also access our report on the 7 Best Stocks for the Next 30 Days. Click to download this free report.

Dolby Laboratories (DLB) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Intrusion Inc. (INTZ) : Free Stock Analysis Report

LiveOne, Inc. (LVO) : Free Stock Analysis Report

For more information on this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.