Meta and Apple Shine with Record Earnings in Q4 2024

The Q4 2024 earnings season is in full swing, showcasing a strong lineup of reports this week. So far, the results have been positive, beginning impressively with major banks.

Among the standout performers are two members of the Mag 7: Apple AAPL and Meta Platforms META. Both companies recorded exceptional quarterly results, highlighting their business success this period.

Meta Achieves Record Sales and Profit

Meta Platforms announced adjusted earnings per share (EPS) of $8.02 alongside record sales totaling $48.4 billion. This translates to growth rates of 50% and 21%, respectively. The net income hit $20.9 billion, marking a historic high for the company.

Over the past year, stock prices have surged nearly 80%, significantly outperforming the S&P 500.

Image Source: Zacks Investment Research

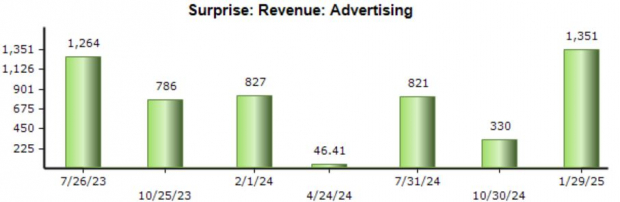

Importantly, the advertising segment thrived, with revenue reaching $46.8 billion, surpassing our expectations and reflecting 20% year-over-year growth. Recent advertising results have consistently exceeded projections, as illustrated below.

Image Source: Zacks Investment Research

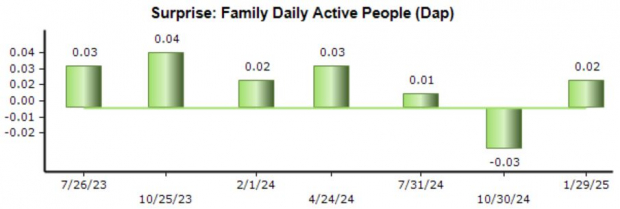

Moreover, Meta saw user growth, with Family Daily Active People (DAP) rising 4% year-over-year to around 3.4 billion. Average revenue per user also saw a significant increase of 41% year-over-year. This metric includes all apps within the Meta family, illustrating total user engagement.

Image Source: Zacks Investment Research

Apple Breaks New Ground

Apple’s latest earnings report revealed adjusted EPS of $2.40 and sales reaching $124.3 billion. This reflects growth rates of 10% and 4%, respectively, with both figures hitting all-time highs for the company. Services revenue also set a new record.

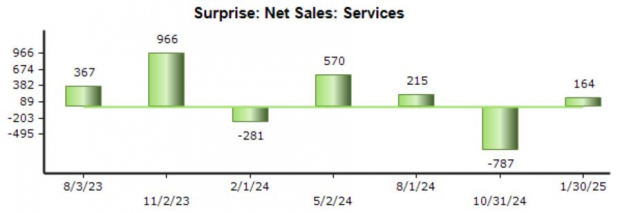

Historically, Apple’s Services results have regularly surpassed our consensus estimates, as illustrated below.

Image Source: Zacks Investment Research

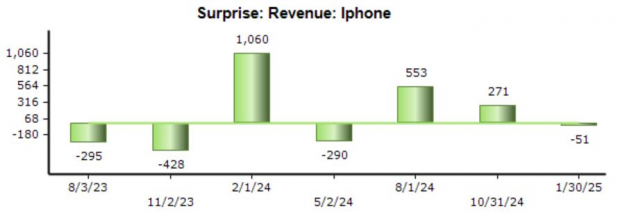

However, iPhone sales came in slightly below expectations. They totaled $69.2 billion, marking a 1% decline year-over-year. This was surprising, considering Apple’s new technology initiatives initiated earlier this year.

Image Source: Zacks Investment Research

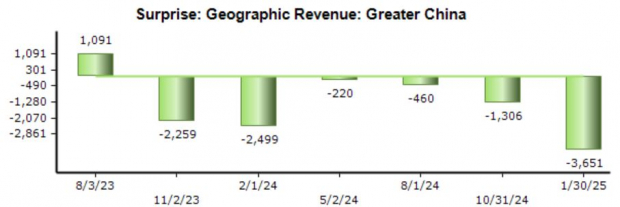

Additionally, sales in China saw a decline, dropping to $18.5 billion from $20.8 billion year-over-year. While this slowdown has been understood for some time, it has affected overall performance amid increased competition.

Image Source: Zacks Investment Research

Despite the challenges, Apple’s installed base of active devices reached an all-time high across all markets, with shares performing well after the announcement—up 27.6% over the past year, closely tracking the S&P 500.

Image Source: Zacks Investment Research

Conclusion

As the 2024 Q4 earnings season unfolds, it is proving to be fruitful, especially highlighted by strong performances from leading companies.

Key players like Apple AAPL and Meta Platforms META have set record highs, indicating a promising outlook for their operations and the tech sector overall.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our research team has released five stocks that show significant potential for growth, including one highlighted by Director of Research Sheraz Mian as the stock most likely to double.

This standout stock belongs to an innovative financial firm with over 50 million customers and a wide range of exciting solutions, indicating strong future gains. While not every recommended stock succeeds, this one could follow the success of past winners, such as Nano-X Imaging, which soared 129.6% in just nine months.

Free: See Our Top Stock And 4 Runners Up

Want the latest investment recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days for free.

Apple Inc. (AAPL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.