Note: The following is an excerpt from this week’s Earnings Trends report. To access the full report, which includes detailed historical actuals and estimates for current and upcoming periods, please click here>>>

Key Financial Highlights

- Total earnings for 245 S&P 500 companies reporting results have risen by +11.6% compared to last year, driven by +5.1% higher revenues. Of these, 80.0% surpassed EPS estimates, while 66.9% exceeded revenue estimates.

- As the earnings season for Q4 2024 unfolds, it showcases strong performance and an optimistic outlook, with companies not just meeting but exceeding estimates while offering positive guidance for the future.

- Within the Tech sector, results for 68.3% of the index’s market capitalization are in, showing earnings up +23.2% from last year on +8.8% increased revenues. A notable 88.9% beat EPS expectations, alongside 77.8% surpassing revenue targets, outperforming previous reports.

- Current projections for the entire Q4 anticipate S&P 500 earnings increasing by +11.9% year-over-year, with +5.3% higher revenues expected.

Major Tech Firms Keep Spending High

Alphabet Inc. (GOOGL) recently reinforced its commitment to substantial spending, particularly in artificial intelligence (AI) infrastructure, joining the trend previously set by Microsoft (MSFT) and Meta Platforms (META). Despite industry challenges, these companies are pressing forward with ambitious budgets.

Alphabet aims for a capital expenditure of $75 billion this year, a +47% increase. Similarly, Meta and Microsoft plan to invest $60 billion and $80 billion, respectively, with further upward adjustments anticipated for Microsoft as analysts reassess its projections.

Despite the high spending, Alphabet’s stock experienced a dip attributed largely to broader business environment concerns. Microsoft also faced setbacks in its cloud service dealings, impacting investor sentiment across the board.

Given the market’s reaction, there appears to be a demand for accountability from these major players, amid uncertainty regarding future returns on their spending. Nevertheless, the financials remain strong; Alphabet’s Q4 earnings climbed +28.3% year-over-year to $26.5 billion, accompanied by a +12.9% rise in revenues to $81.6 billion. In contrast, Microsoft reported a more modest +10.2% growth in earnings to $24.1 billion, while Meta’s earnings surged by +48.7% to $20.8 billion.

These leading companies argue that their hefty capital expenditures are essential for maintaining their competitive edge in the rapidly evolving AI landscape, crucial for sustaining their impressive earnings trajectory.

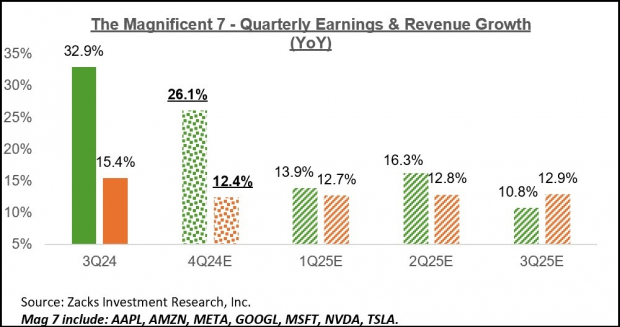

For Q4, earnings from the “Mag 7” tech firms are projected to be up +26.1% from the previous year, with revenues rising by +12.4%, as illustrated below.

Image Source: Zacks Investment Research

Tech Sector Continues to Drive Growth

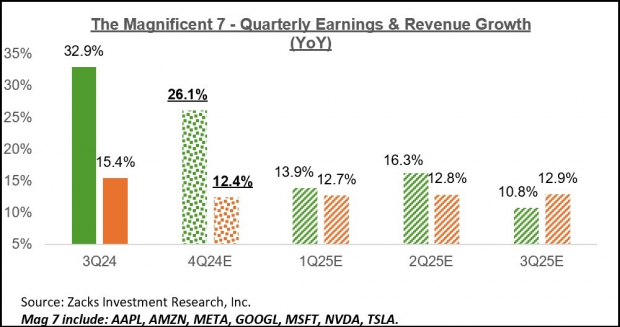

The Tech sector has remained a leading growth engine in recent quarters, a trend expected to persist into Q4 2024 and further. For this Q4, earnings from the sector are projected to increase by +23.3% year-over-year, benefitting from +10.9% higher revenues, marking the sixth consecutive quarter of double-digit earnings growth.

This follows Q3 growth figures where earnings rose by +22.7% alongside +11% revenue growth. Continued growth is anticipated for upcoming quarters, supported by strong fundamentals.

Image Source: Zacks Investment Research

The Tech sector not only showcases strong growth but also demonstrates improved earnings outlook across the board, underscored by positive revisions for both Q4 and the full year 2025.

Overall Earnings Perspective

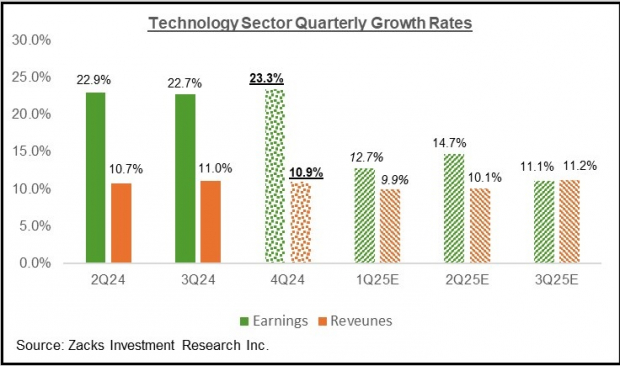

The chart below outlines expectations for Q4 2024, comparing achieved earnings from previous periods with projections for upcoming quarters.

Image Source: Zacks Investment Research

As indicated, total S&P 500 earnings for Q1 2025 are anticipated to rise by +8.8% compared to the same quarter last year, supported by +4.4% higher revenues.

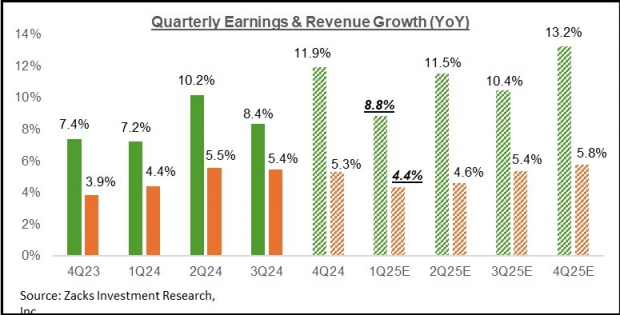

Forecasts have, however, experienced downward adjustments since the beginning of the quarter, as reflected in the chart below.

Image Source: Zacks Investment Research

A comprehensive review shows that estimates for 15 of the 16 sectors have been revised downward since January, with only the Medical sector showing growth in estimates. The sectors facing the steepest cuts include Conglomerates, Aerospace, Construction, and Basic Materials.

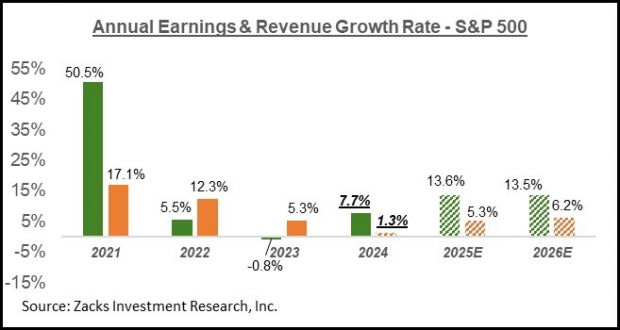

The following chart illustrates the overall annual earnings outlook.

Image Source: Zacks Investment Research

Forecasts indicate robust earnings growth in both of the next two years, with a notable increase in sectors expected to report strong gains compared to recent performance. By 2025, all 16 Zacks sectors are poised for earnings growth, with 8 sectors anticipated to achieve double-digit increases. Unlike previous years dominated by the “Mag 7” firms, the forecast for 2025 exhibits the potential for the S&P 500 to register double-digit earnings growth, even without significant contributions from this mega-cap group.

5 Stocks Set to Double

Each stock was handpicked by a Zacks expert as a top candidate for +100% growth in 2024. While not every selection may succeed, past recommendations have seen impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently under the radar of Wall Street, presenting a promising opportunity for early investment.

Today, See These 5 Potential Home Runs >>

For the latest recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days. Click to get this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.