Evaluating Marathon Digital Holdings

Marathon Digital Holdings Inc. (NASDAQ:MARA) is a key player in the digital asset mining and technology sector with a primary focus on cryptocurrencies, especially Bitcoin (BTC-USD). Despite being headquartered in Fort Lauderdale, Florida, the company’s operational hub lies in Texas and North Dakota. With a current market cap of $5.2 billion, MARA stands as one of the largest public BTC mining enterprises globally.

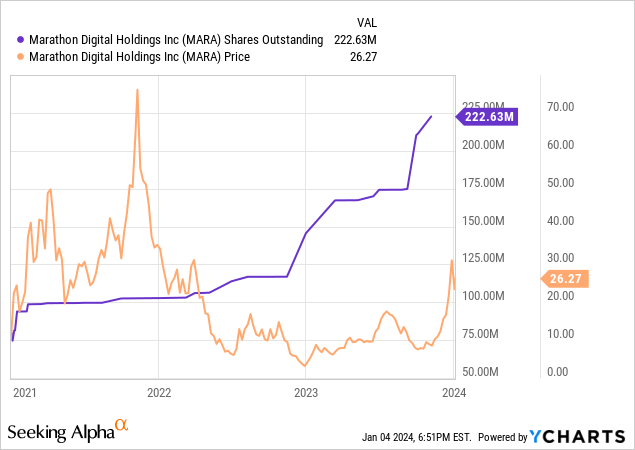

While some may view BTC, cryptocurrency, and decentralized finance as the future, the upcoming BTC halving in April 2024 poses a significant risk. The anticipated halving is likely to halve MARA’s primary revenue source. This substantial dependence on a single revenue driver, coupled with the company’s lack of positive operating income and continuously diluting shares, raises concerns about its current valuation. Despite MARA’s stock witnessing a staggering 450% surge last year and BTC’s impressive 162% year-on-year rise, the company has failed to achieve a positive operating income since 2016. Moreover, it has never recorded a positive EPS, making it a risky investment at its current price.

By most valuation metrics, MARA appears overvalued, with a highly unfavorable P/E FWD ratio of 355x. This valuation, combined with the company’s unimpressive profitability, notably higher than its peers such as RIOT or HUT, indicates caution. Although certain industries experiencing exponential growth, like EV or Biotech, might tolerate poor valuation and profitability, the BTC mining sector faces potential downsizing and consolidation due to BTC halvings. Hence, the company’s longevity depends primarily on widespread BTC adoption or a substantial increase in usage, both risky prospects.

Financial Standing

MARA’s revenue predominantly stems from BTC mining and capital gains on its BTC holdings. With the company possessing 15,174 BTC worth approximately $667 million at the current BTC price of $44,000, any fluctuations in BTC price directly impact the balance sheet and income statement. While surges in BTC price can bolster the company’s financial health, it also renders the firm vulnerable to adverse market conditions.

The company has benefited from a substantial uptick in BTC transactions, with over 500k transactions per day becoming the norm. This surge has led to a notable increase in transaction fees, constituting a record 22% of their total BTC production in December, approximately $16.7 million. Additionally, MARA improved its BTC mining efficiency, witnessing a 253% YOY rise in energized hash rate (EH/S) from 7.0 to 24.7. The company’s recent acquisition of two operational centers from Generate Capital is anticipated to reduce the cost per coin mined by 30%, as per CEO Fred Thiel.

While the revenues for Q3 of 2023 reached record highs at $97.8 million, profitability remains a concern. Despite the positive EPS in the same quarter, derived mainly from debt extinguishment, the company’s income from operations reported a loss of $15.6 million. Additionally, record D&A costs offset the rising EBITDA, reflecting the company’s shaky financial position.

Regulatory Landscape & Future Projections

Rumors regarding the potential approval of BTC ETFs by the SEC have significantly stirred the BTC market in recent months. The approval of BTC ETFs, led by prominent financial institutions like BlackRock and Franklin Resources, could mark a pivotal moment in integrating the cryptocurrency economy into the current financial framework.

Marathon Digital Holdings & the Marathon to Financial Viability

Marathon Digital Holdings (MARA), a renowned cryptocurrency mining firm, finds itself on the precipice of a significant transformation. As the Securities and Exchange Commission (SEC) contemplates approving a Bitcoin (BTC) exchange-traded fund (ETF), the winds of change blow strong for the entire digital currency ecosystem. This potential approval means big players like JPMorgan Chase (JPM) and Goldman Sachs (GS) are warming up to the once-shunned cryptocurrency. The allure for these financial behemoths is apparent, but to what extent remains a tantalizing mystery. Clearly, the price of BTC is at the cusp of fluctuation, poised to surge should the SEC grant approval. Remember the exhilarating surge that greeted the SEC’s approval of BTC futures ETFs, including BITO, in 2021? The upcoming decision may well set the stage for a compelling encore. The preceding plunge and wane of interest experienced after the earlier approval further underscore the volatility this decision holds.

The prospect of SEC approvals spells potential upside for BTC, but the long-term benefits for MARA remain shrouded in ambiguity. Favorable SEC rulings would naturally inflate BTC’s worth, and dramatic increases in revenue from BTC transactions would likely grace MARA’s balance sheets, albeit temporarily, courtesy of swelling participation from institutional investors. While this integration into the financial universe paves the way for MARA to rub shoulders with the global corporate elite, it also invites heightened competition from deep-pocketed firms, enticed by the tantalizing morsels of profit. MARA lacks a formidable competitive edge to safeguard its position, leaving the firm vulnerable to the entry of well-capitalized contenders. The future seems pregnant with the possibility of substantial investment influx into MARA, a double-edged sword poised to swing in either direction.

The Upcoming BTC Halving: Navigating Treacherous Waters

Every four years, BTC miners witness a reduction, by half, in compensation for validating blockchain transactions. The next halving looms on the horizon, anticipated to materialize in April, with the fresh reward pegged at 3.125 BTC. Notably, blockchain validation forms the primary revenue stream for MARA, accounting for a substantial 85%-90% of the firm’s recent BTC production. A chink in the armor emerges – the existing business model haunts MARA with its inherent flaws and questionable sustainability. Foreseeably, the halving of BTC incentivizes a surge in BTC prices, propelled by diminished supply. Regardless, the impending year is likely to witness a halving of MARA’s BTC production, a formidable hurdle for a company already grappling to eke out profits at the current reward rate of 6.25 BTC. The subsequent halving in 2028 further compounds the need for MARA to pivot towards a transaction fee-centric business model, intensifying reliance on the firm’s BTC stack to yield revenue through burgeoning BTC prices.

The impending BTC halving bodes well for MARA, outweighing the drawbacks endured by smaller miners grappling with shrinking margins. Consequently, MARA finds itself favorably positioned to capitalize on potential acquisition opportunities, fortifying its existing operations. Critical to this prospect is MARA’s ability to amass sufficient liquidity, ensuring preparedness to seize promising opportunities that may arise.

Financial Standings & Valuations: Balancing the Books

MARA concludes the year flaunting a cash reserve of $356.8 million (excluding BTC) while bearing a total debt load of $325 million. The acquisition of two operational centers from Generate Capital, priced at approximately $178.6 million, is set to chip away from the balance sheet in early January, leaving the firm with $178.2 million in post-acquisition cash reserves. Notably, the aftermath of the impending BTC halving poses a formidable challenge, compelling MARA to seek acquisition opportunities armed with this residual capital, unless rapid fund-raising or BTC stack liquidation, both potential drags on future earnings, come to the fore. At the culmination of Q3, MARA witnessed its cumulative cash and BTC holdings eclipsing its debt, following the conversion of over half of its debt into equity. This transformative move inflated the outstanding shares by a staggering 18%, from 174.3 million to 206 million, a trend further perpetuated to 222.63 million. This share dilution exercises downward pressure on the stock price.

Evaluative metrics cast a glaringly unfavorable light on MARA, with EV/EBITDA (TTM), EV/SALES, and P/E FWD earning dismal “F” ratings from the SA Quant. The company conspicuously lacks the revenue or earnings to justify its current valuation of $26, let alone the lofty heights it once scaled, radiating an almost $70 tag in late 2021, and plummeting back down to reality in a torrid descent.

Nautical Ventures in Troubled Waters: Navigating the Risks

MARA, indeed all BTC miners, grapple with a looming upheaval necessitated by the inevitable shift to a fee-centric business model, catalyzed by the BTC halvings. Investing in MARA hinges on a bet on the widespread adoption of cryptocurrencies as a transactional medium. I harbor the belief that MARA is destined for a transition to a fee-based business model. Engaging in such an investment, unless merely seeking short-term gains, is fraught with risk that only exacerbates with BTC’s recurrent role as an investment vehicle, rather than a functional currency. Approvals for BTC ETFs and substantial acquisitions of BTC by institutional investors further exacerbate these risks. With approximately 19.58 million BTC in circulation, and over 15 million held by long-term investors, the potential arrival of BTC ETFs threatens to stymie the availability of coins conducive for transactions. This constraint stifles the proliferation of BTC banks and curtails the integration of payment mechanisms such as credit cards into the BTC landscape, foreseeable in the initial stages of BTC assimilation.

Energy poses yet another formidable existential risk for crypto mining firms, who find themselves ensnared in an imbroglio concerning the energy consumption and, particularly, the widespread use of fossil fuels. With impending regulations and outright bans on fossil fuel consumption, akin to the automotive sector, crypto mining companies face intensified scrutiny to curtail or eliminate fossil fuel reliance. While some are fortunate to operate in close proximity to dams or harness geothermal power, the majority pulsate with the heartbeat of fossil fuels. While Marathon ardently addresses this risk, conducting pilot programs to harness methane gas from landfills and operating in Paraguay powered by hydroelectricity, the lion’s share of its operations tethered to fossil fuels underscores the specter of the energy predicament esteemed by MARA and its cohorts.

The risks I have previously articulated, including heightened competition during BTC integration, BTC ETF approvals, and BTC halvings, continue to stalk the company, compelling a strategic embrace of prudence and foresight.

Parting the Clouds: A Dispassionate Appraisal

Intriguing as the realm of decentralized finance and BTC may be, investing in MARA is a wager I am not inclined to place my chips on. The company, overvalued across every metric, languishes without the requisite capability to churn consistent profits, ensnared in the quicksand of high volatility, and perpetually diluting its share structure. At its current valuation, a resounding “Sell” beckons, signifying an opportune moment for investors to consider disengaging from their positions and realizing accrued gains.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.