DeepSeek’s Competitive Edge Disrupts AI Landscape, Impacting Semiconductor Stocks

Chinese Startup Outshines Industry Giants

Chinese artificial intelligence (AI) start-up DeepSeek has caused a stir in the U.S. tech industry. Its affordable, open-source large language model (LLM) has risen to the top of Apple‘s App Store download charts, surpassing OpenAI’s ChatGPT, which has invested billions in AI infrastructure.

Launched on January 10, DeepSeek claims its DeepSeek-V3 model was developed with only $6 million in funding. Recently, the company introduced the DeepSeek-R1 reasoning model, stating it can rival OpenAI’s o1 model while being 20 to 50 times less expensive.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Market Reaction: Semiconductor Stocks Feel the Pressure

DeepSeek’s cost-effective approach has negatively impacted shares of semiconductor firms. Investors are questioning whether companies and governments will continue spending heavily on AI infrastructure after observing the efficiencies demonstrated by DeepSeek, which managed to build its model under sanctions and limited resources.

One of the affected companies, Broadcom (NASDAQ: AVGO), witnessed its stock plummet over 17% on January 27. However, DeepSeek’s innovation might actually be beneficial for Broadcom in the long run.

DeepSeek’s Impact: Potential Growth for Broadcom

The cost claims of DeepSeek are still under scrutiny. Some sources suggest the company might be using high-end chips from Nvidia and could be downplaying its training costs. Nevertheless, it’s evident that DeepSeek has spotlighted the significant financial and computational resources necessary for developing AI models.

Major players like Meta Platforms, Amazon, OpenAI, and Alphabet are already working to lower their computing expenses by decreasing dependence on Nvidia hardware. Broadcom benefits from this shift since these tech giants are creating AI-focused application-specific integrated circuits (ASICs) that cost less than conventional graphics processing units (GPUs).

Unlike GPUs which can handle a wide range of tasks, ASICs are engineered for specific applications, making them faster and cheaper. Broadcom asserts that it has three major hyperscale cloud clients using its custom AI chips, with two more currently negotiating contracts. Following DeepSeek’s success, it is anticipated that more companies may embrace Broadcom’s custom AI chip solutions.

Understanding LLM Distillation and Its Market Potential

DeepSeek employs a technique called LLM distillation, allowing them to create smaller, task-oriented versions of larger models. The DeepSeek-V3 has a massive 671 billion parameters, while the R1 offers distilled models ranging from 1.5 billion to 70 billion parameters. As the R1 is positioned as a reasoning model particularly suited for education and research applications, this could enhance demand for custom AI processors.

Broadcom estimates that the market for custom AI processors and networking chips could expand to between $60 billion and $90 billion over the next three years. Given that the company generated $12.2 billion from AI chip sales in the latest fiscal year, this indicates substantial growth potential in its revenue stream.

Timing is Key: Is it Smart to Invest Now?

With Broadcom’s current stock dip, investors may find the stock to be a more attractive buy.

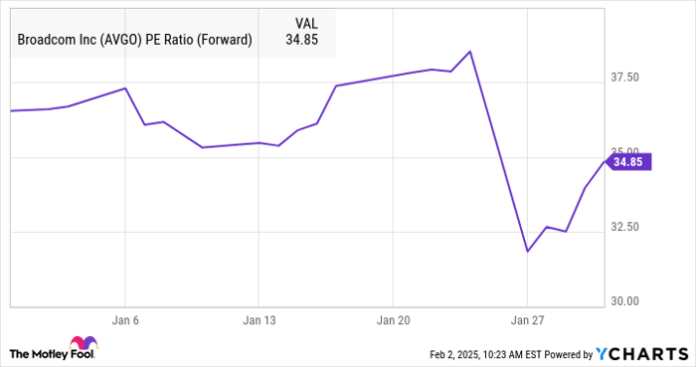

AVGO PE Ratio (Forward) data by YCharts

As seen in the chart, Broadcom is currently trading at 35 times forward earnings, closely aligning with the tech-heavy Nasdaq-100 index’s earnings multiple of 33.5. Investing at this level might be wise, considering the anticipated rise in demand for Broadcom’s custom chips in light of the efficiencies showcased by DeepSeek.

Thus, DeepSeek’s success may not necessarily spell trouble for Broadcom. Investors should assess the situation holistically before making investment decisions, as Broadcom’s stock could see an upward trajectory in the near future.

Evaluating a $1,000 Investment in Broadcom

If you are considering purchasing Broadcom stock, keep the following in mind:

The Motley Fool Stock Advisor analyst team has recently ranked their selection of the 10 best stocks for investment, and Broadcom did not make the list. This selection might offer significant returns in the years ahead.

To put it in perspective, consider when Nvidia featured on this list on April 15, 2005. An investment of $1,000 at that time would now be worth $765,024!*

Stock Advisor provides a straightforward guide for investors, complete with portfolio-building tips, continuous updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500.*

Learn more »

*Stock Advisor returns as of February 3, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, and Meta Platforms. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.