Target Struggles While Nvidia Thrives: A Tale of Diverging Fortunes

After releasing their Q3 results on Wednesday, Target TGT and Nvidia NVDA are in the spotlight, attracting significant investor attention.

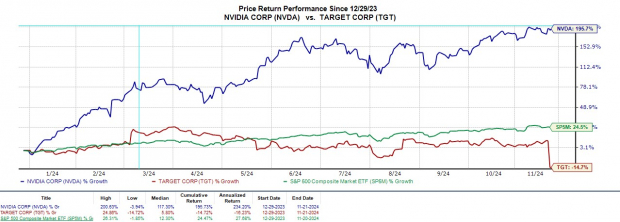

Target’s stock has dropped over 20% following a disappointing Q3 report, while Nvidia’s shares remain surprisingly stable, even after exceeding estimates and reaching a new revenue record.

Image Source: Zacks Investment Research

Target’s Underperformance

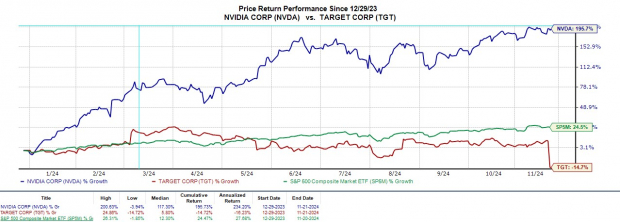

Target reported Q3 sales of $25.66 billion, a 1% increase from a year earlier, but this was below the expected $25.91 billion. CEO Brian Cornell pointed to unique challenges and increasing costs that impacted profits, with Q3 earnings per share (EPS) falling 12% to $1.85, missing the Zacks EPS Consensus of $2.29 by 19%.

Investors have been cautious about Target’s performance, especially after the company exceeded EPS estimates by 19% in Q2, achieving $2.57 per share compared to the expected $2.16.

Image Source: Zacks Investment Research

Nvidia’s Strong Showing

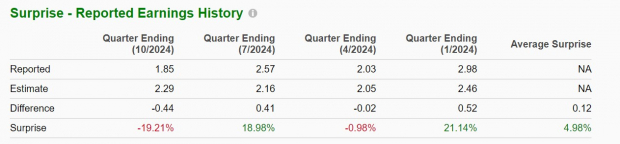

In contrast, Nvidia experienced a staggering 93% increase in Q3 sales, reaching a record $35.08 billion, up from $18.12 billion a year ago. This result exceeded sales estimates of $33.32 billion by 5%. Furthermore, Nvidia’s Q3 EPS of $0.81 doubled from $0.40 a year earlier, comfortably surpassing the projected $0.75.

Nvidia has consistently beaten earnings expectations for eight quarters, averaging a surprise of 9.79% over the last four reports. The company has also topped sales forecasts for 23 consecutive quarters, with an average surprise of 6.7% in the last four reports.

Image Source: Zacks Investment Research

Target’s Future Outlook

For Q4, Target projects adjusted earnings between $1.85 and $2.45 per share, below the current Zacks Consensus of $2.62, reflecting a potential decline of 12%. For the entire fiscal year 2025, Target now forecasts an adjusted EPS range of $8.30 to $8.90, which is lower than the expected $9.54, indicating a growth reduction of 7%. Additionally, the company anticipates comparable Q4 sales to be flat, falling short of Zacks’ estimate of $30.76 billion, a 3% drop.

Nvidia’s Guidance & Blackwell Developments

Nvidia has provided Q4 revenue guidance, anticipating sales of approximately $37.5 billion, plus or minus 2%, compared to Zacks’ estimate of $36.84 billion. Although the guidance might not have thrilled investors, the company noted that its highly anticipated Blackwell GPUs are already sold out for a year, with shipments starting this quarter and production escalating next year.

The Blackwell GPUs are expected to surpass previous high-performance AI chips such as Nvidia’s H200 series and AMD’s AMD MI300 series.

Concluding Thoughts

Currently, Nvidia enjoys a Zacks Rank #1 (Strong Buy), while Target holds a Zacks Rank #3 (Hold). With earnings estimates for Nvidia trending positively, the company’s strong quarterly performance suggests potential for further growth.

On the other side, Target’s shares are at their lowest price-to-earnings (P/E) ratio in over a decade, yet investors may want to wait for more favorable buying conditions given the retailer’s disappointing Q3 results.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Target Corporation (TGT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.