Market Reaction: Powell’s Hawkish Remarks Impact Stocks

Just ten days after the election, the euphoria in the stock market seems to be fading. Major tech stocks and the Nasdaq 100 Index ETF (QQQ) faced significant selling pressure following remarks from Federal Reserve Chairman Jerome Powell. He stated, “The economy is not sending signals that U.S. central bank needs to be in a hurry to lower interest rates.” This highlights the importance of liquidity in the market, especially from the Fed. After a strong rally since the presidential election, with stocks rising 5% last week, some profit-taking is expected.

1. Key Technical Levels Indicate Buying Opportunity

Current trading patterns show that QQQ is moving toward a high-probability buying area. This includes a retest of breakout levels, the significant $500 mark, a daily price gap, and the rising 50-day moving average.

Image Source: Zacks Investment Research

2. Options Expiration Day Effects

Friday marks options expiration day, which often brings irregular trading patterns as traders adjust their positions.

3. Underlying Market Strength Remains

The broader market can tell more than just the main indices. While major stocks retreated, only about 60% of all stocks declined during the session. Notably, stocks like Tesla (TSLA), Coinbase (COIN), MicroStrategy (MSTR), and Root (ROOT) were on the rise.

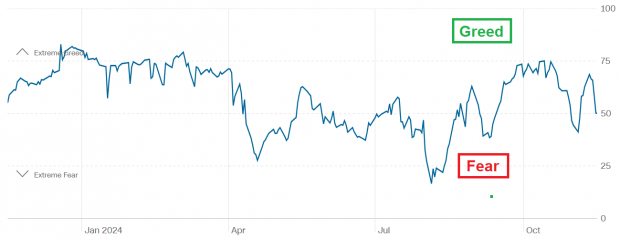

4. Notable Shift in Market Sentiment

This week, the “CNN Fear & Greed” indicator dropped from levels of “Greed” to “Neutral.” Many experienced investors see sentiment changes like this as potential opportunities to buy.

Image Source: CNN

5. Seasonal Trends Suggest Cautions

Historically, markets tend to pull back during Thanksgiving week before generally gaining ground as the year comes to a close.

Bottom Line: Limited Downside Likely

While Friday’s downturn may appear alarming, evidence from the QQQ chart, current sentiment, and seasonal trends indicate that any potential decline may be limited.

Mentioned Stocks in Focus: Solar Sector Anticipates Boom

As the economy shifts from fossil fuels, the solar industry is poised for growth. Trillions of dollars will flow into clean energy over the next few years, with solar expected to make up 80% of renewable energy expansion. This creates a unique opportunity for investors, provided they select the right stocks.

Tesla, Inc. (TSLA): Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

MicroStrategy Incorporated (MSTR): Free Stock Analysis Report

Root, Inc. (ROOT): Free Stock Analysis Report

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.