BellRing Brands (BRBR), a provider of nutrition products primarily under the Premier Protein and Dymatize brands, is facing significant challenges as it heads into 2026. The company has reported a decline in earnings, with a third-quarter EPS of 51 cents that fell short of estimates by nearly 6%. Analysts have revised fourth-quarter earnings estimates down by 11.11% to 32 cents per share, signifying a projected decline of 44.8% year-over-year.

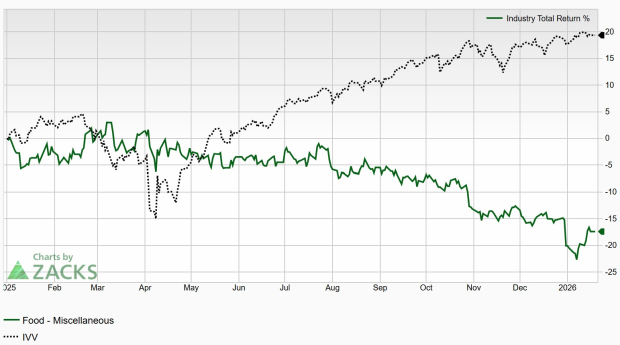

Currently ranked #5 (Strong Sell) by Zacks, BellRing is part of the underperforming food industry, which accounts for a significant downside in the stock’s recent performance. The stock has dropped over 60% in the past nine months and hit a 52-week low earlier this year, indicating a negative trend amidst a challenging macroeconomic environment.

The company’s primary hurdles include changing consumer purchasing behaviors and decreased pricing power, further complicating its outlook in a sector marked by weak consumption growth and high competition in nutritional supplements.