Marriott International, Inc. MAR recently boosted investors’ sentiments with a 21.2% hike in its quarterly cash dividend payments.

The board of directors of this worldwide hospitality company approved a quarterly dividend payout of 63 cents per share ($2.52 per share annually), up from the previous dividend payout of 52 cents per share ($2.08 per share annually). The amount will be paid out on Jun 28, 2024, to shareholders of record as of May 24. Based on the closing price of $240.46 per share on May 10, the stock has a dividend yield of 1% and a payout ratio of 0.3%.

Its decision to hike its quarterly dividend was attributable to a healthy balance sheet and effective capital allocation initiatives.

What’s Aiding the Dividend Policy?

Marriott is committed to implementing effective capital allocation strategies that aid it in fostering its growth prospects. Its primary focus lies in figuring out growth opportunities that prove accretive to its shareholders and investing in them. The company follows a combination of increasing but modest cash dividends and share repurchases to reward its shareholders for the excess capital.

In the first quarter of 2024, the company reported adjusted earnings per share (EPS) of $2.13, which were up 1.9% from the year-ago quarter’s value of $2.09. MAR’s capital allocation philosophy, including commitment to investment-grade rating and investing in growth opportunities, aided the uptick.

Furthermore, the company’s increasing demand trajectory in the international market, expansion initiatives, robust loyalty program and an asset-light business model are added benefits. These factors are aiding Marriott in improving its business growth, thus attributing to the increased capital generation. Although high costs and expenses are headwinds, its focus on leveraging the increased revenue trajectory and allocating the excess capital to various accretive growth opportunities are boding well.

For 2024, MAR raised its adjusted EPS outlook range to $9.31-$9.65 from the prior expectation of $9.18-$9.52 on the back of expected higher incentive management fees from its international regions.

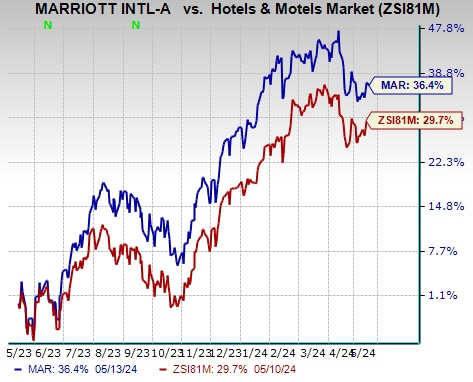

Image Source: Zacks Investment Research

Shares of this current Zacks Rank #3 (Hold) company have gained 36.4% in the past year, outperforming the Zacks Hotels and Motels industry’s 29.7% growth.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has gained 50.2% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and EPS indicates an increase of 6% and 32%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has surged 81.5% in the past year.

The Zacks Consensus Estimate for NFLX’s 2024 sales and EPS implies a rise of 14.7% and 52.1%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 86.6% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.9% and 59.5%, respectively, from the year-ago levels.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.