Capitalize on Market Makers’ Blind Spots: A Guide to Options Trading

Tom Yeung here with your weekly Smart Money update.

Back in the mid-2010s, I took an advanced valuations class that was just one of many requirements to keep my financial education current.

Among my classmates was an options trader from the New York Stock Exchange (NYSE). This trader was an expert at pricing options, determining the value of many trades daily. It is said that traders like him can compute complex calculations at lightning speed, functioning as human calculators. Today, the NYSE’s parent company, the Intercontinental Exchange (ICE), generates $500 million each year from financial options.

However, when it came to the underlying stocks, our “human calculator” classmate was out of his depth. Stocks like AAPL, BAC, and CVX were mere letters to him. He was preoccupied with metrics like delta risk and theta decay—topics not on the average investor’s radar.

This scenario presents an opportunity for you.

Options are essentially bets on the future prices of stocks. If you believe a stock like CVX (Chevron) might double in the next year, you can profit even though a market maker may not share your insight—or care about it for that matter. Their focus is mainly on making average trades based on mathematical principles.

In this week’s Smart Money, let’s explore how to leverage these market makers’ lack of understanding. We’ll break down how options work and present a potential trading opportunity worth your attention.

Understanding Options

For those who may ask, “What is an option?” here’s the answer.

Options are a type of financial derivative that enables investors to earn substantial returns based on stock price movements, though they come with inherent complexities. The simplest form of these bets is known as call options. Think of it like placing multiple bets on a racehorse—with a bet to win, place, and show. Buying stocks, on the other hand, is akin to purchasing the horse outright.

Consider an example from May of this year. You may not have known which horse would win the Kentucky Derby, but perhaps you felt that the Blue Grass Stakes winner would at least finish third. You craft your bets accordingly to maximize your earnings based on how well the horse performs. If your selected horse doesn’t do well, your financial loss is limited to your initial stake.

This same principle applies to call options. Suppose a stock trades at $20, and you purchase a “$30 call option for January 2026” for about $1.

- Breakeven (SHOW): If the stock reaches $31 by January 2026, your investment breaks even as you cover your $1 cost.

- Big win (PLACE): If it rises to $32, you earn $2, resulting in a 100% gain.

- Enormous win (WIN): A surge to $40 yields a whopping $10, leading to a staggering 900% gain on your initial investment!

Since contracts come in lots of 100 shares, if that stock indeed climbs to $40, your $100 investment could balloon to $1,000—netting you $900 after covering costs.

Put options are similar but in reverse; they allow you to profit from a stock’s decline.

Market makers, operating on strict models, generally lack insight into which way a $20 stock will move, much like having no knowledge of the race results while optimizing their bets across multiple competitors.

Identifying Clear Opportunities

This dynamic creates attractive investment opportunities for those willing to look closely—even if they aren’t experts in options pricing.

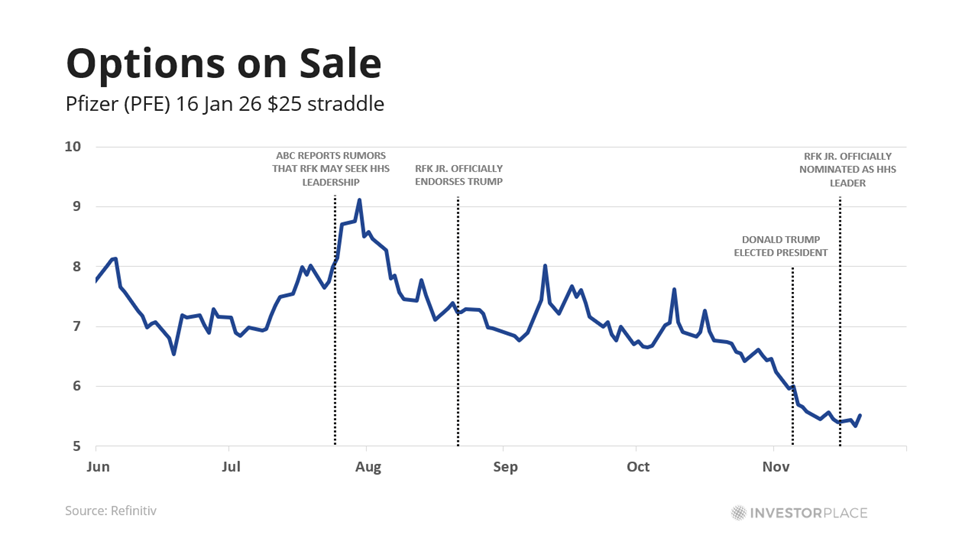

Take Pfizer Inc. (PFE), a company recently recommended for selling by Eric in his Fry’s Investment Report. The recommendation followed Donald Trump’s nomination of Robert F. Kennedy Jr. for Secretary of Health and Human Services (HHS).

Pfizer derives a significant portion of its revenue from COVID-19 vaccines and therapies, placing it at the forefront of the pharmaceutical industry. With Kennedy being a known skeptic of vaccines, Eric is understandably cautious about holding onto this stock.

Nonetheless, even Trump’s most vocal critics concede that some of his policies may positively impact healthcare stocks. These include potential reversals in Medicare negotiations, relaxed regulations on mergers, and tax cuts. Given these opposing outcomes, Pfizer’s stock will not remain stagnant—it will either surge or plummet.

This is where options come into play.

- Pfizer crashes. We could purchase put options to capitalize on a potential decline. If Pfizer’s price drops, our profits increase, while our losses remain capped at the initial expense.

- Pfizer surges. Alternatively, we can buy call options if we anticipate a rise, granting us exponential profit potential if the healthcare sector performs well.

This strategy of buying both put and call options simultaneously is known as a straddle. It capitalizes on the assumption that a stock will break out from its trading range.

What makes this strategy particularly compelling right now is the cost factor.

Options are currently quite affordable.

Market volatility has dipped recently, leading to lower options pricing. Market makers rely on volatility in their calculations, and the transitional period between presidential administrations has not been accounted for in their models.

As a result, the cost of Pfizer’s $25 straddles for January 2026 has fallen to around $5.50. Investors would break even if PFE moves below $19.50 or above $30.50 by that time. The further it moves from these thresholds, the greater the potential profits become.

If PFE climbs to $40 by January 2026, a $1,000 investment would be worth $2,727, translating into a net profit of $1,727. Substantial returns—300%, 500%, or more—could be on the table, depending on how far the stock goes beyond the set price boundaries.

Opportunities for Rapid Gains in Options Trading

For many investors, waiting 14 months for the outcome of Pfizer’s straddles may seem unappealing. The Senate is not expected to confirm Trump’s nominees until at least January, and it will take additional time to evaluate the new administration’s impact on the Covid-19 vaccine market.

This creates an interesting opportunity for traders like Jonathan Rose, an options trading expert. His remarkable trading results include gains of 16%, 48%, and even up to 1,306% within just a few hours.

Rose’s strategy focuses on options that expire today, known as “zero-day options.” These options are quickly becoming a significant part of the market, with approximately $1 trillion traded daily, according to JPMorgan Chase.

High trading volume often indicates potential for substantial returns, making these areas of the market particularly attractive. However, such high rewards also come with corresponding risks, underscoring the importance of a solid risk management plan.

To guide traders in navigating these opportunities, Jonathan will host his One-Day Winners Live Summit on Tuesday, November 26. This event aims to showcase how his system can help participants seize these trading advantages. Reserve your spot today by clicking here.

In his upcoming presentation, Jonathan plans to demonstrate how his methods could have tripled your investment within hours of Donald Trump’s election victory.

Jonathan’s extensive career spans over 25 years, moving from floor trader to CBOE market maker, positioning him as a reliable mentor in options trading. His strategy has enabled others to achieve impressive gains, often exceeding 463% in less than a month.

There’s no doubt that Jonathan offers valuable insights into the rapidly evolving space of zero-day options.

Once again, mark your calendar for Tuesday, November 26, for Jonathan’s crucial summit that reveals his cutting-edge trading strategy. Participation is entirely free.

Click here now to secure your attendance.

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace