Unlocking Profit Potential with Options Trading

Tom Yeung here with your weekly Smart Money update.

Back in the mid-2010s, I took a course on advanced valuations, deeply focused on improving financial skills. Among my classmates was an experienced options trader from the New York Stock Exchange (NYSE).

This trader was an expert in valuing options. Every day, he handled the pricing of countless options. His lightning-fast calculations often made him appear more like a human calculator than a trader. Nowadays, the NYSE’s parent company, the Intercontinental Exchange (ICE), draws in approximately $500 million each year from financial options.

Interestingly, while he excelled in options trading, our classmate had little knowledge of the actual stocks behind those options. Stocks like AAPL, BAC, and CVX seemed like meaningless letters to him. His focus lay instead on technical aspects like delta risk and theta decay, details that most investors don’t typically concern themselves with.

This situation hints at a potential opportunity for you.

Options function as directional bets on stock prices. If you believe a stock like CVX (Chevron) will double in a year, you can profit from that conviction, even if the market maker handling your trade is indifferent to the stock’s future. His main objective is to ensure overall accuracy in trade averages by sticking to rigorous math.

In this week’s edition of Smart Money, we’ll delve into how to leverage the gaps in market maker knowledge through options. Additionally, I’ll highlight a specific trade opportunity that savvy investors might want to explore right now.

Understanding Options

For some of you, the term “option” might need clarification.

Options are financial derivatives that serve as side-bets on stock prices, allowing investors to make substantial profits if they make the right call. Although the calculations can get complex, the concept is straightforward.

The simplest form of these bets is called call options. Buying a call option is somewhat comparable to placing multiple bets on a horse in a race. When you buy stocks, however, you are purchasing the horse itself.

Think back to May of this year.

You might not have known if Sierra Leone would prevail at the Kentucky Derby, but perhaps you were confident that another horse would place placed high enough in the race to give you a return. If that horse performed poorly, your maximum loss would be your initial investment.

This concept applies to call options. If a stock trades at $20, you might purchase “$30 call options for January 2026” for about $1.

- Breakeven (SHOW): If the stock reaches $31 by January 2026, your total returns will equal the difference of $31 and $30, meaning you break even at $1.

- Big win (PLACE): If the stock rises to $32, you’ll earn $2 (the difference being $32 minus $30), resulting in a 100% gain on your investment.

- Enormous win (WIN): If the stock skyrockets to $40, you gain $10 ($40 minus $30). After deducting the initial $1 cost, your profit of $9 represents a staggering 900% gain!

Options typically trade in lots of 100 shares. Therefore, should the stock hit $40, your original $100 investment could jump to $1,000, translating to a substantial profit (about $900 post-expense).

Put options work similarly but function as bets on stock prices declining.

Options market makers often lack insight into where the $20 stock is headed. As long as they hedge their bets wisely (e.g., by taking opposing positions), they remain largely indifferent to the outcome.

Identifying Market Opportunities

This creates clear opportunities for attentive investors who may not fully understand options pricing.

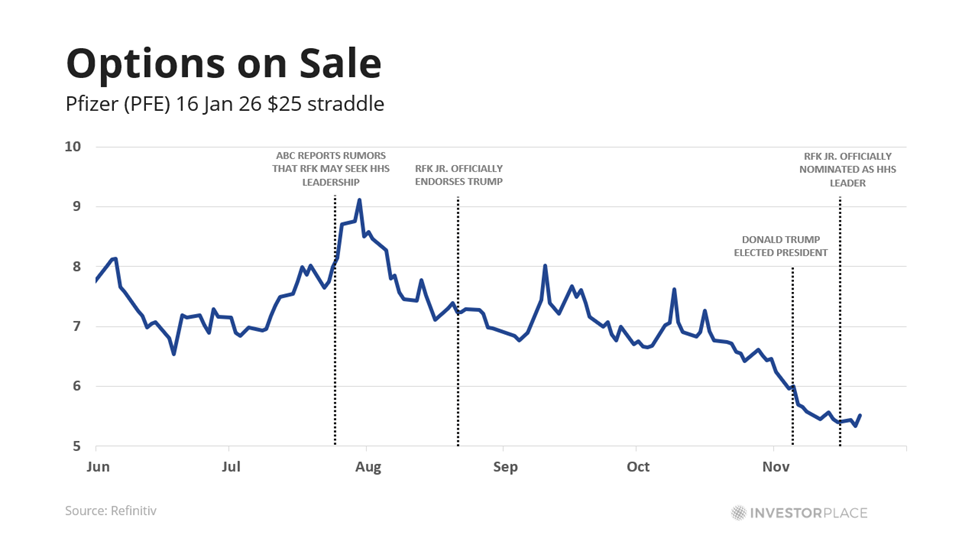

Take **Pfizer Inc. (**PFE**),** which has been suggested by Eric to his members of Fry’s Investment Report for selling. This recommendation followed Donald Trump’s proposed appointment of Robert F. Kennedy Jr. to head the Department of Health and Human Services (HHS).

Given that Pfizer relies on Covid-19 vaccines for 25% of its revenue, it stands out as one of the most vaccine-dependent firms in the pharmaceutical sector. Known for his skepticism about vaccines, RFK Jr.’s appointment poses uncertainty for Pfizer, prompting Eric to steer clear of further investments.

Conversely, even Trump critics acknowledge that some proposed policies will likely benefit healthcare stocks. These could include rolling back some provisions of the Inflation Reduction Act, lowering corporate taxes, and relaxing regulations on mergers.

Thus, Pfizer’s fate could either lead to soaring success or a devastating downturn. It’s clear that the stock won’t remain in its $25 range indefinitely.

Options are particularly useful in this context.

- If Pfizer crashes: To capitalize on a falling stock, consider buying put options. The greater the decline, the higher the profits. If Pfizer’s stock declines or stabilizes, your maximum loss is limited to your initial investment.

- If Pfizer surges: To benefit from a rising stock, buy call options, similar to our prior WIN/PLACE/SHOW analogy. This approach opens up substantial profit potential if healthcare stocks rally.

This strategy of purchasing both put and call options on the same stock is known as a straddle. It bets that the stock’s price will break out of its trading range.

The added advantage of buying straddles at this moment is their low cost.

Market volatility has significantly decreased in recent weeks, particularly during the transitional phase between presidential terms. Consequently, our market maker classmates utilize this low volatility to inform their calculations. This means that prices for Pfizer’s $25 straddles for January 2026 have dropped to around $5.50. Traders can break even if PFE shares move below $19.50 or above $30.50 by that date.

If PFE trades at $40 by January 2026 (similar to their performance during Trump’s first term), a $1,000 investment could increase to $2,727, yielding a profit of $1,727. Should prices keep climbing, potential gains may range from 300% to 500% or even higher.

Unlocking Rapid Financial Gains with Zero-Day Options

Why Wait for Long-Term Growth?

Investors seeking quicker returns may find the wait for Pfizer’s straddles to mature over the next 14 months daunting. With the Senate unlikely to confirm Trump’s nominees until January, plus additional months to evaluate the impact of new policies on the Covid-19 vaccine manufacturer, a more immediate strategy might be appealing.

This is where Jonathan Rose, an options trading expert, comes into play. He has achieved impressive returns of 16%, 48%, 156%, 545%, and even 1,306% within a short timeframe of just six-and-a-half hours.

Rose specializes in trading “zero-day options”—contracts that expire on the same day. This trading style is becoming increasingly popular, and according to JPMorgan Chase, daily trading volume in this area has reached around $1 trillion.

When substantial money starts flowing into a specific section of the market, it often leads to remarkable gains. However, this potential for high rewards comes with significant risk. Therefore, a solid strategy to manage downside risks while capitalizing on upside potential is essential.

On Tuesday, November 26, Jonathan will be hosting the One-Day Winners Live Summit to demonstrate his trading system. Click here now to reserve your spot.

During this presentation, Jonathan will reveal how investors could have potentially TRIPLED their money following Donald Trump’s election victory in less than seven hours.

With over 25 years of experience—from floor trader to CBOE market maker and now a trading mentor—Jonathan has a deep understanding of market money flows. His track record includes trades yielding returns of 126%, 245%, and even 463% in 30 days or less, showing his expertise in navigating this fast-paced environment.

As you explore the dynamic market of zero-day options, Jonathan’s insights will be invaluable.

Join the upcoming summit on Tuesday, November 26. It’s completely free to attend. Reserve your spot now!

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace

“`