Recent findings from ETF Channel highlight the optimistic outlook analysts have for the iShares ESG Aware MSCI USA Small-Cap ETF (ESML). Based on a comparison of its holdings and analyst target prices, the ETF has an implied target price of $49.14.

Muted Trading Price Signals Room for Growth

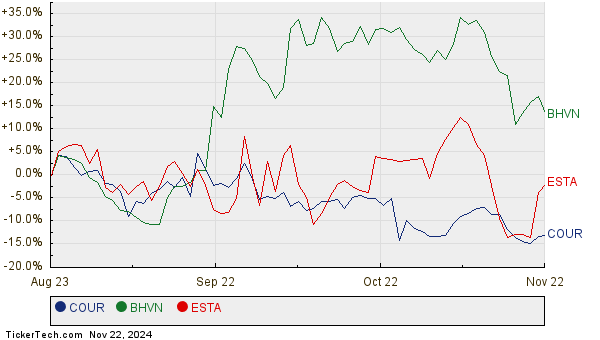

Currently trading at approximately $44.46 per unit, ESML shows a potential upside of 10.53% relative to the analysts’ projected target prices. Among its holdings, Coursera Inc (COUR), Biohaven Ltd (BHVN), and Establishment Labs Holdings Inc (ESTA) stand out for their growth potential. Coursera’s recent share price is $6.98, yet analysts expect it to rise to an average target of $10.94—a notable increase of 56.69%. Biohaven likewise has room for growth; trading at $45.19, it is projected to reach an average of $65.77, reflecting a 45.54% upside. Establishment Labs is also expected to grow—analysts suggest a target of $62.00, up from its recent $42.61 price, indicating a potential rise of 45.51%.

Current Analyst Outlook by Company

Here is a detailed overview of the current target prices for the ETF and its underlying holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares ESG Aware MSCI USA Small-Cap ETF | ESML | $44.46 | $49.14 | 10.53% |

| Coursera Inc | COUR | $6.98 | $10.94 | 56.69% |

| Biohaven Ltd | BHVN | $45.19 | $65.77 | 45.54% |

| Establishment Labs Holdings Inc | ESTA | $42.61 | $62.00 | 45.51% |

Considering Analyst Projections

Investors may wonder if analysts are justified in their price targets or potentially overly optimistic. It is essential to analyze whether these targets reflect a valid perspective on recent developments in the companies’ industries. A relatively high target price compared to a stock’s trading price can indicate optimism but may also foreshadow potential downgrades if the targets become outdated. Investors should conduct thorough research to explore these implications.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of OSEA

• ALEX Videos

• Top Ten Hedge Funds Holding CFP

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.