Unlocking Higher Returns with XP Inc – Class A Options Strategy

Introducing a Profitable Covered Call Opportunity

Shareholders of XP Inc – Class A (Symbol: XP) can enhance their income beyond the stock’s 5% annualized dividend yield by selling the May 2025 covered call option at the $15 strike price. By doing so, investors can grab a premium at an 88 cents bid, which translates to an additional 16.5% return against the current stock price. At Stock Options Channel, we refer to this as the YieldBoost, leading to a total potential annualized return of 21.5% if the stock remains uncalled. However, if the stock’s price exceeds $15, shareholders risk losing any further upside. To trigger this, XP shares must increase by 15.5% from their current value. If the stock is called away, investors could still secure a 22.2% return, incorporating any dividends earned prior to the call.

Understanding Dividend Stability with XP Inc

Dividend stability is often uncertain and is closely linked to a company’s profitability. Reviewing XP’s dividend history can provide insights into its likelihood of maintaining a 5% annualized dividend yield.

Evaluating the Call Option with Historical Context

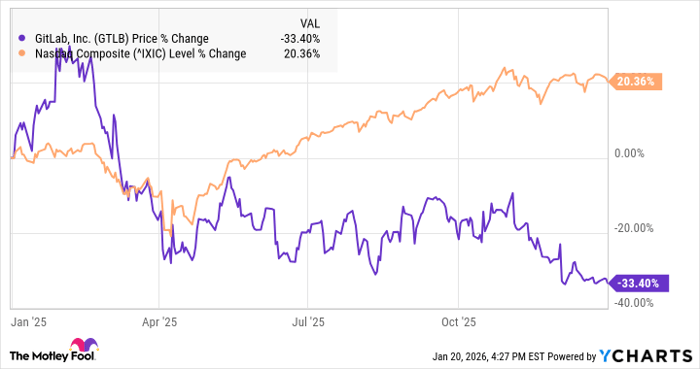

The chart below illustrates XP’s trailing twelve-month trading history, highlighting the $15 strike in red:

This chart, alongside XP’s historical volatility, aids in evaluating whether selling the May 2025 covered call at the $15 strike is a sound strategy. Although many options can expire worthless, understanding this risk is crucial. We calculate the trailing twelve-month volatility for XP Inc – Class A, based on the last 251 trading days and the current price of $12.94, to be 40%. For further call option strategies with varying expirations, check out the XP Stock Options page at StockOptionsChannel.com.

Current Trading Activity Insights

In the mid-afternoon trading on Tuesday, put volume among S&P 500 stocks reached 1.37 million contracts, while call volume was higher at 2.68 million, reflecting a put:call ratio of 0.51. This indicates notably elevated call activity compared to puts. In essence, options buyers are leaning towards calls today.

Find out which 15 call and put options are attracting traders’ attention.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

- Manufacturing Dividend Stock List

- Funds Holding HHGC

- BSCS Average Annual Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.