Andersons Inc. Shares Offer Attractive Income Through Covered Calls

Shareholders of Andersons Inc. (Symbol: ANDE) seeking enhanced income beyond the stock’s 2.1% annualized dividend yield have a viable strategy. By selling the December covered call at the $40 strike price, investors can secure a premium of $2.75. This payout results in an effective yield boost of 12.6%, which when combined with the existing dividend yield, leads to a total annualized return of 14.7%, assuming the stock is not called away. Should the stock price exceed $40, potential gains beyond that threshold would not be realized. Notably, for the stock to hit that price, a 10.4% increase from current levels is necessary, which would deliver an 18% return, in addition to any dividends received prior to being called away.

Dividend payouts can fluctuate based on a company’s profitability, making it crucial for investors to analyze historical data. Examining Andersons Inc.’s dividend history can provide insights into the sustainability of its current dividend yield of 2.1%.

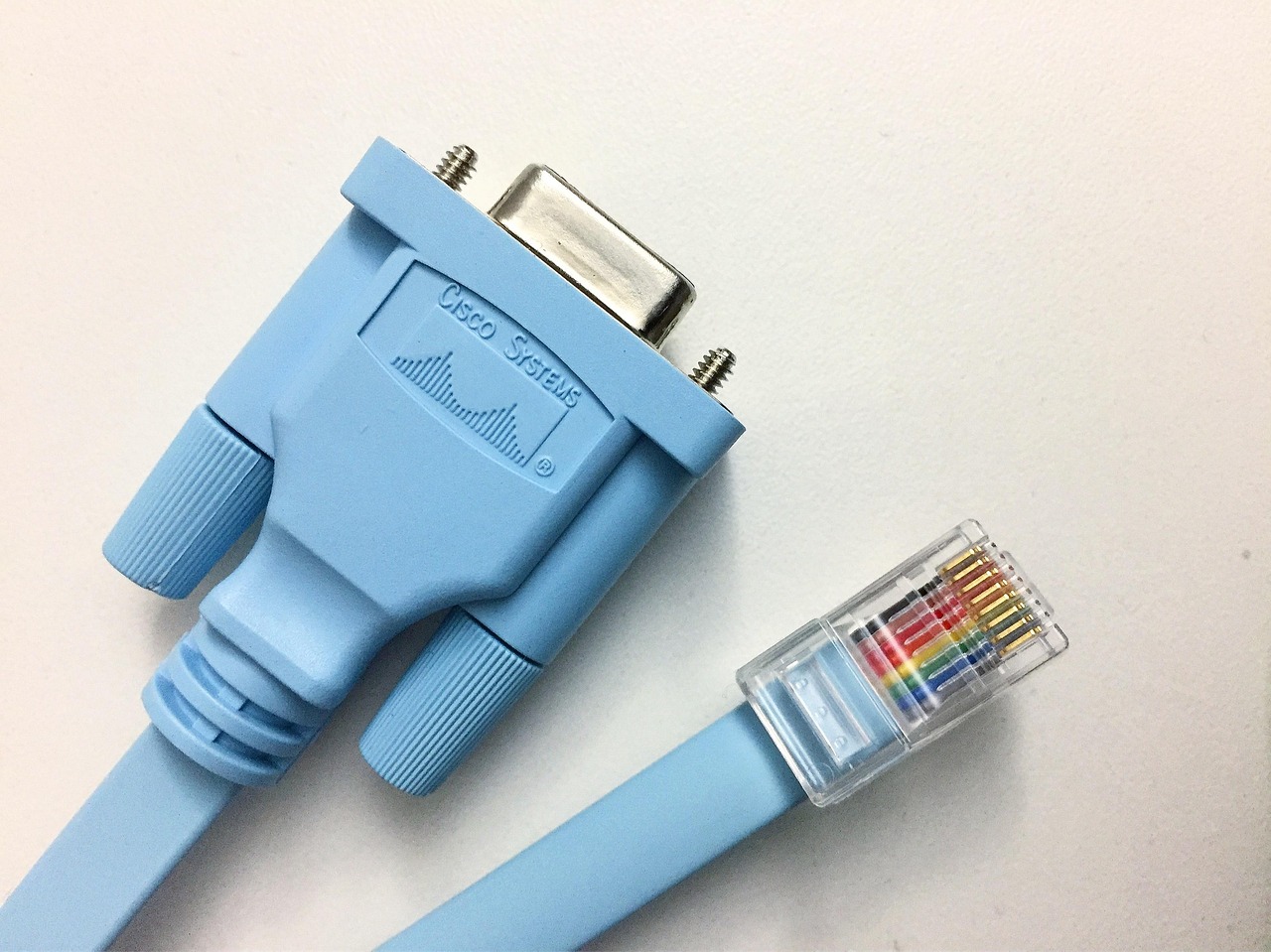

Additionally, the chart illustrating ANDE’s trading history over the past twelve months highlights the $40 strike in red:

This chart, alongside an analysis of historical volatility, serves as a valuable tool. It aids in evaluating whether selling the $40 covered call represents a worthwhile trade-off for foregoing further upside potential. The calculated trailing twelve-month volatility for Andersons Inc. is currently at 39%, based on the last 250 trading days and today’s price of $36.34. For additional options strategies tailored to various expiration dates, you may visit the ANDE options page.

During mid-afternoon trading on Tuesday, the S&P 500 saw a put volume of 1.07 million contracts contrasted against a call volume of 2.39 million, resulting in a put:call ratio of 0.45 for the day. This figure, significantly lower than the long-term median of 0.65, indicates a strong preference among traders for calls over puts in current options trading patterns.

For further details, be sure to explore trending call and put options among traders.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.